|

Bank Reconciliation - Check Reports

The Check Reports provides detailed information primarily on the status of checks recorded in the AP module. Generating these reports provides a necessary audit trail; it is useful for monitoring checks status and facilitates reconciling bank accounts. Each of these reports is especially designed to provide several filter options so you can generate a report that shows the specific information you require. Each report is also presented in various report formats.

Read the information below to get a closer look at each of the Check Reports available in AccountMate Enterprise.

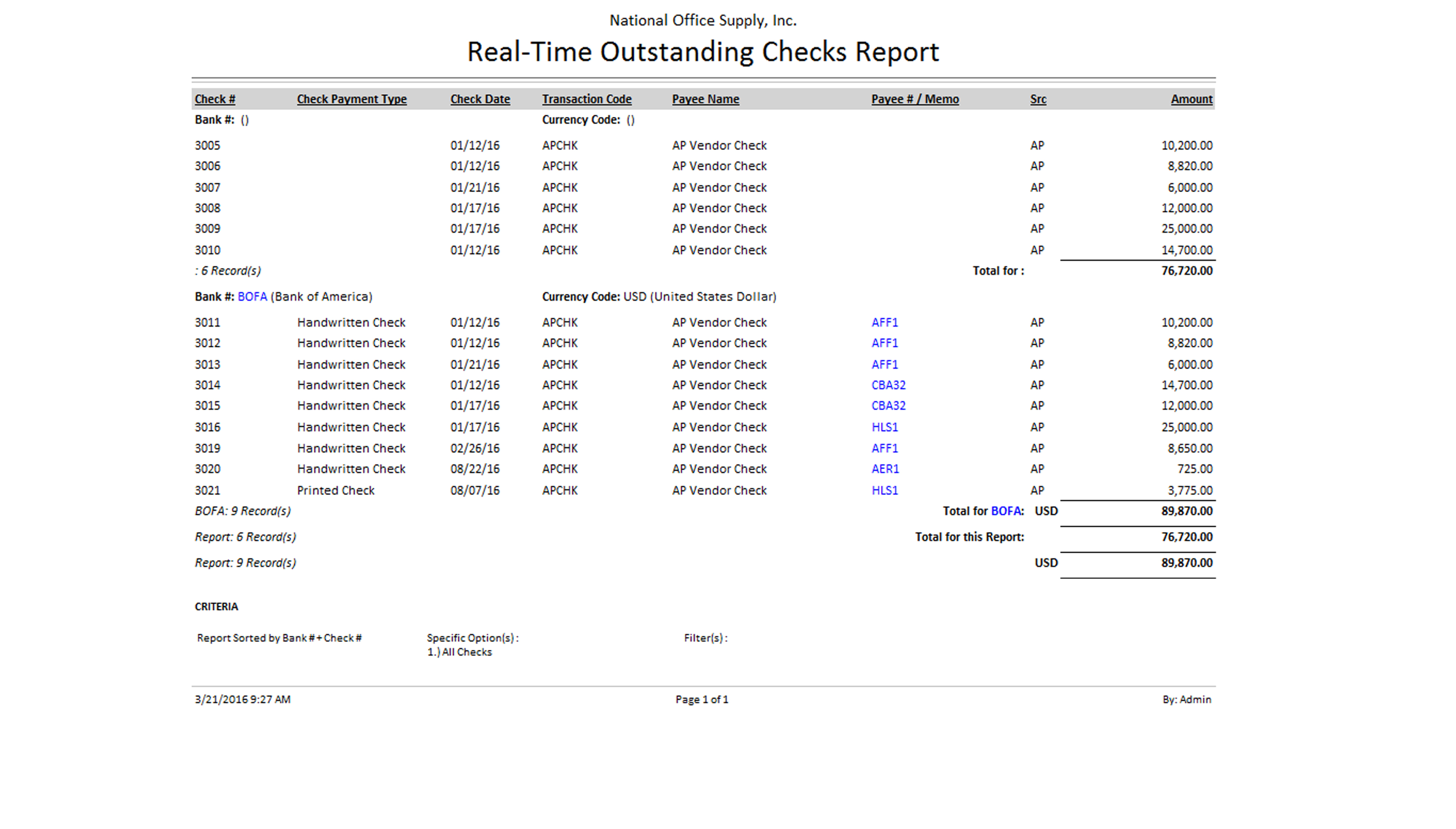

Real-Time Outstanding Checks Report

The Real-Time Outstanding Checks Report provides information on all check transactions recorded in AccountMate that are not yet marked as having cleared the bank. The report displays all outstanding checks in the system regardless of the date the report was generated. The report shows the bank account, check number and check date, check payment type, payee name, source module and check amount. The report is useful for verifying the accuracy and for monitoring outstanding checks. The report is also serves as reference in reconciling check transactions.

