AccountMate 7.x for SQL/Express

Conversion from

AccountMate/LAN 6.5

CONVERSION INSTRUCTIONS

As of November

28, 2007

Important!!

Read this document first.

Do not

run the AccountMate 7.x for SQL/Express (AM 7.x) conversion until you read and

thoroughly understand all pages of this document. If you have any questions

about the conversion process after reading this material, please contact our Product

Support team at (415) 883-1019 or via e-mail at support@accountmate.com before you

attempt the conversion.

What’s New?

This entire document has

been designed to address your conversion needs. This document is made up of two

parts:

·

Checklist –

step-by-step list of the procedures to be performed

·

Installation

& Conversion Details – detailed discussion of

the procedures specified in the checklist

The following section(s) has (have) been

updated:

o

Pre-installation

Steps

o

Converting Data

o

Post-Conversion

Process

CHECKLIST

Note: For a detailed discussion of the specific steps in the checklist

below, please refer to the Installation & Conversion Details section.

A. Pre-installation Steps

|

|

1.

Correct Version |

|

|

2.

Conversion Limitations |

|

|

3.

Do Modifications Exist? |

|

|

4.

Install SQL Server with Mixed Mode Authentication |

|

|

5.

Choose Computer |

|

|

6.

Check Disk Space |

|

|

7.

Run Reports |

|

|

8.

Payroll Module Preparations |

|

|

9.

Backup |

|

|

10.

Perform Data Validation Procedures |

|

|

11.

Verify Data Set Size |

|

|

12.

Close PO/AP and BR |

|

|

13.

Generate and Export Accrued Received Goods Report |

|

|

14.

Download Pre-Conversion Utility |

|

|

15.

Run Pre-Conversion Utility |

|

|

16.

Configure ODBC DSN |

|

|

17.

Backup |

B. AccountMate 7.x for SQL/Express Installation

|

|

1.

Run Setup.exe |

|

|

2.

Select Destination Location |

|

|

3.

Select the “Custom” Installation Option |

|

|

4.

AccountMate Product Key |

|

|

5.

Select Components to Install |

|

|

6.

Launch the Administrator Program |

|

|

7.

Activate Modules |

|

|

8.

Install License File |

|

|

9.

Create Company |

|

|

10.

Back up AM 7.x for SQL/Express |

C. Converting Data

|

|

1.

Verify Exclusive Access |

|

|

2.

Download and Extract Latest Conversion Utility |

|

|

3.

Run Foreign Key Checker |

|

|

4.

Run convert.exe |

|

|

5.

Select Installation Folder |

|

|

6.

Select Database |

|

|

7.

Choose Location for Temporary Databases |

|

|

8.

Perform Data Integrity Check |

|

|

9.

Complete Conversion |

D. Post-Conversion Process

|

|

1.

Input PR Tax Subscription Key |

|

|

2.

Initialize Modules and Install Latest PR Tax Update |

|

|

3.

Access Maintenance Records |

|

|

4.

Compare GL Transfer Report and GL Financial Statements |

|

|

5.

Review Converted Data (by running reports) |

|

|

6.

Perform “Typical” or “Compact” Installation on Workstations |

|

|

7.

Post AP Invoices for |

E. Troubleshooting Errors and Messages

|

|

1.

“VAM/LAN and AccountMate 7.x for SQL company does not have the same

account segment definition. Do you want to overwrite the account segment

definition in AccountMate 7.x for SQL?” |

|

|

2.

“Data errors were detected by the conversion program at Step # 1.

Please fix your data first before you continue with the upgrade program. You

can print the data integrity checking log file(s) from [xxx\convert\work].

Would you like to view the data integrity checking log file(s)?” |

|

|

3.

“AccountMate for LAN and AccountMate for SQL company do not have the

same number of fiscal periods. Conversion cannot proceed.” |

|

|

4.

“AccountMate for LAN and AccountMate for SQL company do not have the

same fiscal year start dates. Conversion cannot proceed.” |

|

|

5.

Conversion failure during Step 5 (Upload Data to SQL Server) |

|

|

6.

Conversion failure during Step 6 (Convert LAN to AM/SQL) |

|

|

7.

Foreign Key Violation Error |

--- Checklist Ends

(Detailed Discussion Follows) ---

INSTALLATION & CONVERSION DETAILS

A.

