AM11 Sample Reports

|

Payroll - Deduction Reports

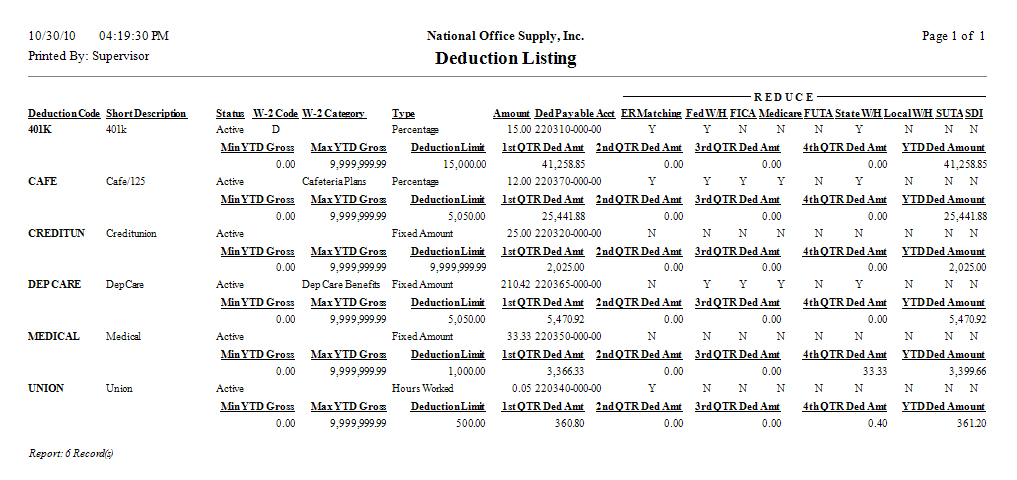

The Deduction Reports help you focus on a variety of payroll deduction-related data including deduction amounts and limits based on age categories, calculated deductions based on employees' earnings, deduction liability resulting from paid salaries/wages, states activated for the deduction and state taxes to be reduced by the deduction, and employer deduction matching/contribution parameters and transactions. Each Deduction Report is especially designed to provide several options so you can generate data to the specific information needed. Read the information below to get a closer look at each Deduction Report available in AccountMate. The Deduction Maintenance function allows you to set up records for deduction items such as pension plans, health insurance plans, and/or union dues, which you apply against an employee's earnings. You must set up the deduction records before you assign the applicable deductions to an employee. Deduction Listing

Detailed information pertaining to payroll deduction items such as pension plans, health insurance plans, and union dues are available in the Deduction Listing. You can refer to this report for a complete list of deduction records set up in AccountMate. This report is useful in reviewing each payroll deduction's detail information including the deduction status, type, amount, GL Account ID to which the deduction payable is posted, and information whether the deduction reduces employee taxable income for purposes of calculating tax withholding and employer federal tax contribution. This report comes with an option to show the accumulated quarterly deduction

amount applied against the employee's earnings for the current fiscal year.

Deduction Age Break Listing

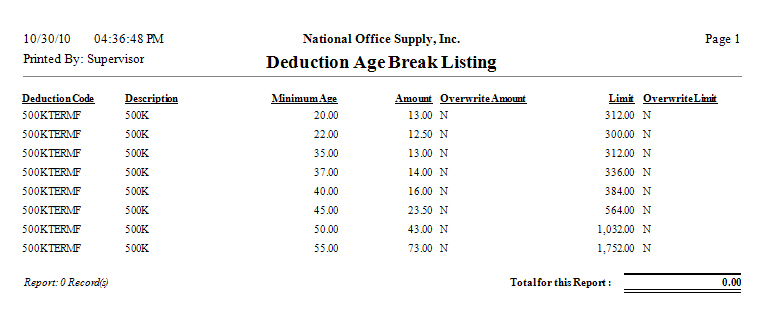

AccountMate provides the flexibility to set the employee deductions by age and

calculates the payroll deductions based on the applicable age breaks or age

categories. The Deduction Age Break Listing provides information on the age

categories and the applicable deduction amounts and annual deduction limits set

up for the applicable deduction records. This report also displays the

parameters for overwriting the amount and limit. This report is most useful

when you verify whether the deduction age break parameters are correctly set up

in AccountMate and when you verify the propriety of the employee deductions

based on the applicable age break.

