AM11 Sample Reports

|

Payroll - Employee Reports

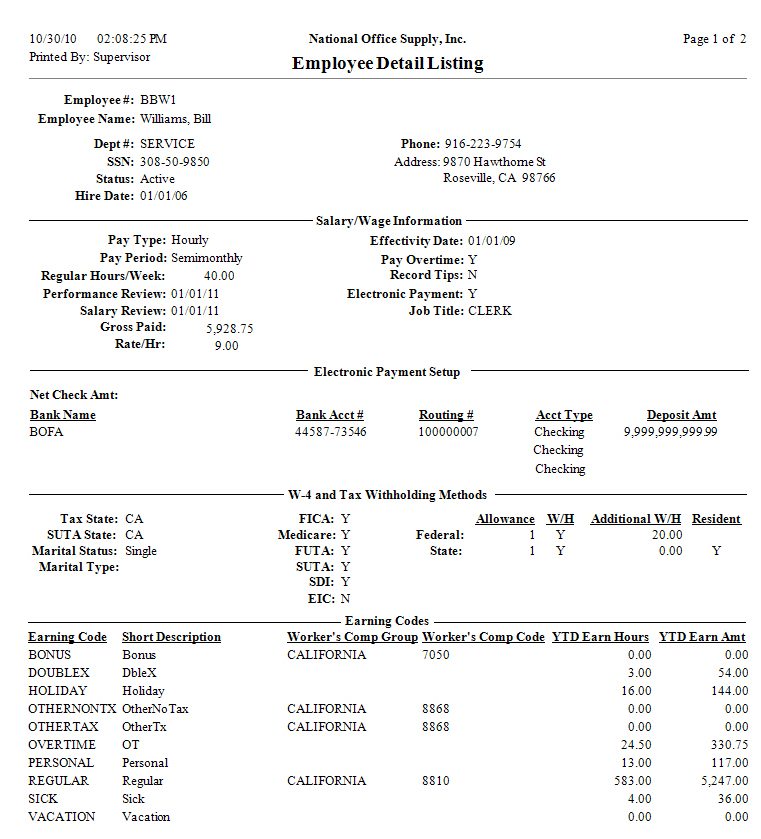

A variety of employee and independent contractor information is shown on the Employee Reports. These reports are helpful in reviewing, analyzing, and comparing employee and independent contractor data. Most of these reports apply only to employees; however, some of them particularly the Employee Detail Listing, Employee Name and Address Listing, and Employee Earnings and Tax Withholdings Listing may include information on independent contractors. While the Employee Detail Listing displays most information about each employee/ independent contractor, each of the other Employee Reports focuses on specific information such as salary and wage, deduction, W-2 data, equal employment opportunity class, or ethnic code that you can quickly review and compare among employees/independent contractors. Read the information below and get a closer look at each of the Employee Reports available in AccountMate. Employee Detail Listing

The Employee Detail Listing displays the most information about each employee and independent contractor. Information shown on this report includes personal data, salary/wage details, electronic payment setting, W-4 and tax withholding methods, accumulated earnings per earning code and associated worker's comp groups/codes, leave benefits and deductions for the current tax year, and dependents. If you need to glance quickly a variety of employee/independent contractor information in one report rather than review multiple reports in order to save time and effort, the Employee Detail Listing perfectly serves your purpose. This report is also useful if you want to verify the employees' names and addresses prior to printing W-2s but you do not want to print information on their salaries/wages. You can choose to generate the report for active, inactive, archived, terminated, or all

employees regardless of their status. You can also opt to suppress

information on employees with zero year-to-date earnings and to exclude

information on independent contractors.

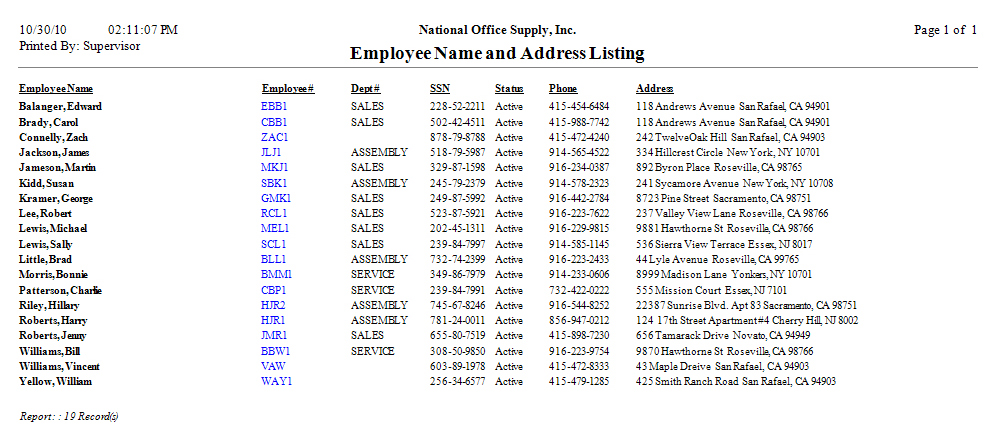

Employee Name and Address Listing

The employee's and independent contractor's names, social security numbers, phone numbers and addresses as well as status (active, inactive, or terminated) are all shown in the Employee Name and Address Listing. This report is most useful when you need personal data and contact information of a certain employee or independent contractor. You can generate this report for active, inactive, terminated, or all employees

regardless of their status. You may opt to exclude from the report information

on employees with zero year-to-date earnings.