Pre-installation Steps

This data migration program is designed to convert:

o

Databases on AccountMate/LAN Version 6.5 (AM/LAN 6.5), Build LN601

or higher to any of the following:

§

AccountMate

7.1 for SQL (AM/SQL 7.1) or higher; or

§

AccountMate 7.1 for Express (AM/Express 7.1) or higher

o

Databases on AccountMate/LAN Version 6.5 (AM/LAN 6.5), Build LN603

with Upgraded PR to any of the following:

§

AccountMate

7.2 for SQL (AM/SQL 7.2) or higher; or

§

AccountMate 7.2 for Express (AM/Express 7.2) or higher

o

Databases on AccountMate/LAN Version 6.5 (AM/LAN 6.5), Build LN604

with Upgraded PR to any of the following:

§

AccountMate

7.3 for SQL (AM/SQL 7.3) or higher; or

§

AccountMate 7.3 for Express (AM/Express 7.3) or higher

Check the build number of your current installation

by accessing the “About AccountMate” or “About Visual AccountMate” function

under the Help menu. If it is on a

build lower than the ones listed above, you must update to one of the required

builds before you can use this conversion program.

Verify that the version number

on the new AccountMate CD is one of the target versions specified above. If you

want to convert to any other version contact AccountMate Product Support at

(415) 883-1019, support@accountmate.com

or call Customer Service at 1-800-877-8896 ext 752.

Please take note of these conversion limitations

that affect the following modules:

a. BR Module:

There are data structure differences between AM 7.x and the older AccountMate

versions. You must therefore complete any bank reconciliation projects that are

pending in your current AccountMate version and then close the period in the BR

module before performing the conversion. Refer to step 12 of this section for

more information.

b.

c. SM Module:

Group and User records are not converted. Any reports created using the Custom

Reports feature are also not converted. You must re-create the Group and User

records when installing AM 7.x and, if applicable, re-create the Custom Reports

after the conversion.

3.

Do Modifications Exist?

To use the generic conversion program, your current

AccountMate system and data structure must be unmodified. If you still need your customizations after

the conversion, you must have a programmer apply them to your new version.

If you modified

the data structure or system, please do

not proceed. Instead, e-mail our Development Consulting Service, devconsulting@accountmate.com,

to inquire about the procedures to modify the generic conversion program to

work with your modified AccountMate data or system. Regular consulting

charges will apply.

4. Install SQL Server with Mixed Mode Authentication

Verify that SQL Server

or Express is properly installed and set up for use with AccountMate.

a. Make

sure that SQL Server/Express is installed under Mixed Mode to support

both SQL and NT Authentication.

b. Be sure

to assign a non-blank password to the ‘sa’ SQL login ID. Take note of

the password as you will need it to configure the ODBC DSN connection.

c. Take

note of the SQL Server/Express Instance name as you will also need it to

configure the ODBC DSN connection and to create the AccountMate databases in

the database server.

Note:

AccountMate does not sell SQL Server. For assistance on installing your SQL

Server or Express, refer to your IT Professional.

5.

Choose Computer

We recommend that you

run the conversion at the computer that holds the SQL server. If for any reason

you cannot perform the conversion at the server, run it at a computer that has

the SQL Client Tools.

6.

Check Disk Space

You should have free disk space of at least 5 times

the size of your current AccountMate data in the computer where you intend to

perform the conversion and in the drive that will hold the AccountMate 7.x for

SQL/Express databases.

7. Run Reports

Run the GL Transfer

Report from each of the non-GL modules that you use. Also generate the GL

financial reports (e.g. Balance Sheet, Income Statement, GL Listing, etc.). If you

encounter any error (e.g. Out of balance, Transfer date is not defined, etc.),

resolve the data problem before proceeding with the conversion. It is advisable

to keep a hard copy of the final, correct reports to compare against the same

reports generated after the conversion.

8.

Payroll Module Preparations

Note: If you do not have

the Payroll module, please skip this

step.

If you have the Payroll module, please note

that there are extensive data structure changes in version 7 Payroll. As such, we

suggest that you generate these

reports before the conversion so you can use them to validate your PR

data after the conversion:

o

Payroll Entry Reports

o

PR Check Reports

o

Management Reports

o

Deduction Transactions

Report

9. Backup

Back up all live company databases in preparation

for performing Data Validation Procedures and Period-End Closing. In case

of problems, you can restore the databases from your backup and try again. DO

NOT SKIP THIS STEP!

10. Perform Data Validation Procedures

Run the Validate

Database and Rebuild Table Indexes

functions for each company to be converted. If you encounter any error, correct

the problem; then, make another backup of the affected database before proceeding

with the conversion.

11. Verify Data Set Size

By default, o

Note: A data set is a combination of the DBF, CDX and FPT files that store a

particular type of data in AM/LAN. For example, APVEND.DBF, APVEND.CDX and

APVEND.FPT all store AP Vendor File information and constitute one data set. It

is the combined size of the three APVEND.* files that is compared against the

default 1.5 GB data set size limitation.

After completing all

pending Reconcile Bank Account transaction records, you must close the period

in the BR module. This is essential for the BR module’s data to be properly converted.

