AM SQL/Express 13 Sample Reports

|

Bank Reconciliation – Deposit Reports

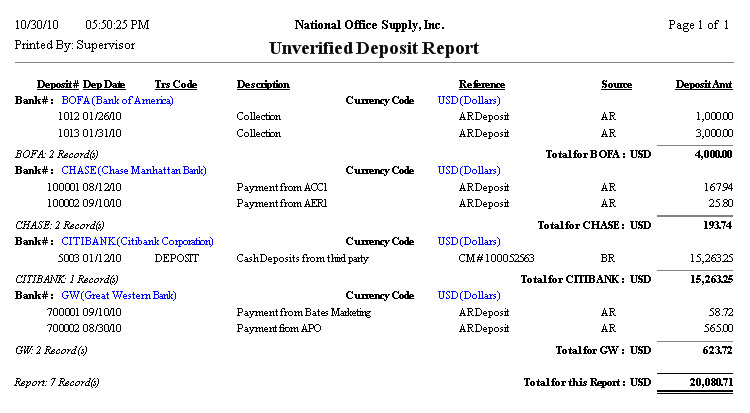

The Deposit Reports is a set of reports that provide detailed information on the status of bank deposits entered in AccountMate using the Bank Reconciliation (BR) and Accounts Receivable (AR) modules. These reports provide a necessary audit trail; these are useful for tracking and monitoring bank deposits and facilitate reconciling bank accounts. Each of these reports is especially designed to provide several options so you can narrow down data to the specific information needed. Each report is also presented in various report formats. Read the information below to get a closer look at each of the Deposit Reports available in AccountMate. Unverified Deposit Report The Unverified Deposit Report provides detailed information on the deposit

items that have not yet been marked in the system as having cleared the bank.

It shows the deposit number and date, transaction code, description, source

module and the deposit amount. This report is useful for efficiently

forecasting your cash balance by adding the total unverified deposit amount

that will be credited to the bank in the future. These cash deposit projections

will help you effectively manage your cash transactions. This report also

serves as a guide in reconciling your bank deposits.

You can generate this report for BR deposits only, AR deposits only, or for

both AR and BR deposits.

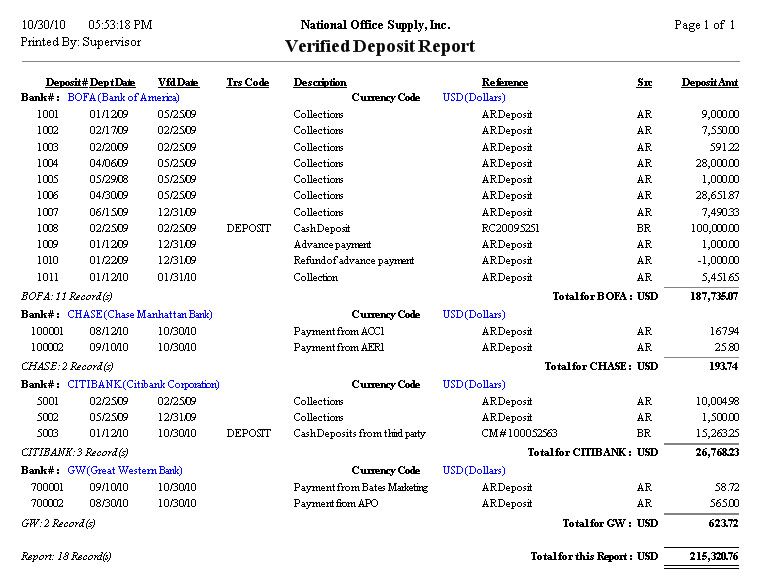

Verified Deposit Report

The Verified Deposit Report provides detailed information on the deposits that

have cleared the bank. It shows the deposit number and date, verified date,

transaction code, description, reference, source module and deposit amount. You

may use the report to verify the actual clearing time of these deposits for

each bank. By properly monitoring the clearing of deposits in these bank

accounts, it allows you to better manage your cash disbursements or check

issuances. This report is also useful for reconciling bank deposits.

You can generate this report for BR deposits only, AR deposits only, or for

both AR and BR deposits.

|