AM11 Sample Reports

|

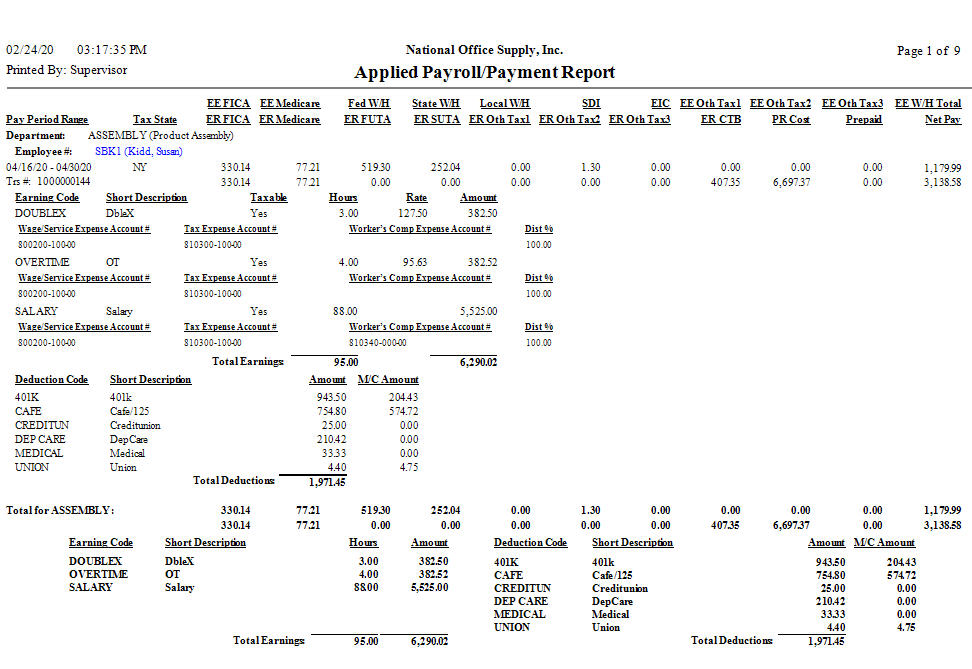

Payroll - Applied Payroll/Payment Report

The Applied Payroll/Payment Report shows for each pay period the employees' earnings and deductions for which payment has been applied but checks are yet to be issued. This report also displays the employer's withholding tax contribution and payroll cost. This report is useful when verifying accuracy of the applied payroll/payment transactions prior to issuance of checks to employees and independent contractors. You can opt to print the applied payroll/payment transactions on a new page for

each department. You can also select to show in the report the GL Account IDs assigned to each applied payroll/payment transaction and its attributes.

|