The BR period you are closing

does not have to match the bank statement period you have reconciled. For

example, if the most recent bank reconciliation you have completed is for the

June statement period but your current period in BR is July you can still

proceed with the Period-End Closing. It is also not necessary for all bank

account records to be reconciled for the same statement period. For example, if

some but not all your bank accounts have been reconciled for the July statement

period you can still proceed with the Period-End Closing. The system only

requires that there are no pending bank reconciliation projects in the

databases that are to be converted.

You must also perform

Period-End Closing for your PO/AP modules; however, these modules must be

closed through the period that has transactions that have yet to be posted to

GL. For example, if you have recorded PO/AP transactions dated up to July

31, 2007 you must close PO/AP through July 2007. Closing the period in

PO/AP is necessary to generate the correct information for the succeeding

steps.

13. Generate and Export Accrued Received Goods Report

Run the Accrued Received

Goods Report sorted by Vendor#. This must be performed in your current

AccountMate installation as you will no longer be able to generate this report

in AM 7.x for

Be sure to keep a copy

of the said report. You will need it after the conversion to identify

which

Note: You must keep a copy of

this report for as long as accrued receipts recorded in your previous

AccountMate version are not reversed in your AP invoices. Do not dispose

of them after the conversion until all of the PO receipts in the report have

been fully reversed in AP.

14. Download Pre-Conversion Utility

You can obtain the Pre-Conversion

Utility (accrual_ln.zip) from the Download

Center\Conversion and Upgrade Tools section of the AccountMate website. If

you are an AccountMate End User, you must ask your AccountMate Reseller to

download this file for you. You will need this file if you have Accrued

Received Goods transactions in your

15. Run Pre-Conversion Utility

The Accrued Received

Goods Report does not show which accruals have been posted to GL, which is why

you need to run the Pre-Conversion Utility as an additional step. Follow

the steps defined below:

a. Extract

the content (accrual_ln.exe) of the

Pre-Conversion Utility you downloaded in step 14 to the data directory of the AccountMate

LAN company database you are converting.

b. Run the

file extracted against the database that you are converting. This will

generate a special report showing the accruals made for

c. Click

on the close button (marked “X”). The system will automatically generate an

Excel file showing the same information as the utility you just ran. This Excel

file will be called ACCRUAL.XLS by default and will be stored in your

company database directory. If you have previously run the utility and have

kept the Excel file under its default name, the system will prompt you to

overwrite the existing file with the new output.

Save the results from

running this file into a directory that can only be accessed by authorized

personnel to minimize the risk of deletion. You can print the Excel file

for a hard copy that you can use when posting AP invoices for these accruals.

Caution:

This must be performed on the correct database, for all databases that

you need to convert. Moreover, you must not delete or dispose of

these files/printouts for as long as the corresponding

16. Configure ODBC DSN

Note: If you

are converting to AM 7.3 or higher, please

skip this step.

Before installing AM

7.x, verify that your System DSN is configured correctly for AccountMate. The

procedures described below must be performed on the server and on every

workstation that will run the AM 7.x program.

Verify that:

a. Your

System Data Source name is “AMMS”.

b. Type in

the correct SQL Server/Express instance name.

c. Set the

ODBC to use SQL Server Authentication.

d. Mark

the check box “Connect to SQL Server to obtain default settings for the

additional configuration options”.

e. Use ‘sa’ for the login ID and use a valid password; and, as much as possible, do not use a blank password.

f. Test the connection and verify

that your test results will read, “Tests completed successfully”.

17. Backup

Back up the entire AccountMate

LAN folder; in case the conversion fails or you decide to postpone it for

another time, you can delete the AccountMate folder used in the failed conversion,

restore the files from your backup and either try again or reschedule the

conversion. DO NOT SKIP THIS STEP!

B.

AccountMate 7.x for SQL/Express Installation

Insert the AccountMate 7.x for SQL/Express CD into a

CD-ROM drive. If the installer does not automatically run, click on Setup.exe.

You will be shown the AccountMate 7.x for SQL or the AccountMate 7.x for Express

Setup screen.

2. Select Destination Location

On the Choose

Destination Location screen, accept the default Destination Folder by

clicking the Next> button; or click

the Browse… button to change to the

desired path. This should be the folder in which you will find it most

convenient to run AM 7.x.

Note: You must install AM 7.x

in a separate folder than the one that holds your current AccountMate

installation. In case the conversion fails and you decide to postpone it for

another time, you will be able to easily go back to your previous AccountMate

version.

3. Select the “Custom” Installation Option

Click on the Next button to proceed to the Setup Type screen. Since you are

installing on the server where you will perform the conversion, make

sure that you choose the Custom installation

option.

4.

AccountMate Product Key

In the Product

Key window, enter

the 25-character AccountMate Product Key

printed on the License File CD that

was shipped to you with your AM 7.x package. Should you encounter problems with

your Product Key, contact AccountMate Customer Service at 1-800-877-8896 ext

752.

Note: The

Product Key is version specific, which means that the product key for version 7.3

will not work for any other version and vice versa.

5.