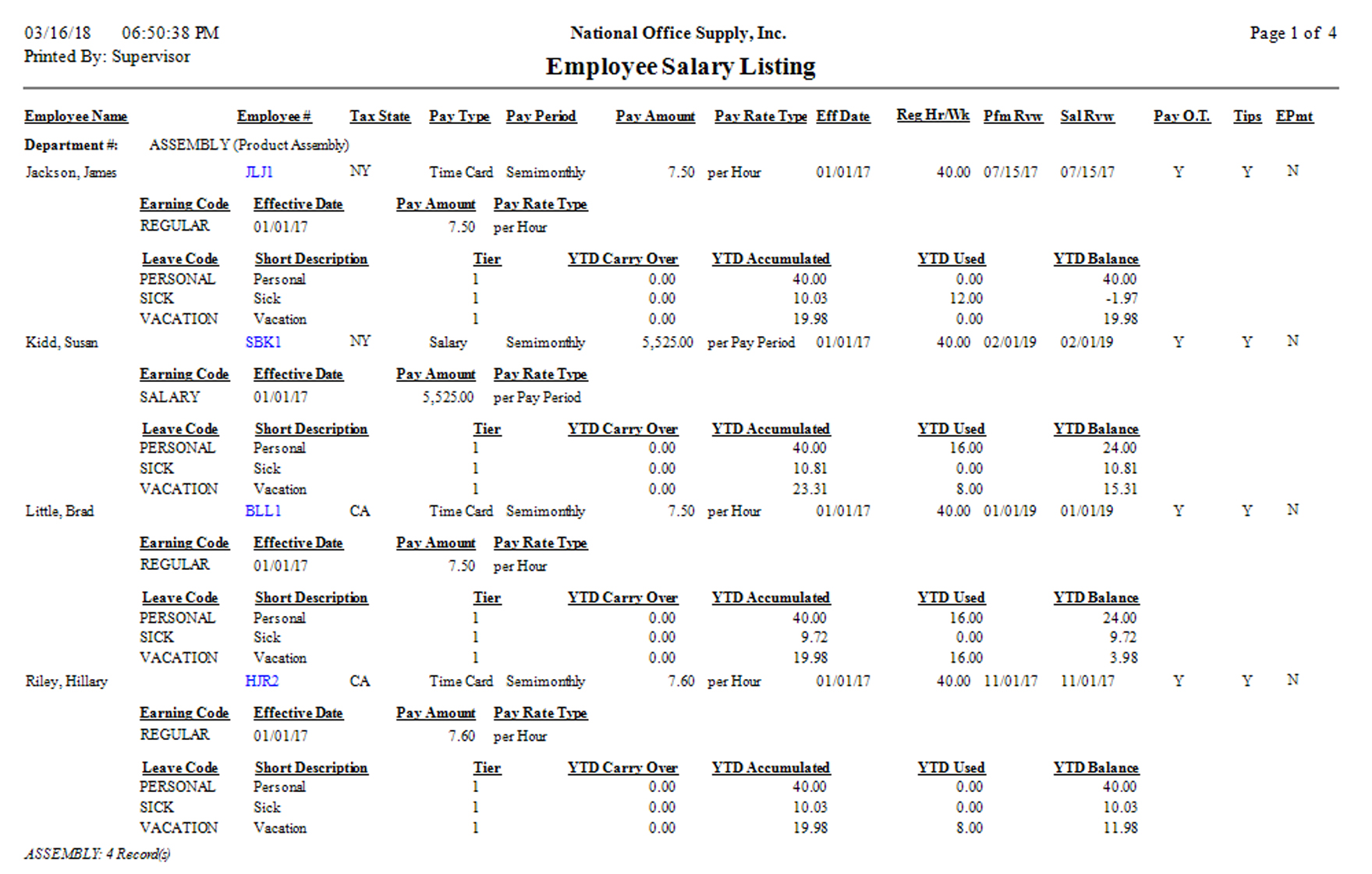

Employee Salary Listing

Generate the Employee Salary Listing if you need to know each employee's salary information including the pay type, pay period, pay amount, pay rate type, effective dates, weekly regular hours, as well as dates of performance and salary review. This report also tells you whether the employee is entitled to overtime and tips and is set up for electronic payment. This report helps you review each employee's salary/wage information and track the next performance and salary review schedule. You can generate the report for active, inactive, terminated, or all employees

regardless of their status. You can also opt to include in the report

employee's salary history and available paid leave credit. You also have an option to exclude

employees with zero year-to-date earnings.

