AM12 Sample Reports

|

Bank Reconciliation – Check Reports

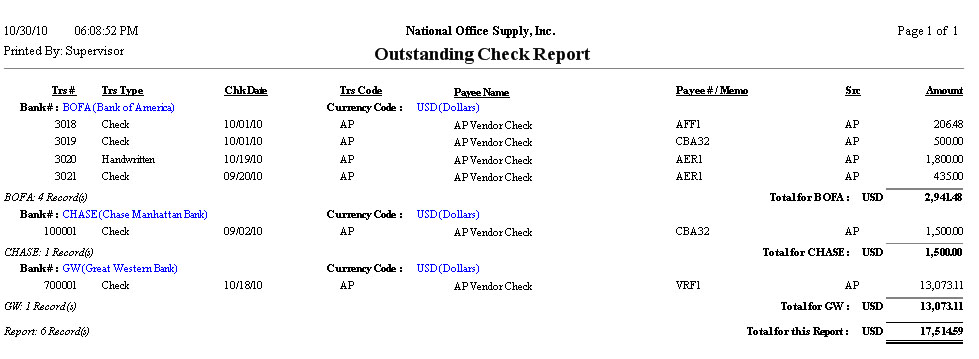

The Check Reports provides detailed information primarily on the status of checks entered in the BR, PR and AP modules. Generating these reports provides a necessary audit trail; it is useful for helps you in monitoring checks status and facilitates reconciling bank accounts. Each of these reports is especially designed to provide several options so you can narrow down data to the specific information needed. Each report is also presented in various report formats. Read the information below to get a closer look at each of the Check Reports available in AccountMate. Outstanding Check Report The Outstanding Check Report provides detailed information on non-cancelled or outstanding checks issued from the Accounts Payable (AP), Payroll (PR), and Bank Reconciliation (BR) modules. This report shows the check number and date, transaction code, payee name, source module and check amount. Generate this report for verifying the accuracy of issued checks not yet recorded as cleared in the system and as reference for monitoring these outstanding checks. This report also serves as a guide in reconciling your checks. You can generate this report for BR checks only, PR checks only, AP checks

only, or for all checks.

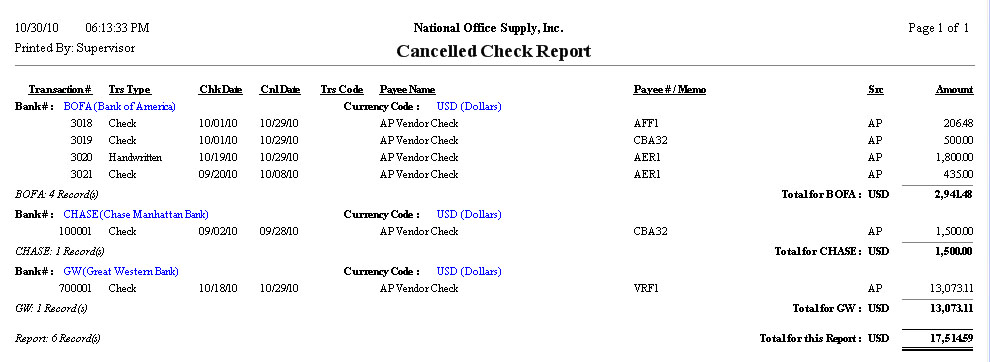

Cancelled Check Report The Cancelled Check Report provides detailed information on checks issued from the Accounts Payable (AP), Payroll (PR), and Bank Reconciliation (BR) modules that are recorded in the system as cleared in the bank. It shows the check number and date, cancellation date, payee name, source module and check amount. This report is useful for verifying the accuracy of checks shown as cleared in the bank statement and for monitoring checks marked as cancelled in the system. The Cancelled Check Report also serves as a guide in reconciling cancelled checks. To generate this report, you can select to show BR checks only, PR checks only,

AP checks only, or all checks.

|