|

Accounts Receivable - Revenue Amortization Reports

The Revenue Amortization Reports provides various information about the customer invoice line items set up for deferred revenue. These reports allow you to review revenue realization schedules, monitor the status of customer invoice line items set up for deferred revenue and track earned revenues. Note that the Revenue Amortization Reports are available only when the Revenue Amortization feature is activated in AR Module Setup.

Each of the Revenue Amortization Reports is especially designed to provide several options so you can narrow down data to the specific information needed. Read the information below to get a closer look at each of the Revenue Amortization Reports available in AccountMate.

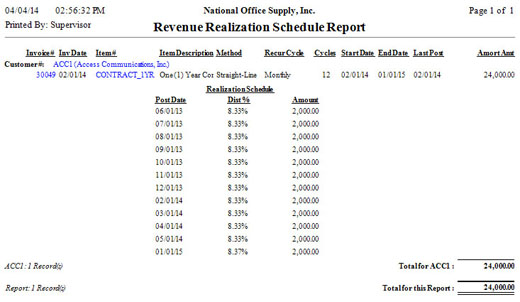

Revenue Realization Schedule Report

The Revenue Realization Schedule Report provides information about the revenue realization schedule for customer invoices which line items are set up for amortization. This report is useful for reviewing the timing you set up for the deferred revenues will be earned using the Schedule Revenue Realization function. The report shows the amounts projected to be earned and the dates when they are expected to be realized.

You can select to include in the report the details of the revenue realization schedule. You can further opt to display the description of inventory line items set up for amortization and to show multi-currencies.

Click image to enlarge view

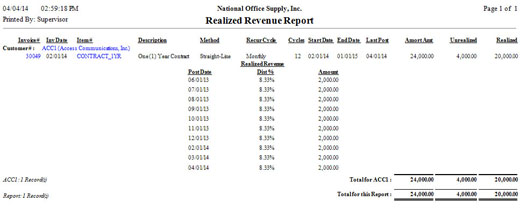

Realized Revenue Report

The Realized Revenue Report shows the details of the revenues realized as of the selected Report Date from invoice line items that are set for amortization. This report can be used as reference when reconciling deferred and earned revenue account balances.

You can choose to include in the report the details of each realized revenue transaction such as the amounts that have been earned for each deferred revenue line item with their corresponding Post Dates. You may also opt to show the description of each inventory item included in the report and to show multi-currencies.

Click image to enlarge view

Revenue Realization Transaction Listing

The Expense Amortization Transaction Listing provides information on all realized revenue transactions. The report shows the details of deferred revenues that were posted as earned.

You can select to include in the report realized revenue transactions that were voided and to show multi-currencies.

Click image to enlarge view

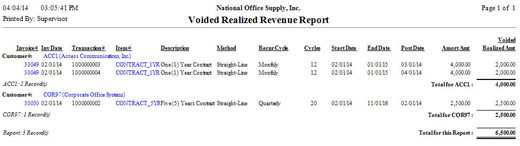

Voided Realized Revenue Report

The Voided Realized Revenue Report generates a list of all realized revenue transactions that were voided. This report serves a reference when reconciling realized and unrealized revenue account balances.

You can choose to show the description of each inventory item included in the report and to show multi-currencies.

Click image to enlarge view

|