AM12 Sample Reports

|

Consolidated Ledger Ė Budget Reports

The Budget Reports provides details on financial budgets set up in AccountMate. These reports help you evaluate the companyís performance based on the companyís set goals. These reports are useful in monitoring cost management relative to the allocated resources, identifying unusual circumstances and trends, and helping you focus on problem areas. Each of the Budget Reports is especially designed to provide several options so you can narrow down data to the specific information needed. Read the information below to get a closer look at each of the Budget Reports available in AccountMate. Budget Listing

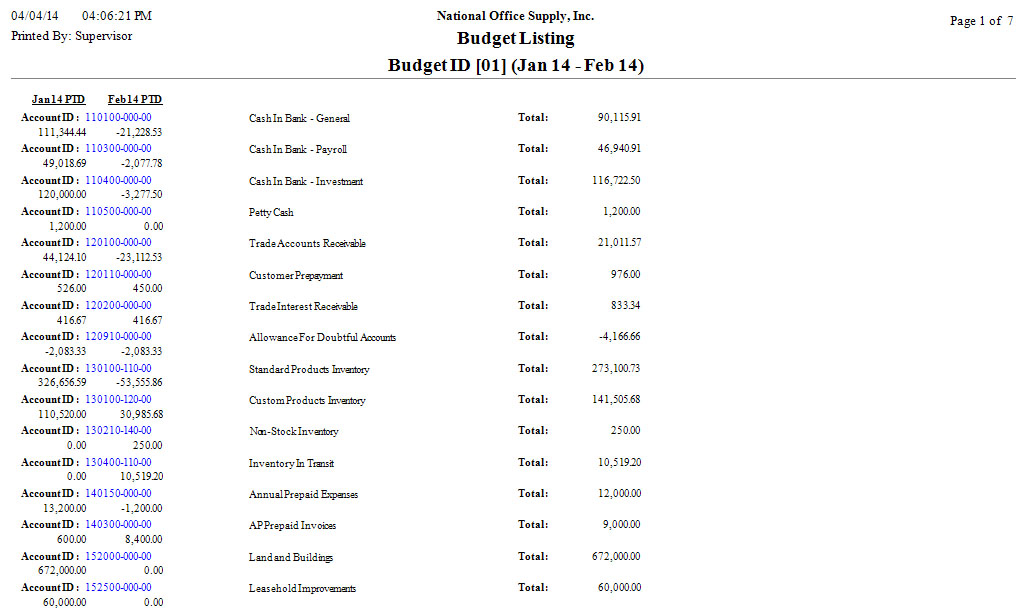

The Budget Listing report provides information on the budget amount allocated for each account ID and for each period in a fiscal year. It shows a list of each GL Account ID with its allocated amount for each period. This report is useful for verifying the budget recordsí completeness and reviewing the allocated amounts for a specific period. It also serves as reference in monitoring each GL Account IDís budget balance against actual operations. You can generate this report using either the period-to-date or year-to-date

option. You can also opt to include in the report the balance sheet accounts,

income statement accounts, comprehensive income accounts, and zero balance accounts.

