|

Payroll - Earning Code Reports

AccountMate uses earning codes to make it possible for you to assign wage rates, paid leave and wage and tax expense GL Account IDs to payroll transactions in a more flexible manner to comply with the policies of each department to which an employee is assigned. An earning code represents regular, overtime, tip, holiday, paid leave time or other types of payroll transactions as well as the pay rate, worker's compensation, and GL Account IDs associated with it; thus, it is important that earning codes be set up correctly to ensure accuracy of recorded payroll transactions. Equally important are the Earning Code Reports in helping you review the earning code parameters and recorded payroll transactions using various earning codes.

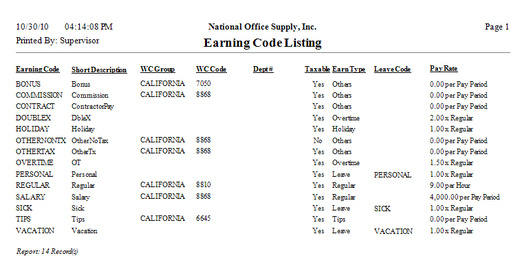

Each of the Earning Code Reports is especially designed to provide several options so you can narrow down data to the specific information needed. Read the information below to get a closer look at each report. Earning Code Listing

Do you want to see a list of all the earning codes in AccountMate and how each one of them is set up? If you do, simply generate the Earning Code Listing. This report displays the earning code's short description; associated department; default worker's compensation group and worker's compensation code when assigning the earning code to employee records. What's more? This report provides information on whether the payroll transactions assigned the earning code are subject to payroll taxes; earning type--regular, overtime, tips, holiday, leave, or others; pay rate type-annual, hourly, fixed, or factor; and associated leave code for leave earning types. Incorrect set up of earning codes may result in incorrect payroll computation; thus, using the Earning Code Listing as reference, it is vital for you to review the completeness and propriety of the earning codes set up in AccountMate. You can choose to display the default Wage/Service and Tax Expense GL Account IDs to which the payroll transactions using the earning code will be posted and their distribution percentages. Earning Code Transaction Report

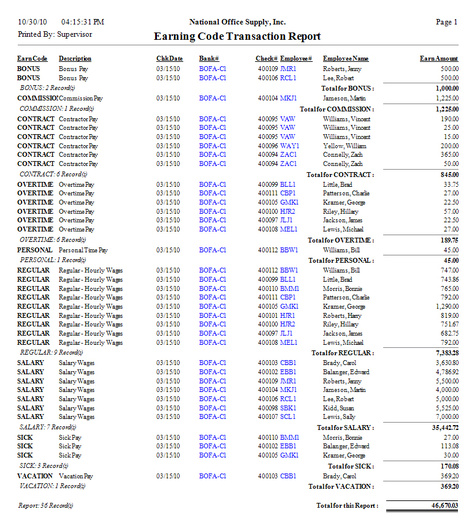

The Earning Code Transaction Report provides information on the various earning codes used in paid payroll transactions. More specifically, this report shows the employee earnings for each earning code and the associated check number, check date, and bank number. This report helps you verify the accuracy of the system-calculated employee earnings based on the earning code parameters. You may also use this report as reference when reconciling the total paid earnings by earning code or by employee. |