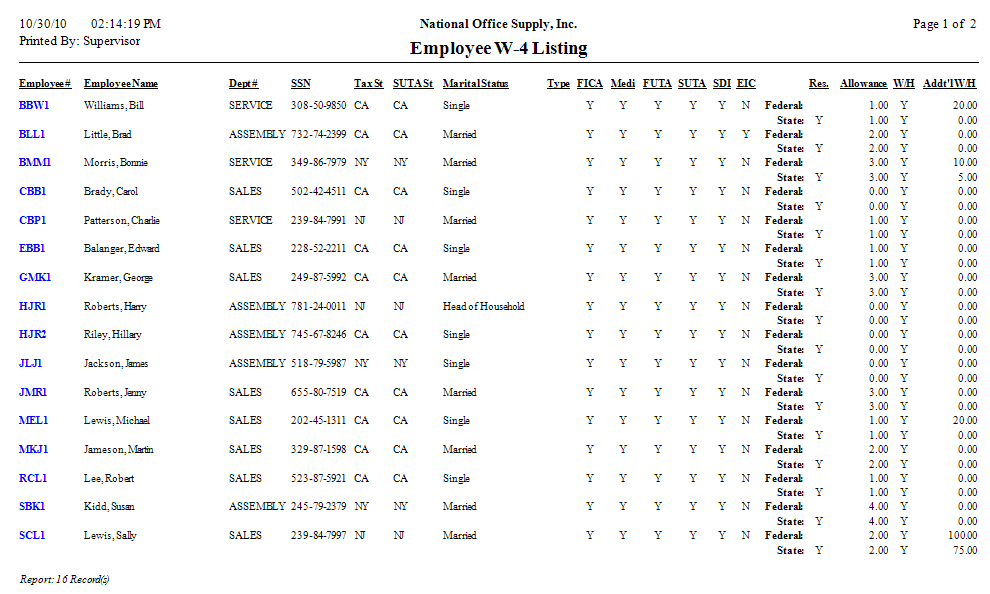

Employee W-4 Listing

The Employee W-4 Listing shows each employee's W-4 and tax withholding parameters including the social security number, tax and SUTA states, marital status, number of federal withholding allowances claimed, and additional federal tax amount withheld. It also provides information on whether the applicable taxes-FICA, Medicare, FUTA, SUTA, SDI, and EIC--are withheld, whether the employee is a resident of the state, and whether the employee's earnings are subject to federal and state taxes. You can refer to this report to verify the accuracy of the calculated withholding taxes shown on the Employee Earnings and Tax Withholdings Listing. You can select to generate this report for active, inactive, terminated, or all

employees regardless of status. You can also opt to exclude W-4 information of

employees with zero year-to-date earnings.

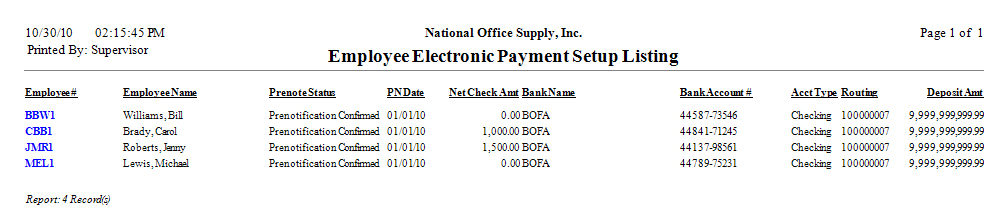

Employee Electronic Payment Setup Listing

To view the electronic payment parameters set up for employees, print or preview the Employee Electronic Payment Setup Listing. This report shows the portion of the employee's net pay to be deposited electronically into each assigned bank. Use this report to determine which employee records still require prenotification prior to their activation for electronic payment. You may refer to this report to verify how much of the employee's pay is to be paid by check and how much is to be paid through direct deposit. This report offers the flexibility to generate it for active, inactive,

terminated, or all employees regardless of status. You can also opt to exclude

from the report electronic payment setup information of employees with zero

year-to-date earnings.