Yearly Budget Total

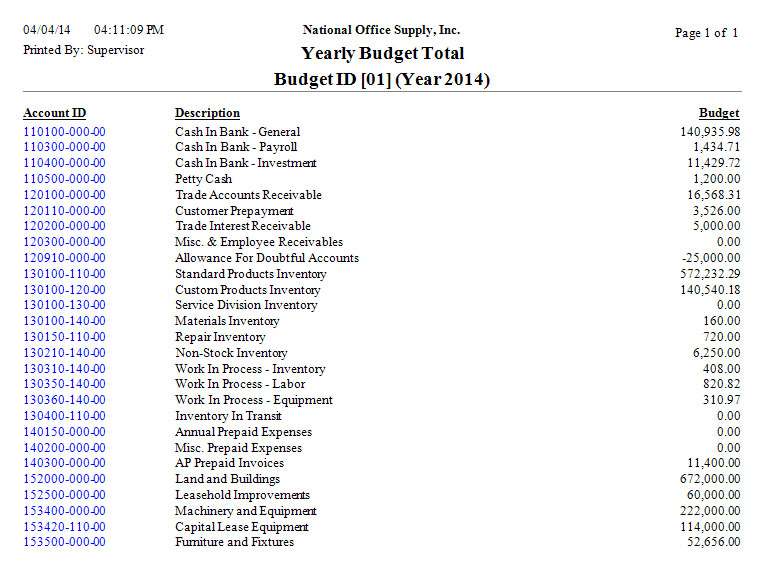

The Yearly Budget Total report provides information on the total amount budgeted for each GL Account ID for the entire fiscal year. It lists each GL Account ID and its budget amount for the fiscal year. This report is useful for verifying the budget recordís accuracy. It also serves as reference for monitoring each GL Account IDís budgeted balance against actual operations on a yearly basis. You can select to include in this report the balance sheet accounts, income

statement accounts and comprehensive income accounts.

Budgeted Balance Sheet

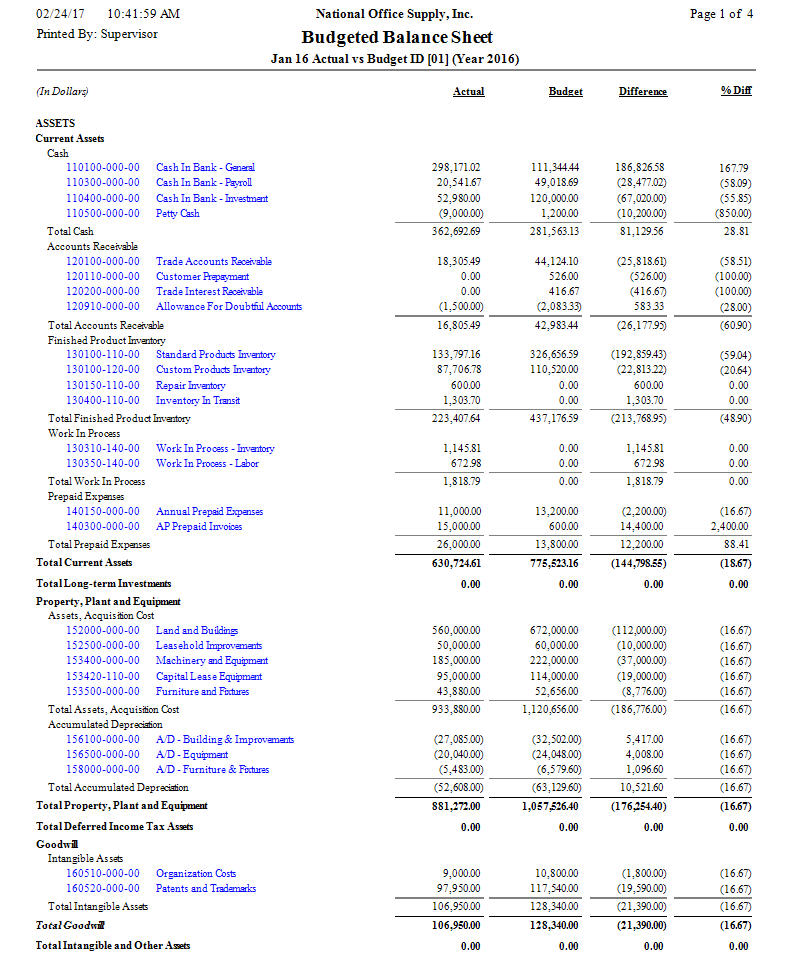

The Budgeted Balance Sheet provides information on the comparison between the actual and budgeted amounts for a single period or range of periods based on a predefined budget. This report is useful in assessing actual against the budgeted amounts, and in monitoring and updating your companyís budget. To generate the report, you must enter in the Budget ID field the number of the budget information that you want to display in the report. You can generate the report for a single period or a range of periods. You can opt to display GL Account ID balances assigned to all chosen segments, to show the balances grouped into similar account groups regardless of their segments, to display a total balance for each account number or major segment, and to display the actual balances before the budget figures. You can select to present data as actual versus budgeted or budgeted versus actual and to either show variance or prior year balance. You can opt to show the GL Account IDs and decimals and to include GL Account IDs with zero balance or with no activity. You also have the option to generate a single report for all segments, to show the Liabilities and Equity section on a page that is separate from the Assets section, and to show the amount which is over the budgeted amount. In addition, you can also select to generate the report to show as comparison or availability of the budgeted amount.  Budgeted Income Statement