You can generate this report for an individual bank account or you can opt to filter this report to show transactions from all or a range of bank accounts. You can also opt to filter this report by specifying all or a range of check numbers, transaction codes, or by the checks’ entry date and check date. You can further select to show in the report only checks issued from the AP module, checks issued from the Payroll module or all checks.

Click image to enlarge view

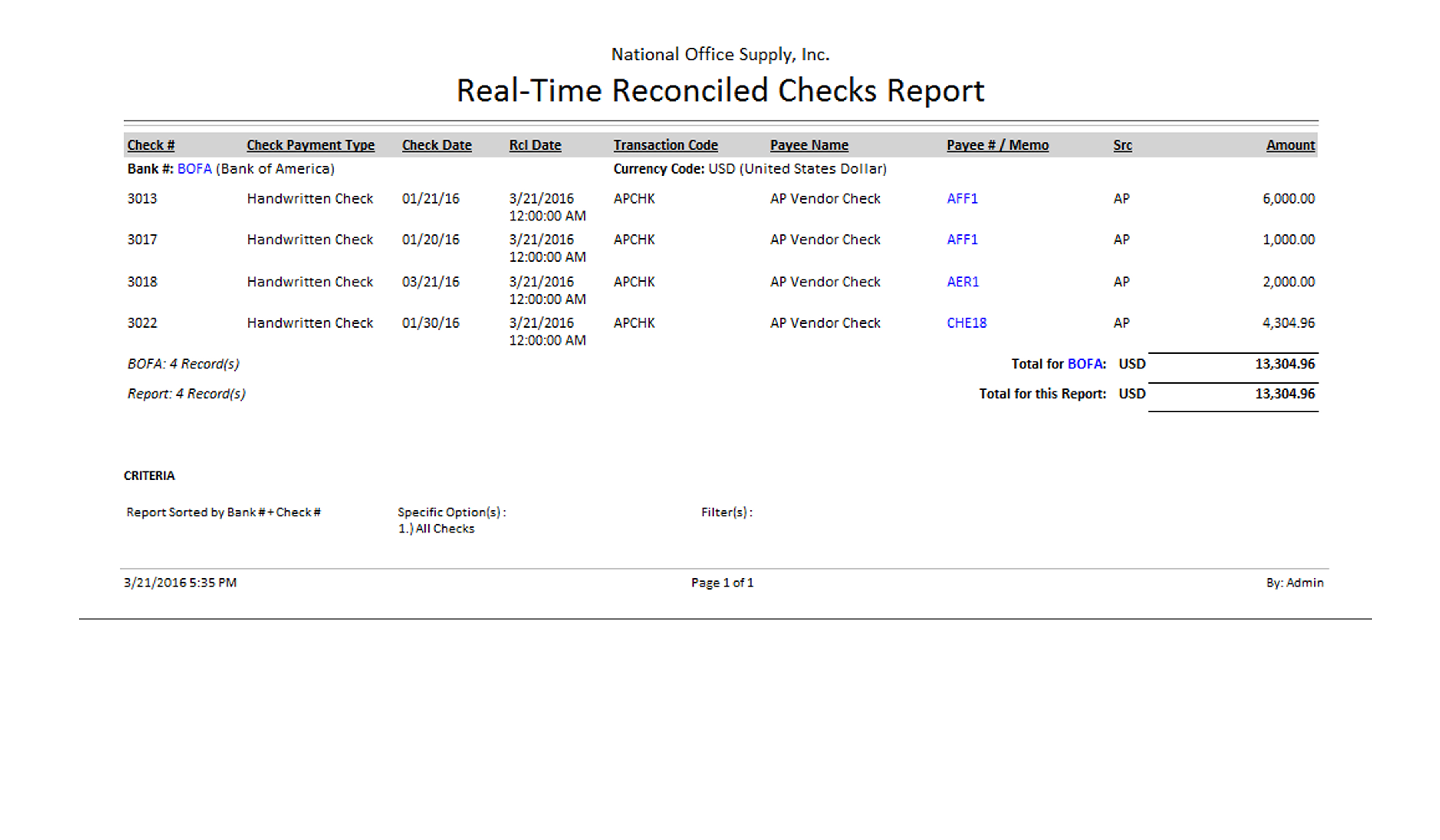

Real-Time Reconciled Checks Report

AccountMate refers to checks that have cleared the bank and are consequently included in a bank reconciliation as reconciled checks. The Real-Time Reconciled Checks Report provides detailed information on all check transactions marked in AccountMate as reconciled regardless of the date the report was generated. The report includes information such as bank #, check # and check date, check payment type, payee name, source module, check amount and the date it was marked as reconciled. The report is useful for verifying accuracy of reconciled checks and can be used as reference in reconciling check transactions.