Select Components to Install

In the Select Components window, you will see

three Components to install. These are:

o

Program Files => these are the executable files, which will

allow you to run the main AM 7.x program and all its functions and reports.

o

Administrator Program => installs the

o

Run-time Files => will install the Crystal Reports and Visual

FoxPro run-time libraries (DLL’s) necessary for running various AM 7.x functions

and reports.

Be

sure to select the Program Files and Run-time Files option boxes in this window so that the

executable program as well as the Crystal Reports and Visual FoxPro run-time

libraries (DLL’s) will be installed.

For the server, the computer

where the conversion will be performed (if other than the server), and those workstations

that need to run the

Continue with the rest

of the installation screens until you see the InstallShield Wizard Complete

window.

6.

Launch the Administrator Program

Run the AccountMate Administrator program either

from your desktop or the AccountMate program folder.

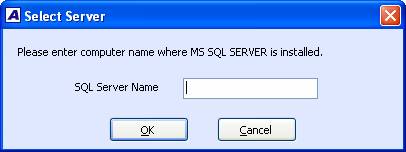

If you are converting to AM 7.3 or higher, you should be prompted for the SQL Server or

Express instance where your AccountMate data is stored (Figure 1). Enter the

computer name and the SQL Server or Express instance name (e.g. COMP1\SQL1NSTC);

then, press OK.

Note: Those who are converting to AM7.2 or lower versions

will not see this message.

Figure 1. Select Server Dialogue Box

At this point, AccountMate will automatically create

the system database and the sample company database on the SQL server.

a. When prompted for the default password, enter “go”.

b. When prompted for a country tax setting for the sample

company, select the option that most closely represents the sales tax system

that applies to your own company; then, click OK.

c. When asked for the SQL and Mapped data directories, accept

the default or enter the correct path. The SQL Data Directory is the folder on

the server where Microsoft SQL Server is installed. The Mapped as Directory is

the path that represents the mapping you made to the SQL Data Directory on the

workstation from where you are running the Administrator program.

d. When asked if you want to continue

with the installation of the AccountMate databases, click Yes.

e. Wait until the system displays a

message stating that the system and sample company databases have been

successfully installed; then, click OK.

7.

Activate Modules

Activate all your modules.

a. In the

Administrator program, select Setup > Licensing > Activate Module. The system will display the

Important Notice window that contains the AccountMate License and Copyright

Notice. Click on “I Agree” to proceed.

b. Verify the value entered in the

space provided for the AccountMate

Product Key. If the Product Key supplied is valid, the system will list all

the modules that you acquired with a check mark on the Purchase column.

c. To activate a module, click on the

box in the Activate column beside

the module you want to be able to use.

Note: If you

entered the AccountMate Product Key upon installation, you will see the same

information upon accessing the Activate Module function window. If you purchased

any new modules since the new version was installed, you will be issued another

Product Key. You must enter the new Product Key in the space provided in the

Activate Module window to activate the new modules purchased.

8.

Install License File

The AccountMate license is in a License File CD that comes with your

AccountMate 7.x for SQL/Express package. The License File CD label shows your

company name, Support ID and Product Key. If you notice any discrepancy in your

company name or Support ID, please contact Customer Service at 1-800-877-8896

ext. 752.

To install the License

File:

a. Insert the

License File CD into a CD-ROM drive

that is accessible from the computer where you will perform the License File

installation.

b. Access

the AM 7.x Administrator program (click on Amsqladm.exe in the

AccountMate root directory).

c. Select

the Install License File option under the Licensing function on the Setup menu. This will display

the Important Notice window. Click “I Agree” to be shown the Install License

File dialogue box.

d. Click

the ellipsis button beside the License File field and select the path that

points to the CD-ROM drive.

e. Click

on the Install button on the

dialogue box to initiate installation of the license.

Notes:

§

You have 90 days from the

installation of your new AM 7.x version to install the license file. After 90

days, the unregistered copy will expire and you will be locked out of the main

AccountMate program until the license is installed.

§

You

will also be limited to a database size of approximately 0.25 gigabytes.

If your converted data has a size that is greater than 0.25 gigabytes, you will

be locked out of the main AccountMate program even if you have not exceeded the

90-day grace period; you will only be able to use the program once you have

installed your license file.

9.

Create Company

In

AM 7.x, create the company to which you will be converting your AccountMate LAN

data. You can do this through Company

Setup. Make sure it has the same information as the AccountMate LAN

company database being converted for the following fields:

o

GL Account Segment Definition - the structure as well as the major segment and,

where applicable, the fund segment. For example, the Description [ID] is case

sensitive. If the Description you created in AccountMate LAN is in small

letters, make sure that the Description you specify in AM 7.x is also in small

letters.

o

Number of fiscal periods

o

Fiscal Period Interval – if you choose a 12-period fiscal year setting, you

must choose the “1 Month(s)” option as the other options are not available in

previous AccountMate version releases.

o

First Day of the Fiscal Year

o

Current Fiscal Year

o

Home Currency

o

Fund or Non-Fund Company Setup

o

Consolidation Setup (i.e. no consolidation,

parent or subsidiary)

Notes:

§

The conversion requires that the above eight settings in the AM 7.x

company be identical to those of the AccountMate LAN company you are

converting.