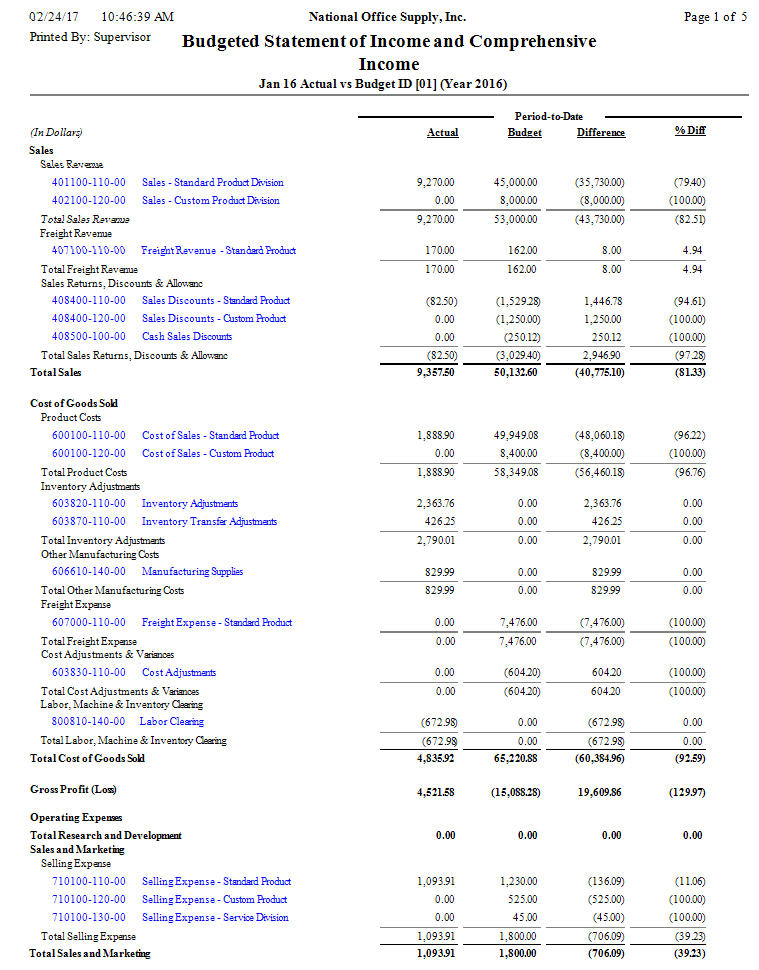

The Budgeted Income Statement provides information on the comparison between the actual and budgeted amounts for a single period or range of periods based on a predefined budget. This report is useful in assessing actual operations expenses against the budgeted amounts, and in monitoring and updating your companyís budget. To generate the report, you must enter in the Budget ID field the number of the budget information that you want to display in the report. You can generate the report for a single period or a range of periods. You can opt to display GL Account ID balances assigned to all chosen segments, to show the balances grouped into similar account groups regardless of their segments, to display a total balance for each account number or major segment, and to display the actual balances before the budget figures. There are options to display the budgeted revenue and expense balances for each period only, for the fiscal year only, for each period and fiscal year, or for the specified period range. You can choose either the Multiple Step Format or Single Step Format in showing the non-IFRS account categories in the reportís Income from Continuing Operations section. You can choose between the One Statement Approach, which presents the budgeted Other Comprehensive Income account categories immediately after the budgeted Net Income, and the Two Statement Approach, which presents the Other Comprehensive Income account categories in a separate report page with a different report caption. In addition, you can select to present data as actual versus budgeted or budgeted versus actual and to either show variance or prior year balance. You can opt to show the GL Account IDs and decimals and to include GL Account IDs with zero balance or with no activity. You also have the option to generate a single report for all segments, to show the Liabilities and Equity section on a page that is separate from the Assets section, and to show the amount which is over the budgeted amount. You can also select to generate the report to show as comparison or availability of the budgeted amount.

|