AM SQL/Express 13 Sample Reports

|

Accounts Receivable – Sales Tax Reports

The Sales Tax Reports provide information about the sales tax codes and the sales taxes calculated for each taxable sales invoice. These reports are useful for reviewing the sales tax codes assigned to the sales invoices and for verifying taxable sales information. Each of the Sales Tax Reports is especially designed to provide several options so you can narrow down data to the specific information needed. Read the information below to get a closer look at each of the Sales Tax Reports available in AccountMate. Sales Tax Entity Listing

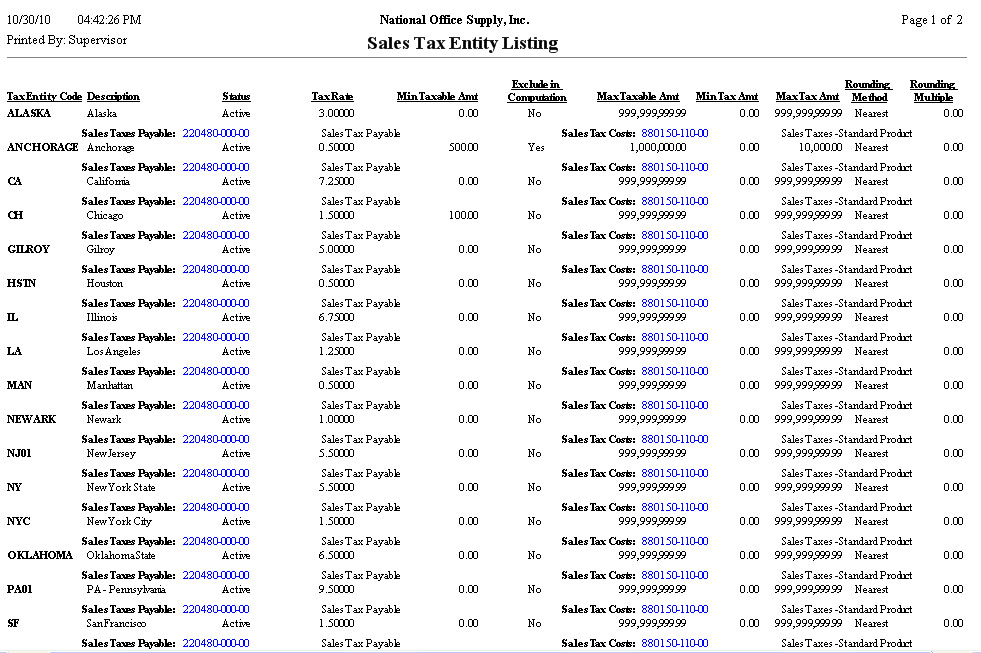

AccountMate allows you to set up multiple sales tax entities that can be

assigned to one or more sales tax codes. The Sales Tax Entity Listing provides

information on these sales tax entities. This report helps you verify the sales

tax entity records that are set up and maintained in AccountMate.

Sales Tax Code Listing

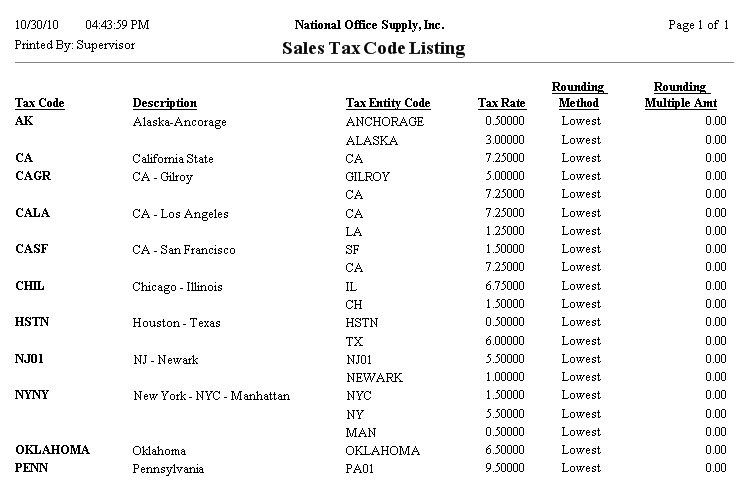

The Sales Tax Code Listing provides detailed information on the sales tax codes that are set up using the Sales Tax Code Maintenance function. This report is useful for reviewing the accuracy of the sales tax codes and for validating the sales tax entities and rates assigned to each sales tax code. You can elect to show in the report the predefined minimum and maximum taxable

and tax amounts.

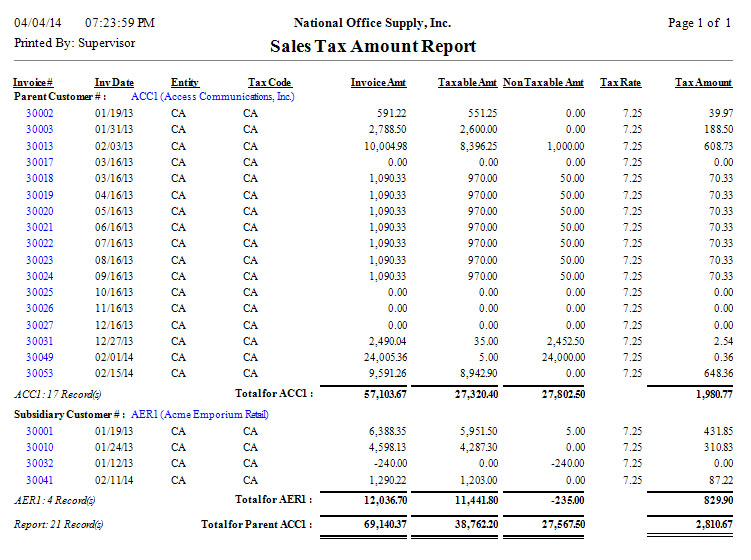

Sales Tax Amount Report

The Sales Tax Amount Report provides detailed information on the system-calculated sales tax amount for each taxable sales invoice. This report is useful for reviewing the correctness of the sales tax amount applied to each taxable sales invoice. It also facilitates the preparation of sales tax returns. You can select to include non-taxable invoices in the report. You also have the option to generate a consolidated report for the parent account and its designated subsidiaries. This option is applicable only when you are generating the report for an individual customer.

|