Deduction Transactions Report

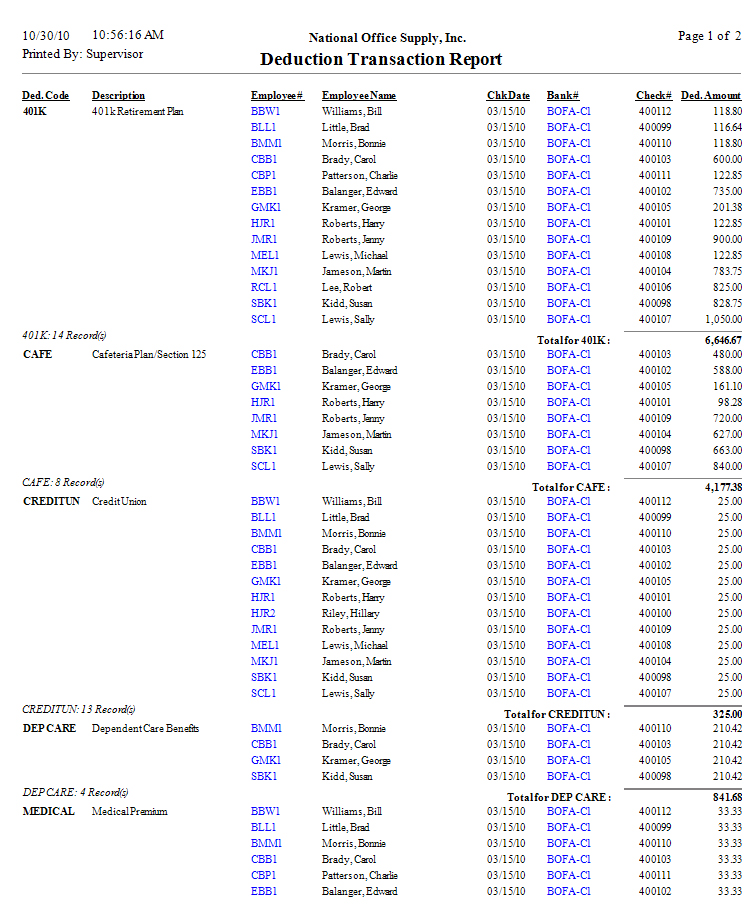

The Deduction Transaction Report displays the deduction amounts taken from the

employees' earnings. This report is most useful when you need information on

the total deduction amount taken from each payroll check, each deduction code's

total deduction amount, or total deduction amount taken from each employee's

earnings for the specified payroll.

Deduction Liability Report

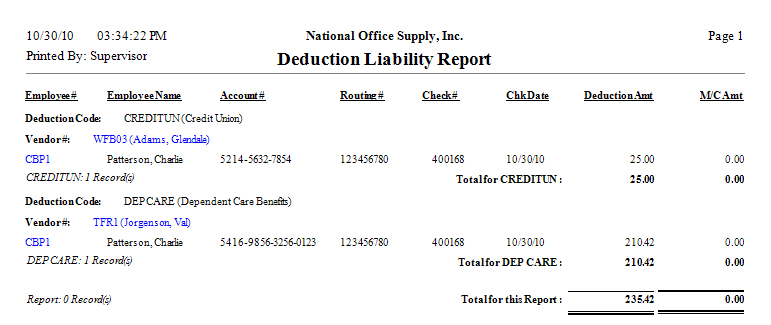

There are instances when you need information on your deduction liability

resulting from paid payroll transactions. The Deduction Liability Report serves

this purpose. This report shows the employee payroll check number, vendor

assigned to the deduction record, bank routing and account number to which

remittance will be made, and the deduction amount. Use this report as reference

for recording AP invoices for employee deductions to be remitted to certain

vendors.

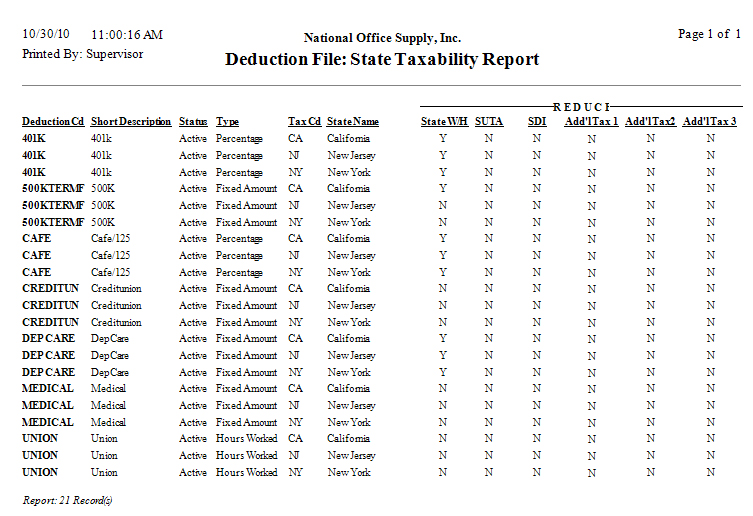

Deduction File: State Taxability Report

The Deduction File: State Taxability Report displays the states activated for

the deduction and the applicable state taxes that will be reduced by the

deduction. This report is most useful when you need to verify accuracy of the

system-computed state and/or local tax liability reduced by the deductions.