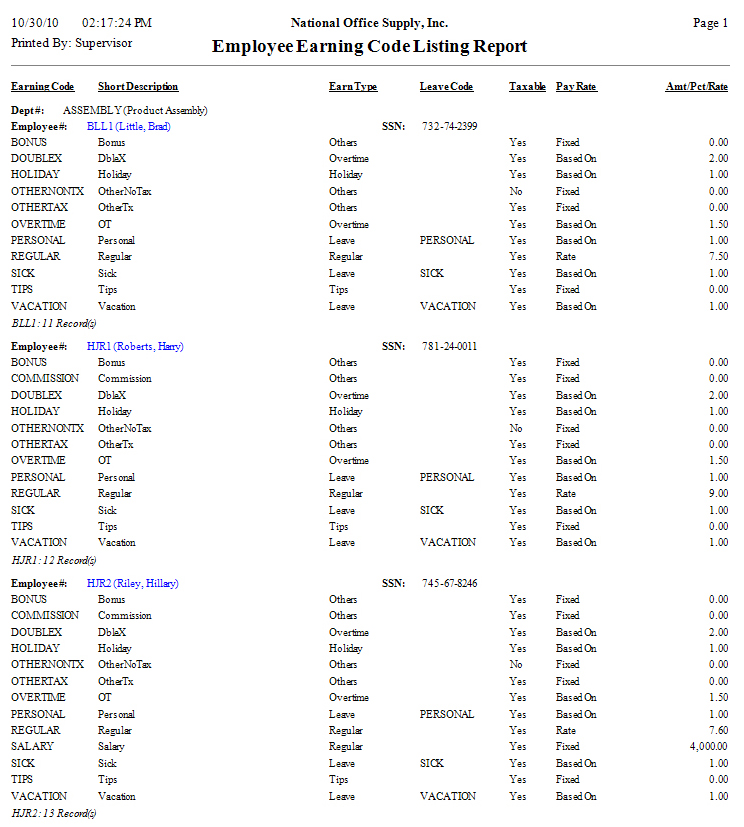

Employee Earning Code Listing

The Employee Earning Code Listing is made available to help you verify the propriety of the earning codes assigned to each employee record. By using this report, you can quickly obtain information on the earning codes assigned to each employee including the earning type and leave code, if applicable, as well as the pay rate and its corresponding amount/percentage/rate. For more information about earning codes, refer to the Earning Code Listing section. You can select to generate this report for active, inactive, terminated, or all

employees regardless of status. You can also opt to exclude from the report

earning code information of employees with zero year-to-date earnings.

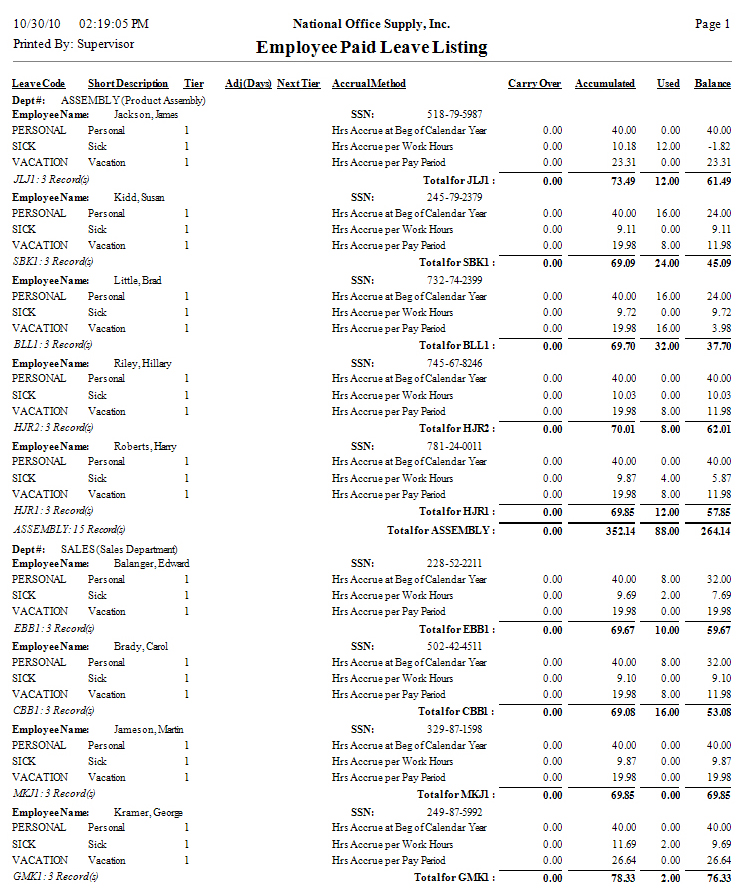

Employee Paid Leave Listing

The Employee Paid Leave Listing provides information about the parameters set up for each paid leave code assigned to each employee. It presents not only the paid leave balance for each employee but also the paid leave hours that have been carried over, accumulated, and used in the current tax year. This report is most helpful when used to verify the propriety of paid leave codes assigned to each employee and the accuracy of the paid leave balances. It also helps you determine the paid leave liability amount. You can generate this report for active, inactive, terminated, or all employees

regardless of status. You can also opt to show the paid leave cost based upon

the employee’s most recent regular pay rate.

