|

Payroll - Worker's Comp Reports

Worker's compensation laws were created to allow employees who die or suffer a disability on the job or as a consequence of performing their functions financial recourse without the need for litigation. AccountMate allows you to track and calculate the employer's liability for worker's compensation. You simply set up the worker's compensation codes and groups; then, assign these to the applicable earning codes. Each time an earning code set up for worker's compensation is used in a payroll transaction, AccountMate calculates the employer liability based on the parameters set up for the worker's compensation code and group.

The Worker's Comp Reports are available to help you track your worker's compensation liability. Read the information below to get a closer look at each of the Worker's Comp Reports available in AccountMate.

Worker's Comp Code Listing

Worker's compensation code represents the various legal provisions that govern the implementation of worker's compensation. These codes facilitate recording of the company's worker's compensation liability. The Worker's Comp Code Listing serves as a quick reference for a complete list of worker's compensation codes and their descriptions as set up in AccountMate.

Click on the image to enlarge view.

Click on the image to enlarge view.

Worker's Comp Group Listing

A variety of information on the worker's compensation groups set up in AccountMate is available in the Worker's Comp Group Listing. It displays for each worker's compensation group the GL Account ID to which AccountMate posts the accumulated liability and the states for which you are setting up the worker's compensation codes assigned to the group. The report also displays for each worker compensation code the associated premium rate for every $100-worth of qualified wages, the experience factor by which the worker's compensation premium is adjusted upon meeting or exceeding a certain threshold, and the maximum amount of liability that can be accumulated in a given tax year. This report serves as a quick reference for the worker's compensation group records.

Click on the image to enlarge view.

Click on the image to enlarge view.

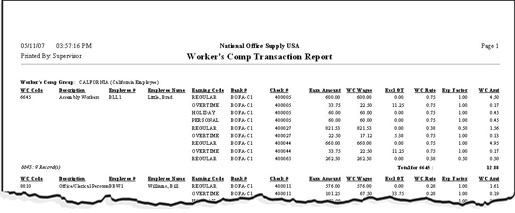

Worker's Comp Transaction Report

The Worker's Comp Transaction Report allows you to track the worker's compensation liability that is calculated based on the payroll checks. The report shows the worker's comp code and group and their associated employee numbers and names, earning codes, bank numbers, check numbers, amount of earnings, worker's comp wages and rates, and worker's compensation liability, among others. You can use this report to verify the accuracy of the system-calculated liability for worker's compensation.

Click on the image to enlarge view.

Click on the image to enlarge view.

|