§

Create Groups and Users, and

assign access rights to the Company database you created through the Group/User

Setup function.

10. Back up AM 7.x for SQL/Express

Back up the AM 7.x company database you just

created. In case of failure, you can restore this backup and resume the

conversion without having to recreate your target company database. DO NOT SKIP THIS STEP!

C.

Converting Data

Check that no one

accesses the source AccountMate LAN company you are converting and the AM 7.x system

while you perform the conversion. You can verify this by selecting the Current

Login User List function; make sure you are the only user currently logged

in. Exit the AccountMate LAN and AM 7.x programs; then, continue with the conversion.

2.

Download and Extract Latest Conversion

Utility

Make

sure you have the latest conversion utility (i.e. Conversion File for AM7.x). The latest version of this file is

available for download from the Download

Center\Conversion & Upgrade Tools section of the AccountMate website. If

you are an AccountMate End User, you must ask your AccountMate Reseller to download

these files for you.

Extract the contents of the download file LAN_to_MS7.zip into the AM 7.x

application folder. When extracting the contents of the zip file, verify that

the “overwrite existing files” and “use folder names” checkboxes are marked.

Note: If you

are converting to AM 7.2 or lower, please

skip this step.

Locate the Foreign Key Checker (AMFKCHKL.EXE) in the Convert

subfolder of your AM 7.x application folder.

This tool must be run

against all AccountMate databases, including the sample company. It

checks for possible foreign key violation errors that could occur during the conversion process.

Depending on the validation results, you must fix the data and then create

another backup before proceeding with the conversion. The Convert folder also

contains the AccountMate for LAN Foreign

Key Checker Utility_User Guide (PDF). Please read this document carefully

before using the tool.

4.

Run Convert.exe

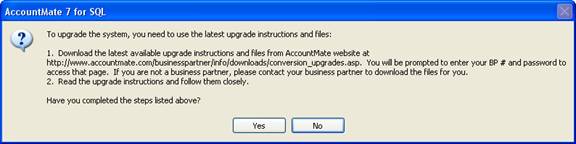

Run CONVERT.EXE from the Convert folder of your AM 7.x application folder.

You should see the following reminder:

Figure 2. Conversion Dialogue Box

Click Yes to proceed.

5.

Select Installation Folder

The second form (Figure 3)

will ask you for the location of your source AccountMate LAN installation. This

is the directory path where your AccountMate LAN program can be found.

Figure 3. AccountMate LAN Installation Directory

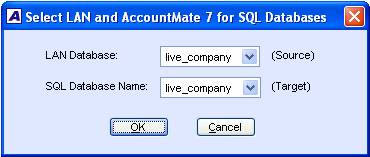

6.

Select Database

The third form (Figure 4)

will ask you for the name of the source AccountMate LAN company database and

the target AM 7.x company database. Key settings for both companies will be

compared. If they are not the same, an error message will be generated.

Figure 4. Database Selection

If everything is set up

properly, you will then be asked if a backup of your target company has already

been made. Click Yes to proceed.

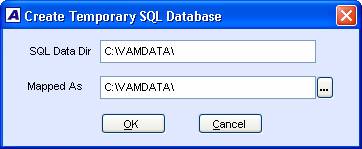

7.

Choose Location for Temporary

Databases

Another form will ask you

for the AM 7.x data drive and its mapped drive. The AM 7.x SQL Data Dir is the

physical drive in the server that contains the SQL database files (i.e. AMDATA

directory). The mapped drive is the logical drive that is mapped to the SQL

data drive. If the SQL Server database resides in the computer where you are

performing the conversion, the mapped drive is the same as the SQL data drive.

If you are working from a computer on the network, check through the AM 7.x Administrator

Program’s Company Setup of your target company for the correct drive

information.

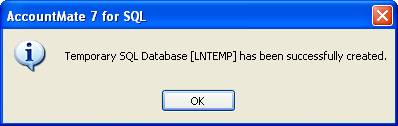

The forms shown in

Figures 5 and 6 will not be displayed if you have previously run the conversion

program and the temporary SQL database has already been created.

Figure 5. Temporary SQL Database

Figure 6. Temporary SQL Database

8.

Perform Data Integrity Check

You should now be able

to see the main conversion interface. Run Step 1, Check LAN Data Integrity. This

step checks for possible primary key violations. The program will generate

a log if it finds data problems in your AccountMate LAN data. You must fix

the AccountMate LAN data before proceeding with the conversion. This procedure will save you time if your data set

is large.