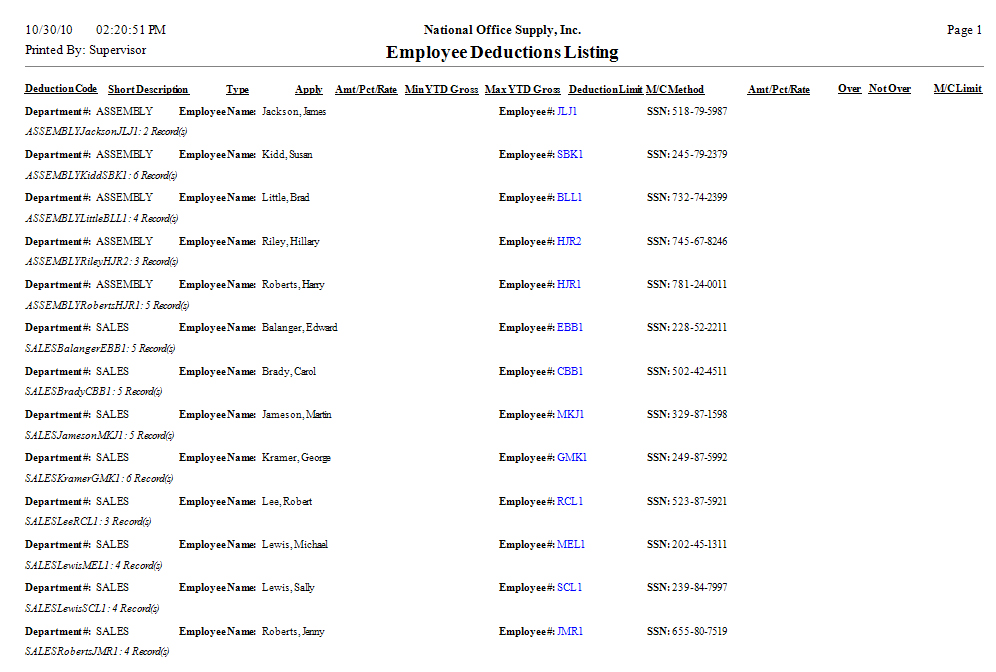

Employee Deductions Listing

Deductions affect employees' net pay; thus, it is vital that deductions are correctly set up and calculated. It is equally important that you verify the propriety of each deduction set up for each employee; thus, you need a report that allows you to thoroughly review each deduction's settings including the type, fixed amount/percentage/rate per work hour, and deduction limit, among others. The Employee Deductions Listing serves this purpose. You can use this report as reference to ascertain whether the deduction setup is accurate to help ensure that the system correctly calculates the employee deductions during payroll application. You have the flexibility to include deduction information for active, inactive,

terminated, or all employees regardless of status. You also have the option to

exclude from the report deduction information of employees with zero

year-to-date earnings. If you want the report to show the employer

matching/contribution parameters, simply select the available option.

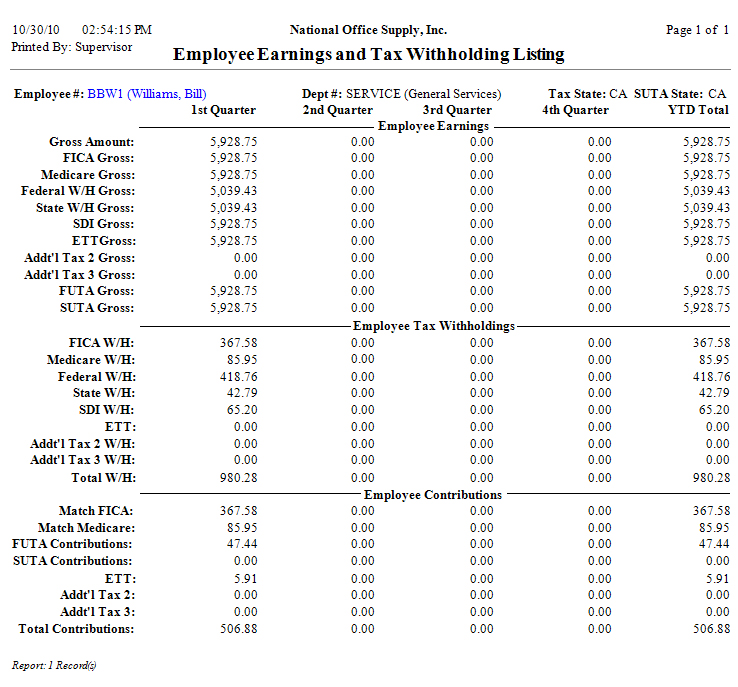

Employee Earnings and Tax Withholdings Listing

One of the most vital employee reports is the Employee Earnings and Tax Withholdings Listing. This report lists each employee's quarterly and year-to-date gross earnings, withheld taxes, and contributions for the current tax year. If an individual earns or pays taxes in multiple states, the report separately shows information for each state. This report helps you review and compare on a quarterly basis the employees' earnings, tax withholdings, and contributions. Use this report and the Employee W-4 Listing to help you verify the accuracy of the system-calculated earnings, tax withholdings, and contributions. You can choose to generate this report for active, inactive, terminated, or all

employees regardless of status. An option to exclude from the report employees

with zero year-to-date earnings is also available.

