|

Payroll - Quarterly Reports

The Quarterly Reports functions allow you to generate a quarter-to-date tax withholding report and to print quarterly federal, state, and local payroll tax returns, thereby facilitating the filing of your quarterly tax requirements. AccountMate allows you to generate these Quarterly Reports for either the current or prior tax year.

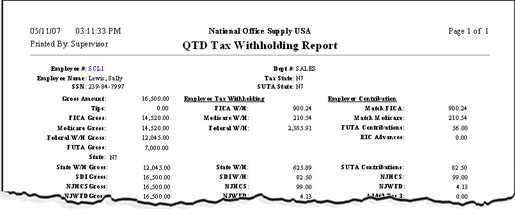

QTD Tax Withholdings Report

To determine the total taxes withheld from each employee's earnings and the company's total tax contribution for each quarter of either the current or prior tax year, generate the QTD Tax Withholdings Report. If an employee has earnings or tax withholdings in multiple states, the employee's earnings and taxes will be shown separately for each state. This report is most useful as reference in verifying the accuracy of the quarterly tax returns. Keep copies of this report for audit purposes.

You can choose which quarter of either the current or prior tax year you want to print the report for. This report also provides an option to exclude information for those employees with zero quarter-to-date gross amounts (FICA gross, Medicare gross, Federal Withholding gross, etc).

Click on the image to enlarge view.

Click on the image to enlarge view.

Form 941 Quarterly Tax Return

The Form 941 Quarterly Tax Return function provides the information required to fill in Form 941 and Schedule B of Form 941 for each quarter. Form 941's primary page provides the basic summary data pertaining to federal 941 taxes withheld while Schedule B of Form 941 summarizes payroll amounts by pay check date, with monthly subtotals and a grand total for the quarter. These forms must be submitted to the Internal Revenue Service (IRS) in compliance with the federal tax filing requirements.

This function allows you to choose the quarter and tax year for which you want to print the form and the frequency of tax remittance-semiweekly, monthly, or others. You may also select to print the form for a particular state or multiple states. You may also opt to generate the report using Form 941 or Schedule B. If necessary, you may choose to print your company name and address on the form and to print a form for alignment test purposes.

Click on the image to enlarge view.

Click on the image to enlarge view.

State Quarterly Return

If you are looking for a report that you can use as reference for preparing the payroll quarterly tax returns for a particular tax state, generate the State Quarterly Return. This report shows, for each type of tax applicable to the selected state, the gross taxable wages and the state tax amount. It also shows the total state tax liability for the month and quarter as well as the deposited amount of state taxes and the balance due.

You can choose the particular tax state and the quarter of either the current or prior tax year for which you want to print the report.

Click on the image to enlarge view.

Click on the image to enlarge view.

Local Quarterly Return

The Local Quarterly Return provides information required to fill in the quarter-to-date payroll tax return for a particular local tax jurisdiction. This report shows the gross taxable wages, local tax amount, total local tax liability for each month and quarter, deposited amount of local taxes, and balance due. This report is most helpful in preparing the quarterly payroll tax return for local taxes.

You are required to select the quarter of either the current or prior tax year for which you want to print the report.

Click on the image to enlarge view.

Click on the image to enlarge view.

|