AM11 Sample Reports

|

Bank Reconciliation – Bank Reconciliation Reports

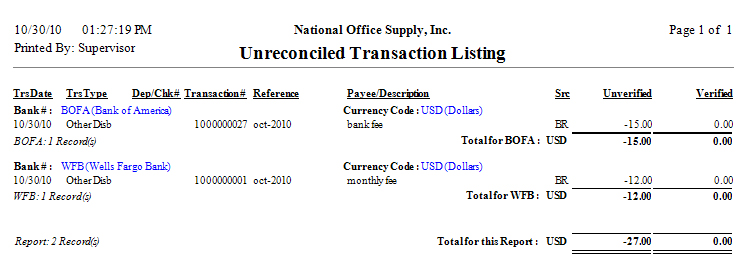

The Bank Reconciliation Reports is a set of reports that provide detailed information on bank transactions that are not yet reconciled in AccountMate, previous bank reconciliations, and most recent bank reconciliation. These reports facilitate review of previous and current bank reconciliation recorded in the system, monitor transactions which are yet to be reconciled or marked are cleared in the bank, and serve as references in reconciling your bank accounts. Each of these reports is especially designed to provide several options so you can narrow down data to the specific information needed. Each report is also presented in various report formats. Read the information below to get a closer look at each of the Bank Reconciliation Reports available in AccountMate. Unreconciled Transaction Listing

The Unreconciled Transaction Listing provides detailed information about bank transactions that are either outstanding or have been verified as part of a bank reconciliation which is not yet finalized in the system. These bank transactions may come from the Accounts Payable, Accounts Receivable, Bank Reconciliation, and Payroll modules. This report allows you to see the transaction type, source module, transaction date and amount, and whether a particular transaction is verified or not. This report aids you in determining and monitoring which transactions need to be reconciled, and in verifying the accuracy of the information on each transaction. It also serves as a guide in reconciling your bank accounts. You can choose to include in the report check transactions only, other

disbursement transactions only, deposit only, other receipt only, transfers

only, all or a combination of these options. You can limit the report to

include transactions from AP only, AR only, BR only, PR only, all four modules

or a combination of these modules. You can further select to generate this

report for unverified transactions only, verified transactions only or all

transactions.

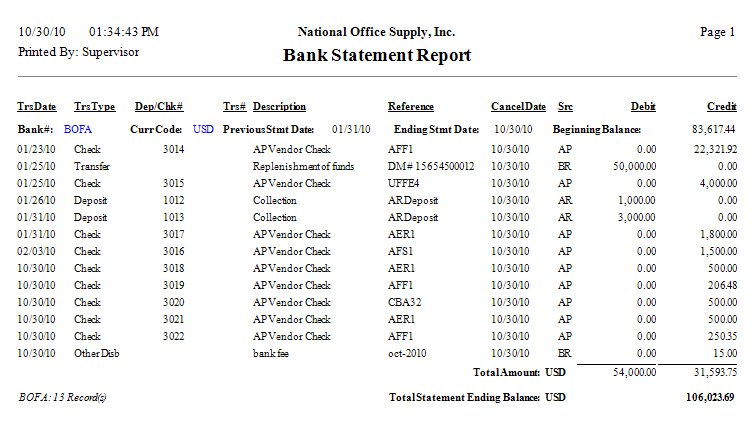

Bank Statement Report

The Bank Statement Report provides information about finalized bank

reconciliation of previous statement periods. This report allows you to

retrieve a bank statement by specifying a statement date. It shows the

transaction date and type, debit and credit amounts, source module of a certain

transaction, and the beginning balance of the bank statement. This report

provides you the flexibility of reviewing the reconciling items in previous

bank reconciliations and of reprinting these bank statements.

Bank Reconciliation Report

The Bank Reconciliation Report is a set of reports that provide information

about the latest reconciliation project processed for a bank account. It allows

you to generate the report by specifying a statement date. These reports aid

you in verifying the accuracy of your bank account reconciliation, and serve as

a reference in monitoring the clearing of bank transactions that were

outstanding in prior bank statement periods.