You can generate this report for an individual bank account. You can also opt to generate this report either for all or a range of bank account, all or a range of check numbers, and all or a range of transaction codes. You can further filter the report by specifying the check date or the reconciled date. You can also generate the report to show reconciled checks solely from the AP module, exclusively from the Payroll module, or all checks regardless of source module.

Click image to enlarge view

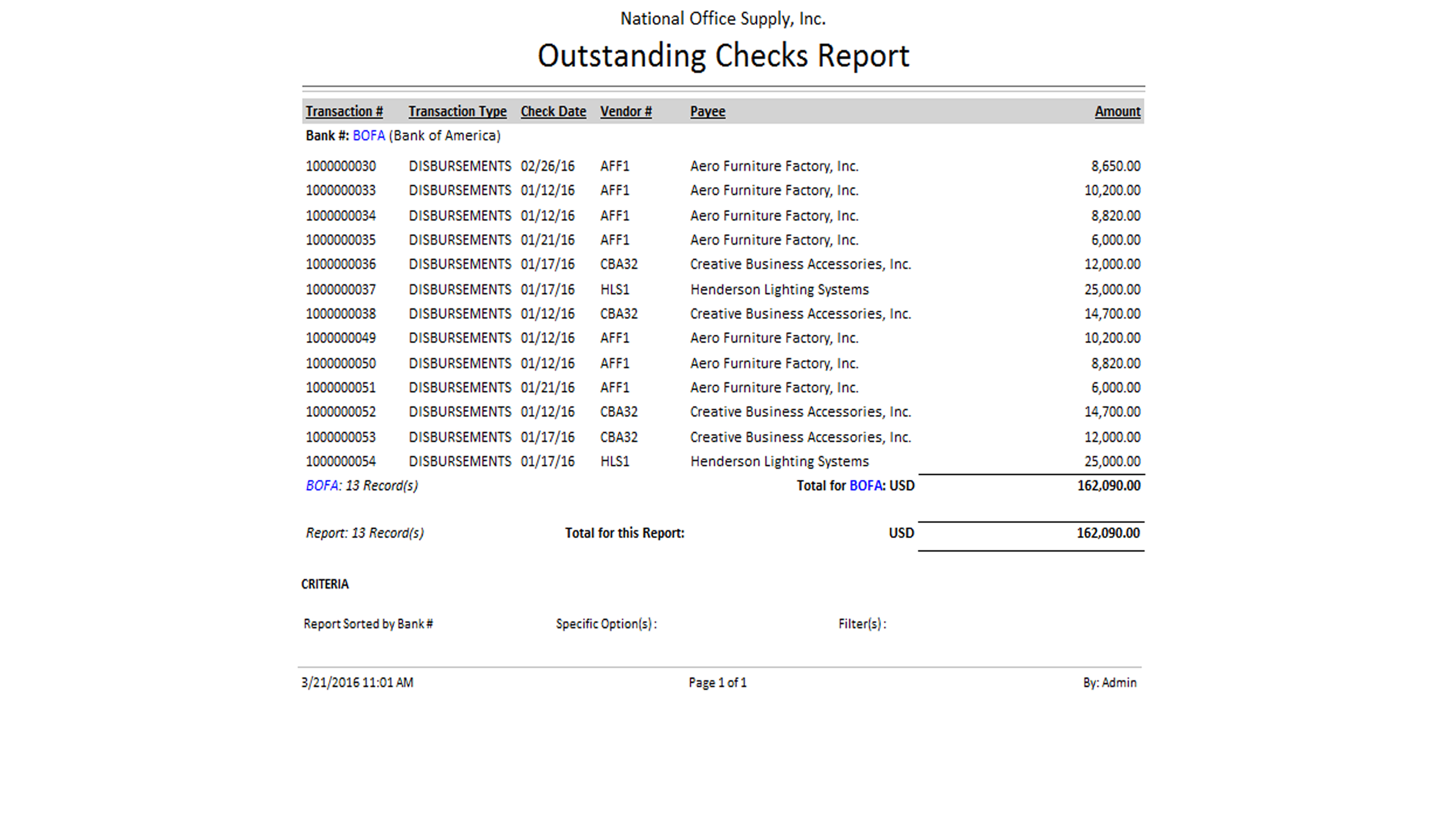

Outstanding Checks Report

The Outstanding Checks Report provides detailed information on checks issued from the Accounts Payable (AP) module which are not yet marked in AccountMate as having cleared the bank as of a specified Report Date. The report shows AP checks which were marked as outstanding based on the date you specify in the Report Date field of the report criteria. The report shows the check number and check date, transaction type, payee name and check amount. Generate this report to verify the accuracy of issued checks not yet recorded as cleared in the system and as reference for monitoring outstanding checks. This report also serves as a guide in reconciling your checks.

You can generate this report for an individual bank account. You can also opt to generate the report for either all or a range of bank accounts. You must specify a Report Date to be able to successfully generate the report.