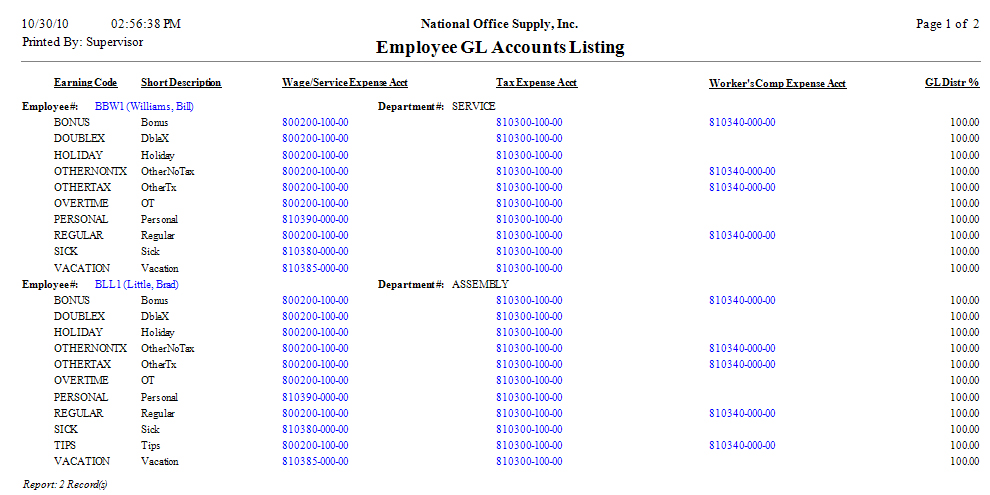

Employee GL Accounts Listing

The Employee GL Accounts Listing shows the GL Account IDs and distribution percentage for each employee and/or independent contractor's wage/service costs and the related employer payroll tax costs. For employee records, this report shows one or more pairs of GL Account IDs for employee earnings and payroll tax. For independent contractors, the report shows one or more pairs of GL Account IDs for the independent contractors’ earnings only. Use this report to review the GL Account IDs assigned to wage/service expense and tax expense of each employee or independent contractor and to verify the percentage of distribution assigned to the GL Account IDs set up for each employee record. You can choose to generate the report for active, inactive, terminated, or all

employees regardless of their status. This report also allows you to suppress

information on employees with zero year-to-date earnings and to exclude from

the report information on independent contractors.

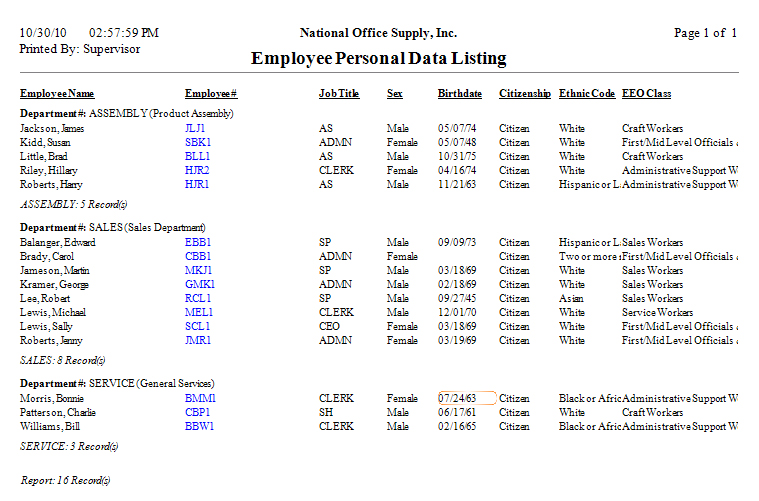

Employee Personal Data Listing

There are instances when you need to quickly view an employee's personal information such as the assigned department, job title, gender, birth date, citizenship, ethnic code, and EEO (Equal Employment Opportunity) class. In those instances, the Employee Personal Data Listing is what you need. This report provides the flexibility to generate data for active employees