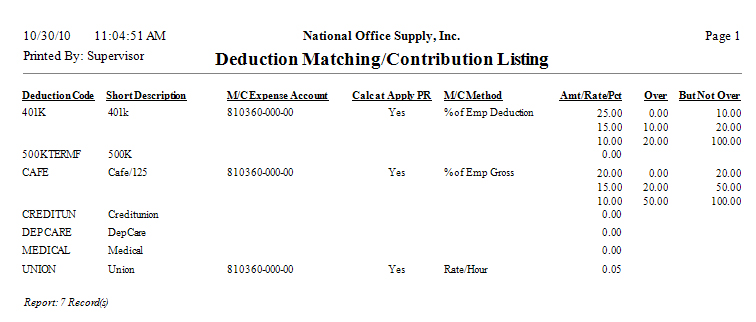

Deduction Matching/Contribution Listing

To review the employer match/contribution parameters set up in the deduction

records, generate the Deduction Matching/Contribution Listing. Displayed in

this report are the GL Account ID to which the system will record the expense

resulting from the employer's share in the deduction; setting whether

AccountMate calculates the employer match/contribution during payroll

application; calculation method and the relative fixed amount, rate per hour,

or percentage. This report helps you review the parameters that will be applied

when calculating the employer's share of each deduction.

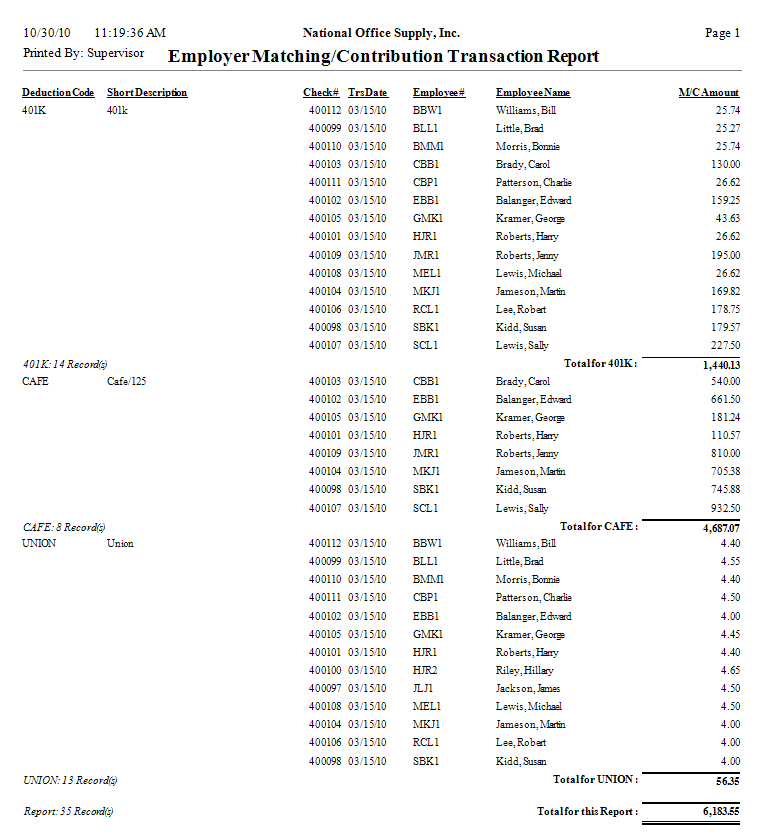

Employer Matching/Contribution Transaction Report

Generate the Employer Matching/Contribution Transaction Report to view the

details of the employer match/contribution amount for each applicable deduction

from the employees' earnings. Depending upon the sorting options selected, this

report provides information on the total employer match/contribution for each

deduction code, employee or applicable pay check. This report helps you verify

the accuracy of recorded employer match/contribution for each deduction from

the employee's pay check and reconcile the total employer contribution by

deduction code or by employee.

|