Click image to enlarge view

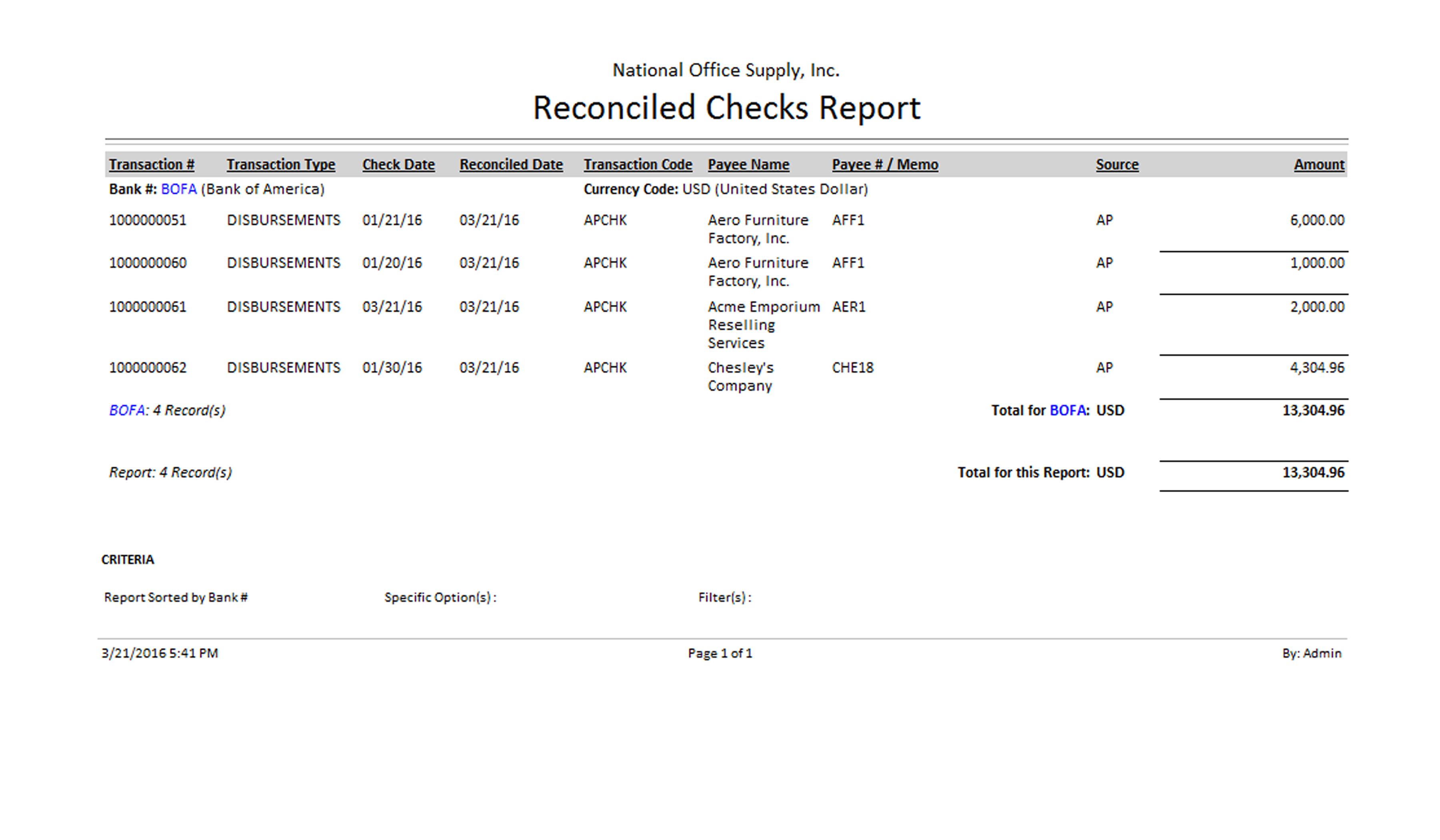

Reconciled Checks Report

The Reconciled Checks Report provides detailed information on checks issued from the Accounts Payable (AP) module that are marked in AccountMate as having cleared the bank and reconciled as of a specified Report Date. The AP checks that is displayed in the report are those that were marked a reconciled based on the date you specify in the Report Date field of the report criteria. The report shows the check number and check date, reconciliation date, payee name, transaction code, currency code, source module and check amount. This report is useful for verifying the accuracy of checks shown as cleared in the bank statement and for monitoring checks marked as reconciled in the system. The Reconciled Check Report also serves as a guide in reconciling cleared checks.

To generate this report, you can select to show reconciled checks for an individual bank account. You may also opt to generate the report for all or a range of bank accounts. You must enter a value in the Report Date field to successfully generate the report.

Click image to enlarge view

|