|

Purchase Order – Landed Cost Reports

The Landed Cost Reports provide information about the landed cost accruals and

reversals posted in the respective Accrue Landed Cost and AP Invoice

Transactions functions. These reports have various options and criteria that

enable you to generate information in various report formats. Read the

information below to get a closer look at each of the Landed Cost Reports

available in AccountMate.

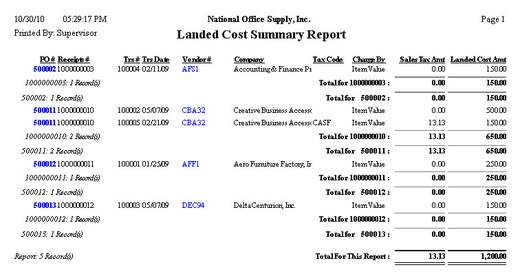

Landed Cost Summary Report

The Landed Cost Summary Report provides information on the landed cost accrual

transactions including the purchase order numbers, receipt numbers, transaction

numbers and dates, vendor numbers and company names, tax codes, landed cost

allocation methods used, landed cost amounts, and the applicable taxes. You can

use this report to verify changes in the inventory item’s average cost due to

accrued landed costs.

You may display in the report the journal entries for the landed cost accrual

transactions and multi-currencies.

Click image to enlarge view

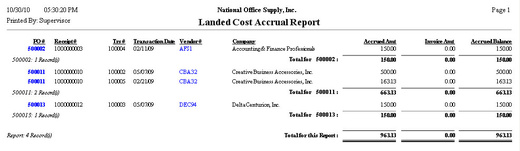

Landed Cost Accrual Report

The Landed Cost Accrual Report lists the landed cost accrual and reversal

transactions including the purchase order numbers, receipt numbers, transaction

numbers and dates, vendor numbers and company names, accrued amounts, invoice

amounts, and accrued balances. You can use this report to verify the landed

cost accruals that are reversed by posting invoices and those accruals that are

yet to be invoiced and reversed. You can also use this report to reconcile the

accrued liability generated when the landed cost accruals are posted.

You may include in this report the fully reversed landed cost accrual

transactions. You can opt to show on the report the landed cost accrual

reversal amount on each applicable AP invoice and to show multi-currencies.

Click image to enlarge view

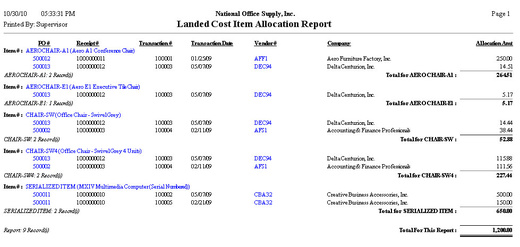

Landed Cost Item Allocation Report

The Landed Cost Item Allocation Report provides information on how the landed

cost accruals are allocated to inventory items. This report shows the purchase

order numbers, receipt numbers, transaction numbers and dates, vendor numbers

and company names, and allocated amounts. This report is useful in determining

the accrued landed cost amounts and their distribution to the various line

items received from the vendors.

You can configure this report to show the journal entries created during

posting of landed cost accruals. You can also opt to show multi-currencies in

the report.

Click image to enlarge view

|