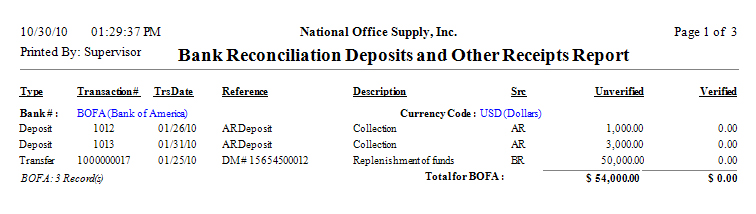

Bank Reconciliation Deposit and Other Receipts Report

This report shows details of all the deposits and other receipts transactions

included in the Bank Reconciliation Bank Summary Report. It shows the

transaction date, number, description, reference, source module and amount. It

also shows whether the transaction has been tagged as cleared during the

current reconciliation project. This report facilitates review on deposits,

receipts and transfer transactions in your bank account.

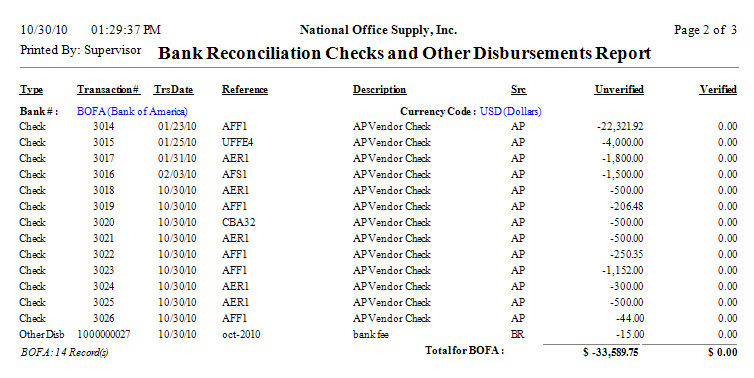

Bank Reconciliation Checks and Other Disbursements Report

This report shows details of all checks and other disbursement transactions

included in the Bank Reconciliation Bank Summary Report. It shows the

transaction date, number, description, reference, source module, amount, and

whether the transaction has been tagged as cleared during the current

reconciliation. This report is useful for reviewing checks, other disbursements

and transfer transactions in your bank account.

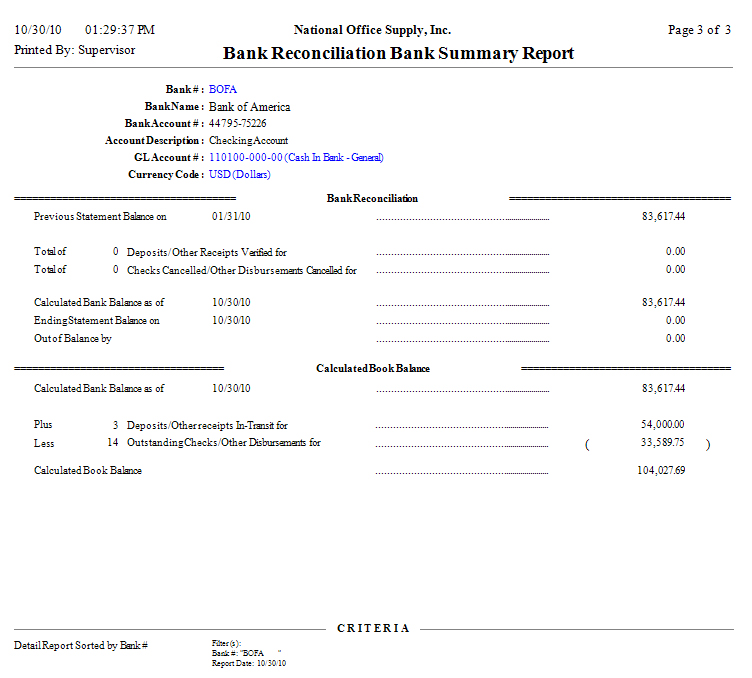

Bank Reconciliation Bank Summary Report

This report provides summary information on the current reconciliation project

of a bank account which includes the verified deposits and other receipts total

amount, cancelled checks and other disbursements total amount, calculated book

balance, and calculated bank balance, and shows any out-of-balance amounts.

This report allows you a quick view on the status of your currently reconciled

bank account to help you better manage your cash disbursements or issuance of

checks, among other bank transactions.

|