only, inactive employees only, terminated employees only, or all employees

regardless of status. You may also opt to exclude from the report employees

with zero year-to-date earnings

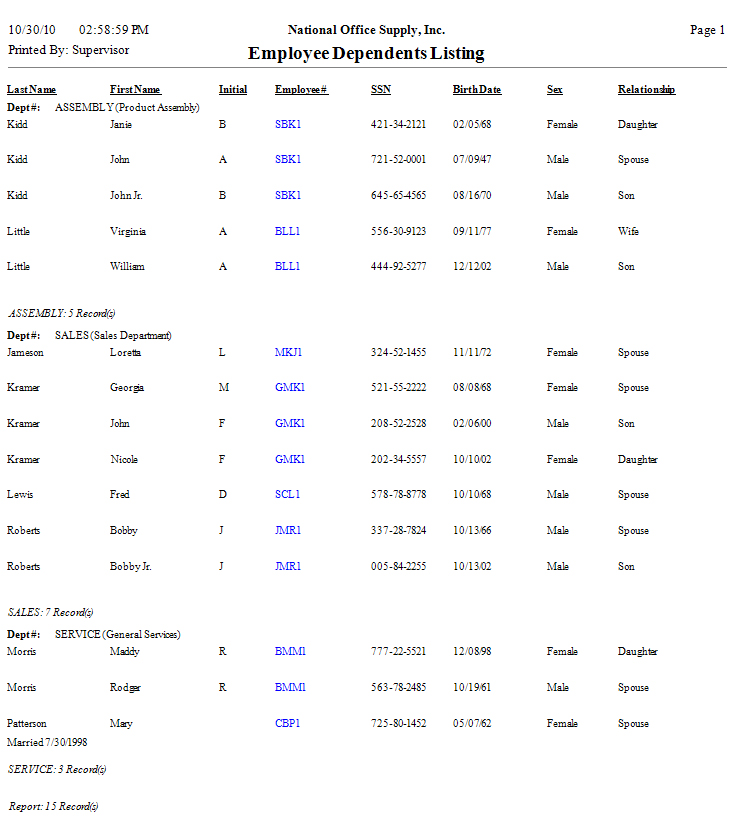

Employee Dependents Listing

The Employee Dependents Listing shows the complete names, social security numbers, birth dates, and gender of the dependents claimed by each employee on his/her federal and state tax returns. This report also shows each dependent's relationship with the employee. Use this report to verify the validity of the dependents claimed by each employee and to reconcile the number of dependents against the claimed allowances specified in the employee record. You may opt to show in the report the Notepad remarks about each dependent.

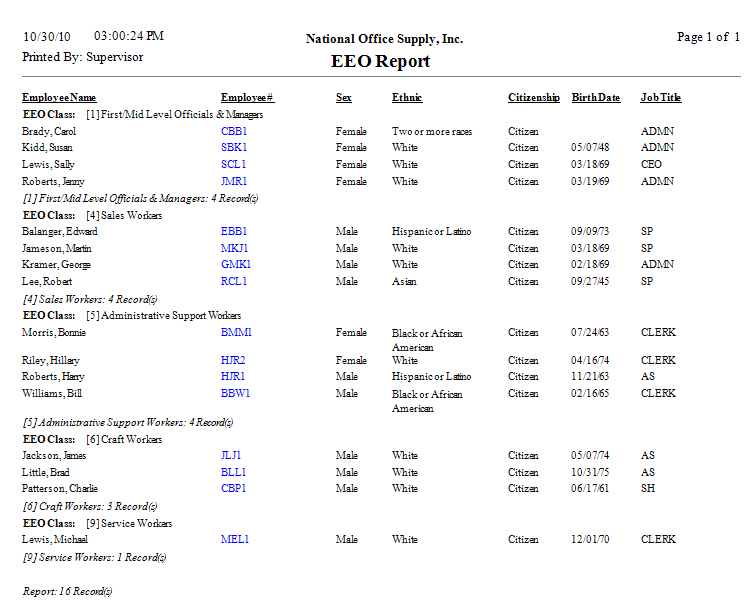

EEO Report

The EEO Report provides optional equal employment opportunity data that the employees or employer provides. This report includes only the active employees. Generate this report if you need a quick glance of the EEO class and/or ethnic code assigned to each active employee. Options are available to exclude from the report those employees to whom no EEO

class or ethnic code is assigned.

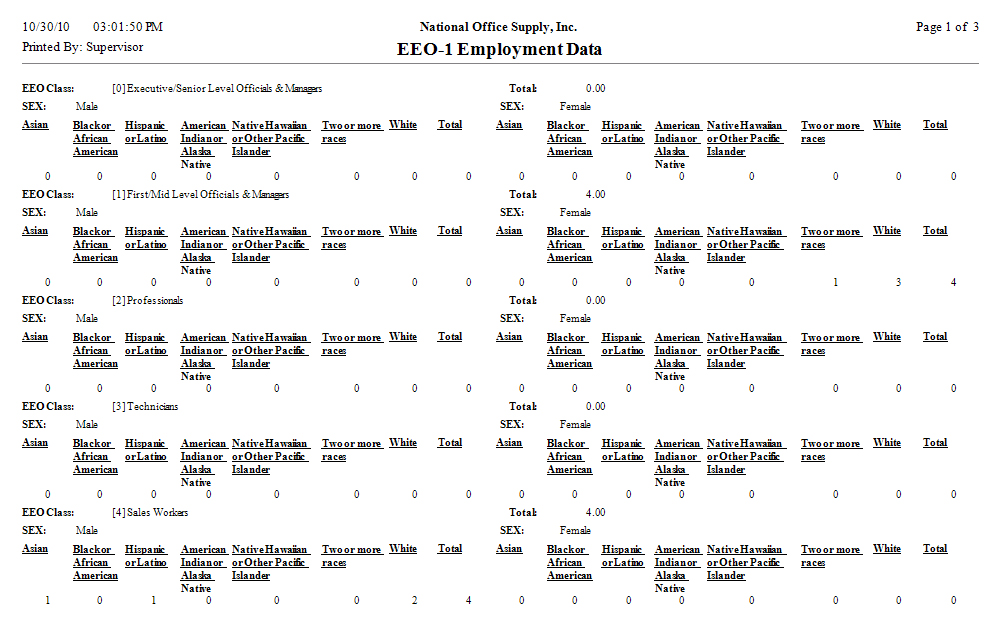

EEO-1 Employment Data

If you need equal employment opportunity data for the entire company, generate the EEO-1 Employment Data report (a.k.a. Employer Information Report). This report displays the number of employees assigned with a certain EEO class and ethnic code. You can use this report together with the EEO Report to review the statistics of the employees' EEO classes and/or ethnic codes. This report is available if the EEO Reporting State/Local Government checkbox is unmarked in PR Module Setup's General (2) tab. You can select to generate this report for active, inactive, terminated, or all

employees regardless of their status.

