|

Accounts Receivable - Sales Tax Reports

The Sales Tax Reports provide information about the sales tax codes and the sales taxes calculated for each taxable sales invoice. These reports are useful for reviewing the sales tax codes assigned to the sales invoices and for verifying information on taxable sales.

Each of the Sales Tax Reports is especially designed to provide several options so you can narrow down data to the specific information needed. Read the information below to get a closer look at each of the Sales Tax Reports available in AccountMate.

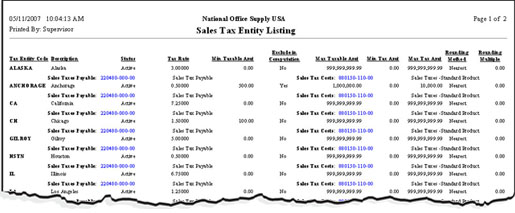

Sales Tax Entity Listing

AccountMate 7 allows you to set up multiple tax entities that facilitate the set up of sales tax code records to be used in sales orders and invoices. The Sales Tax Entity Listing provides quick information on these tax entities; thus, it helps you save time, effort, and resources when setting up sales tax records.

Click on the image to enlarge view.

Click on the image to enlarge view.

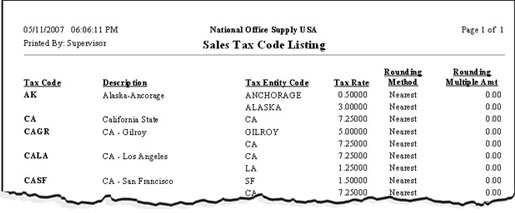

Sales Tax Code Listing

The Sales Tax Code Listing provides detailed information on the sales tax codes set up through the Sales Tax Code Maintenance function. This report is useful for reviewing the accuracy of the sales tax codes and for validating their associated sales tax entities and rates.

You can select to include in the report the predefined minimum and maximum taxable and tax amounts.

Click on the image to enlarge view.

Click on the image to enlarge view.

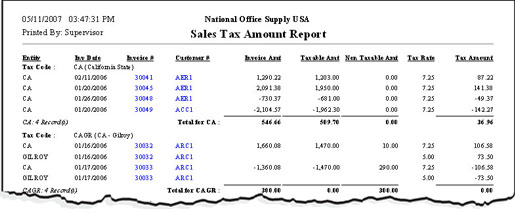

Sales Tax Amount Report

The Sales Tax Amount Report provides detailed information on the system-calculated sales tax amount for each taxable sales invoice. This report is useful for reviewing the correctness of the sales tax amount applied to each taxable sales invoice. It also facilitates the preparation of sales tax returns.

You can select to include non-taxable invoices in this report.

Click on the image to enlarge view.

Click on the image to enlarge view.

|