9.

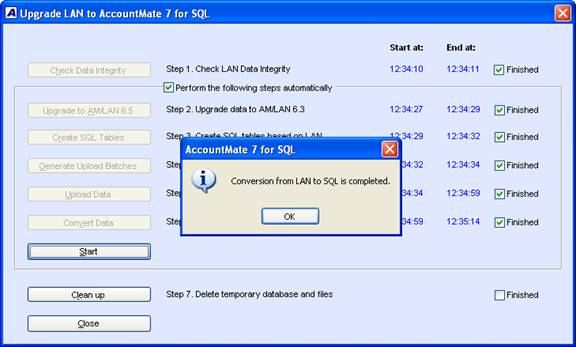

Complete Conversion

If there is no error, you can choose to do either an

unattended conversion or perform each step of the conversion manually. The

option to “Perform the following steps automatically” will allow

unattended conversion. If an error occurs at any step, the conversion

program will display a message and provide you with another error log.

When you reach Step 5 of the conversion

process, a DOS screen will appear beside the Conversion screen. If you have a

large data set, the DOS screen may appear for an extended period of

time. Don’t terminate the process unless you are 100% certain that the SQL

server is locked up. Click OK to continue.

If the conversion successfully goes through Step 6,

you will see a message like the one shown in Figure 7.

After the conversion, you can

click the Clean up button to delete the temporary database and files. If

you close the Conversion screen without doing clean up, you must manually

delete the temporary database (lntemp) created in your SQL server for this

conversion, and clear the Work folder.

Figure 7.

Conversion Status Screen

D.

Post-Conversion Process

1. Input PR Tax Subscription Key

Note: If you do not have the Payroll

module, please skip this step.

If you have the Payroll module and an active

Payroll Tax Subscription, you will be issued a PR Tax Subscription Key. The PR

Tax Subscription Key is printed

on the AccountMate 7.x for SQL/Express License

File CD, provided that your Payroll Subscription was active at the time the

new version was shipped to you. This key controls the states that you will be

able to activate in the Payroll module. It also includes information about the

tax year covered by your subscription, which in turn determines your ability to

manually update the federal and state tax tables for the current tax year.

To input the PR Tax Subscription Key:

a. In the

Administrator program, select Setup > Licensing > Input PR Tax Subscription Key.

b. In the space provided, enter the 20-character PR Tax Subscription Key

printed on the AccountMate 7.x for SQL/Express License File CD. If the Subscription

Key supplied is valid, the system will display in the New Tax Year field the tax year covered by your subscription.

c. You can drill down on the New PR

Tax Subscription Key field caption to view the states covered by your

subscription.

If you notice any discrepancy with

the subscribed tax year or states or if you receive an error message when you

enter the Subscription Key, please contact Customer Service at 1-800-877-8896

ext. 752.

2.

Initialize Modules and Install

Latest PR Tax Update

For

each activated module that you use, you must access the Housekeeping menu and

perform Module Setup.

If you are using the Payroll module and have a PR Tax

Subscription for the current tax year, you must also verify that you have

the latest PR tax updates installed. You can check this by running the

Federal/State/Local Tax Table Maintenance functions. If you do not have the

latest PR tax updates, you must download them from the

Go through the different Maintenance functions and

verify that all required fields are set up or assigned the desired values. This

must be performed for each module you have activated and initialized. Pay

particular attention to the following Maintenance records:

o

Inventory Maintenance => verify that a

Unit-of-Measurement is assigned to each inventory item record. You must also

verify that an inventory item marked for Use in Work Order is not set up

to Use Specification, and vice versa. If both checkboxes are marked, you must

verify which one you want to apply to the inventory record and unmark the

feature that does not apply to the item.

o

Inventory Type Maintenance

=> verify that a Unit-of-Measurement is assigned to each inventory type

record.

o

Sales Tax Entity Maintenance

=> verify that GL Account IDs are assigned to the Sales Taxes Payable and

Sales Tax Costs fields of each tax entity record.

o

Employee Maintenance => verify the accumulated

earnings, paid leave, deductions, and taxes of each employee. You must also

verify that the correct Earning Codes, Paid Leave Codes, and Deductions have

been assigned to each employee record.

Note: If you convert to AM 7.2 or

higher, you must also verify the Expense GL Account IDs assigned in the Earning

Code tab of the Employee Maintenance function.

o

Earning Code Maintenance => verify the assigned

Expense GL Account IDs and the Accumulate Paid Leave settings defined for each

earning code record.

o

Paid Leave Code Maintenance

=> verify the assigned Accrual Method, Tier settings, and the assigned

Liability and Expense accounts.

Notes:

§

Each paid leave code created by

the conversion process will have one

tier only. Only the Salaried Base

and Carry leave settings will be converted.