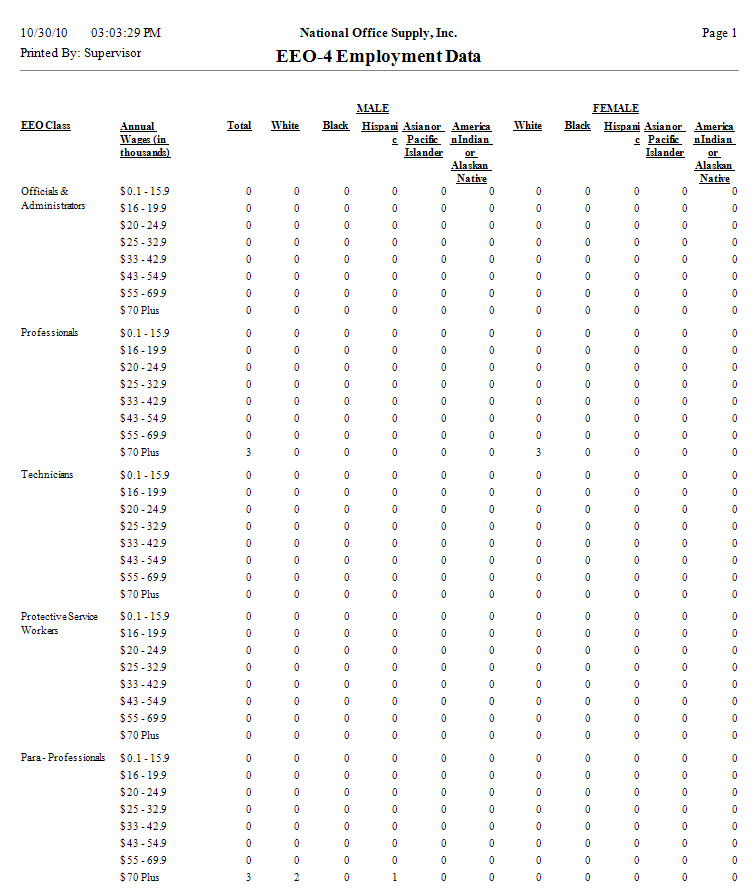

EEO-4 Employment Data

The EEO-4 Employment Data report (a.k.a. State and Local Government Report) is specific for the EEO-4 survey participants. The report shows a different set of EEO Class and Ethnic Code options than those used in the EEO-1 Report. This report also provides Equal Employment Opportunity data for the entire company. You can generate this report if you mark the EEO Reporting State/Local Government checkbox in PR Module Setup's General (2) tab. You can select to generate this report for active, inactive, terminated, or all

employees regardless of their status.

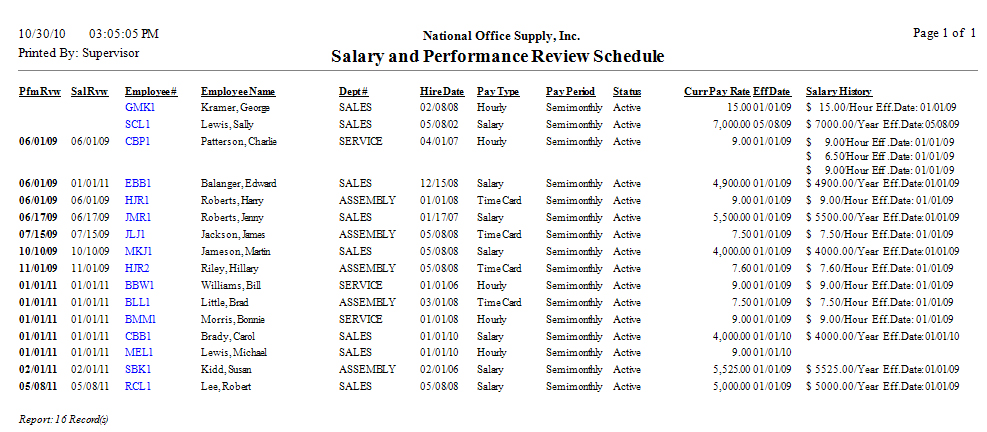

Salary and Performance Review Schedule

When it is time for performance appraisal and salary reviews, the Salary and Performance Review Schedule comes in handy. This report displays not only the dates for the next performance appraisal and salary review for each employee but also the hire date, pay type, pay period, current pay rate and effective date, and salary history. This report serves as a quick reference especially during employee regularization, regular performance appraisals, and promotions. You may filter the information shown on the report by excluding employees who

are inactive or have zero year-to-date earnings. This report also allows you to

exclude from the report the employees' salary history. You can opt to view the

information on a separate page for each department.

|