§

Prior to version 7, the Payroll

module did not accrue liability for employee leave benefits. If you want

to fully employ the Paid Leave feature in AM 7 you must post an adjusting journal entry in the General Ledger module to record the employee leave balance as

of the time you started using AM 7 Payroll.

4.

Compare GL Transfer Report and GL

Financial Statements

Run the GL Transfer Report for your non-GL

modules and the GL financial statements

(i.e. Balance Sheet, Income Statement, and GL Listing) and compare the

information generated against the same reports from your previous AccountMate

build. This will help identify any issues that may have resulted from the conversion

and will make it possible for you to correct these problems before data

processing is resumed in the new version.

5. Review Converted Data (by running reports)

You

should run the newly converted company in AM 7.x and review the data to ensure

everything has been converted successfully. Here is a partial list of

reports you can run to help verify the conversion:

o

GL : Trial Balance, Income Statement, Balance

Sheet

o

AR : AR Aging, Payment Distribution Report

o

AP : AP Aging, AP Check Register

o

SO : Open Order Report, SO Shipment Report

o

PO : Backorder Report,

o

IC : Inventory Transfer In-Transit

Report

o

MI : Back Order Report

o

BR : Bank Reconciliation Report

o

PR : PR Check Register Report, Earning Code

Transaction Report, Paid Leave Transaction Report, Deduction Transactions

Report, QTD or YTD Tax Withholdings Report

o

CL : Consolidated Account Balance Report,

Consolidated Account Balance Analysis

6.

Perform “Typical” or “Compact”

Installation on Workstations

Caution: You need not run the workstation installation on the

computer where you performed the server installation. If you

previously performed the server conversion through one of your workstations,

running the installer on that same workstation will display the Uninstall

AccountMate window.

a. Access

each workstation where you will run the new AccountMate version. Insert the AccountMate

7.x for SQL/Express CD into a CD-ROM drive. If the installer does not

automatically run, click on Setup.exe. You will be shown the AccountMate 7.x

for SQL or AccountMate 7.x for Express Setup screen.

b. On the Choose Destination Location screen,

accept the default Destination Folder by clicking the Next> button; or click the Browse…

button to change to the desired path.

c.

Click on the Next

button to proceed to the Setup Type

screen. Since you are installing on a workstation, make sure that you choose either

the Typical or Compact installation option.

o

Choose the Typical

option if you want to run a separate client installation from each workstation.

This option installs the AccountMate program and run-time files on the

workstation.

o

Choose the Compact

option if you want to run the AccountMate program through a mapping from a file

server. This option installs just the run-time files on the workstation.

d. Next, the wizard will take you

through the selection of a Program

Folder, after which the files for the new version will be installed. Click Finish to complete the workstation

installation.

e. Configure ODBC DSN on each workstation unless you

are converting to AM 7.3 or higher. Refer to step 16 in Part A for more

information.

7.

Post AP Invoices for

When posting an AP invoice in AM 7.x

for

a.

Retrieve

your Accrued Received Goods report and the report generated from running the accrual_ln.exe

file against the corresponding AccountMate LAN company database.

b.

Check

whether the AP invoice you are posting pertains to a

c.

When

posting an AP invoice for the said receipt, change the reference account

defaulted in your AP Invoice Transactions\GL Distribution tab to the GL Account

ID used for your accrued liability for

d.

Do

not post any value in the Reverse Accrued Amount field of the Information Tab

in the AP Invoice Transaction screen. The conversion does not bring over

records of

e.

All

other AP invoices involving PO receipts that are not in the report generated

from the accrual_ln.exe file but which appear as outstanding accruals in the

Accrued Received Goods report were never posted to GL. As such, no

outstanding obligations have been created for them in GL. For these invoices,

you can just post them like you would a regular AP invoice for an obligation

that was never processed through

f.

For

all other AP invoices, post them as you would normally do. This applies to

all invoices pertaining to either non-PO transactions or to

E.

Troubleshooting Errors and Messages

The

succeeding sections will provide tips for troubleshooting some of the more

commonly encountered conversion error messages.

This

happens when the account segment definition in your AM 7.x target company does

not match that of the source AccountMate LAN company. To resolve this, click

“Yes” on the message window. This will change the account segment definition of

your AM 7.x target company to match that of the AccountMate LAN company being

converted. You can then proceed with the rest of the conversion.

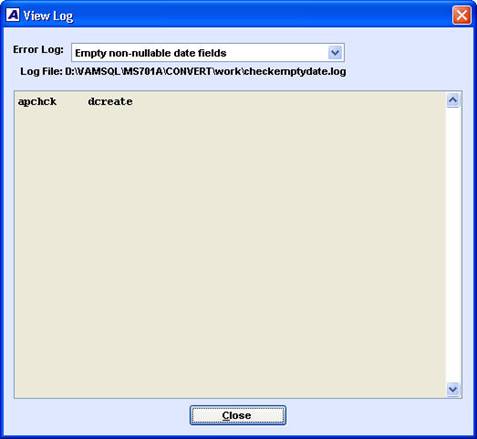

This error is caused by different types of primary

key violations. For

example, it may be caused by records with empty non-nullable fields that SQL

will not allow.

If you choose to view

the data integrity check’s log file, you will see information similar to the

one shown in Figure 8. If the report is long, you can print it using

Notepad. Please take note of the file name and the location displayed next

to the label Log File.

You must fix your AccountMate

LAN data using Visual FoxPro. In this example, any empty non-nullable date

field (e.g. Create Date) must be filled in with the correct data before you can

continue.

Figure 8. Sample Check LAN Data Integrity Error Log File

3.

“AccountMate for LAN and AccountMate

for SQL company do not have the same number of fiscal periods. Conversion

cannot proceed.”

This error is generated when the AccountMate LAN

company and the AM 7.x target company do not have the same Number of Fiscal

Periods. The Number of Fiscal Periods is defined during Company Setup. To

resolve this error, do not proceed with the conversion. Delete the target

company created in AM 7.x; then, create another company and make sure that the

number of fiscal periods matches that of the source AccountMate LAN company

data. Back up the AM 7.x company data before resuming the conversion.

4.

“AccountMate for LAN and AccountMate

for SQL company do not have the same fiscal year start dates. Conversion cannot

proceed.”

This is generated when the AccountMate LAN company

and the AM 7.x target company do not have the same First Day of the Fiscal

Year. The First Day of the Fiscal Year is defined during Company Setup. To

resolve this error, do not proceed with the conversion. Delete the target

company created in AM 7.x; then, create another company and make sure that the

First Day of the Fiscal Year matches that of the source AccountMate LAN company

data. Back up the AM 7.x company data before resuming the conversion.

5.

Conversion failure during Step 5

(Upload Data to SQL Server)

If the conversion fails at Step 5, perform the

following:

a.

Do not click the Clean up

button; instead, close the conversion program.

b.

All files used in Step 5 are located in the Convert\Upsize directory. The log files

have the .LOG extension and there is

one file created for each table. Each table must be fixed in the AccountMate

LAN database before proceeding with the conversion. The log file includes

the following information:

o

Number of records affected by the insert/conversion

operation

o

Errors

Note: When you open each *. log file with Notepad, use the

search function to look for the key word “Error”. You will find the

errors that are causing the conversion to fail.

c.

Correct all errors identified in the log before

resuming conversion for the same company.

d.

Restore the backup of the target AM 7.x company

database to its pre-conversion state.

o

If you choose NOT to delete the AM 7.x company

database, you can restore the backup you made prior to conversion (step 10 of

Part B). Nobody must access the company database at the time you restore

the backup.

o

If you deleted the AM 7.x company database, you must

create another target company. You do not have to worry about the account

segment definition because you can overwrite that when you restore your

backup. Restore the company database from the backup made (step 10 of Part

B).

o

If ever a backup was NOT made before running the

conversion program, do the following:

i.

If the AM 7.x company database was NOT deleted

during conversion, delete it using the AccountMate

ii.

Create a new company in AM 7.x. The company

settings should match the setup of the company in AccountMate LAN.

e.

Make

sure you correct all the errors listed in each *.LOG file; then, run the

conversion program again.

6. Conversion failure during Step 6 (Convert LAN to AM/SQL)

If the conversion fails at Step 6, perform the

following:

a.

Do not click the Clean up

button; instead, close the conversion program.

b.

All files used in Step 6 are located in the Convert\Upgrade directory. All log

files have the .LOG extension. Depending on the target build,

there will be at least three LOG files. All errors are to be fixed in the AccountMate

LAN database before proceeding with the conversion.

Note: When you open each *. log file with Notepad, use the

search function to look for the key word “Msg” to find the errors

that are causing the conversion to fail.

c.

Follow

steps 5c-e above.

7. Foreign Key Violation Error

One of the possible issues that could cause the

conversion to fail during step 6 is a foreign key violation. You may find an

error entry similar to the following in the log file:

The UPDATE statement conflicted with the

FOREIGN KEY constraint “FK_…” The conflict occurred in database “database

name”, table “dbo.tablename”, column ‘cacctid’.

This

problem occurs if you do not perform step 3 of Part C (Run Foreign Key

Checker) before performing the conversion. To resolve this problem, you must:

a. Delete the AM 7.x company database used in the

failed conversion.

b. Restore the backup made prior to conversion

(step 10 of Part B).

c. Run the

foreign key checker utility against your AccountMate LAN database (step 3 of

Part C).

Downloads: The

following can also be obtained from our website; visit: /businesspartner/info/downloads/conversion_upgrades.asp

·

Conversion File for AM7

· Pre-Conversion Utility

· Check File Corruption Utility