AM SQL/Express 13 Sample Reports

|

Payroll - Check Reports

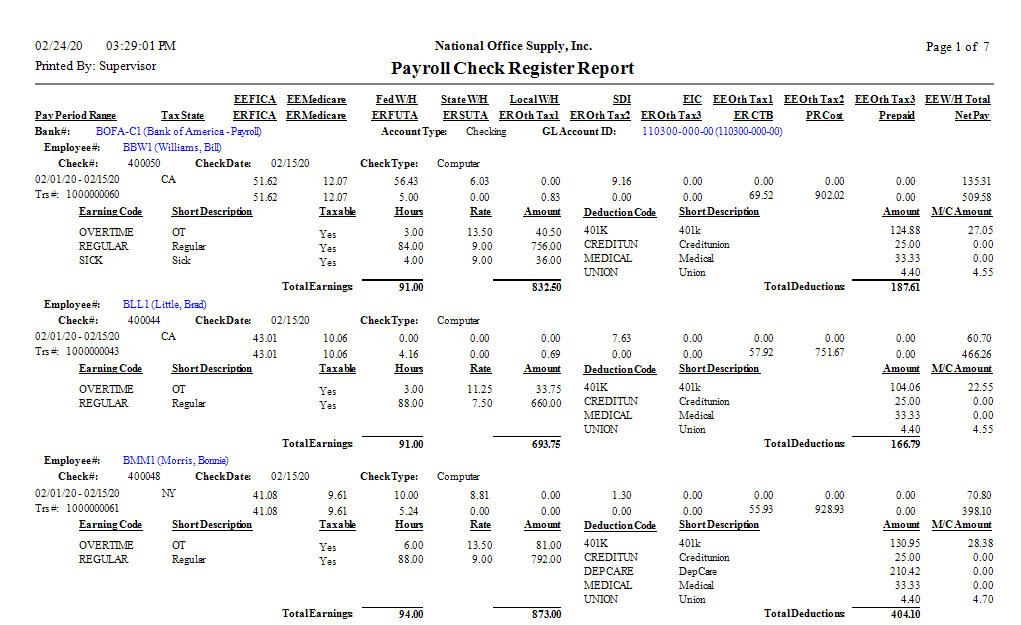

The Check Reports provide information on all check transactions recorded using the Print Payroll Check, Post Handwritten Check, Post After-the-Fact Payroll, and Payroll Tax Deposit functions. These reports are helpful in facilitating bank reconciliation. Each of the Check Reports is especially designed to provide several options so you can narrow down data to the specific information needed. Read the information below to get a closer look at each of the Check Reports available in AccountMate. Payroll Check Register Report

The Payroll Check Register Report provides information on checks issued to employees and independent contractors and generated/recorded using the Print Payroll Check, Post Handwritten Check, and Post After-the-Fact Payroll functions. This report excludes the tax deposit checks. This report is a good way to reconcile the check details against the Payroll Check Summary Report and to verify the pay checks before you distribute them. You can also use this report as reference for reviewing details of released checks and reconciling bank accounts. You can generate this report for computer-printed checks only, handwritten

checks only, or both. You can configure the report to exclude employee earning

and deduction details. You can also opt to view the check register on a

separate page for each department.

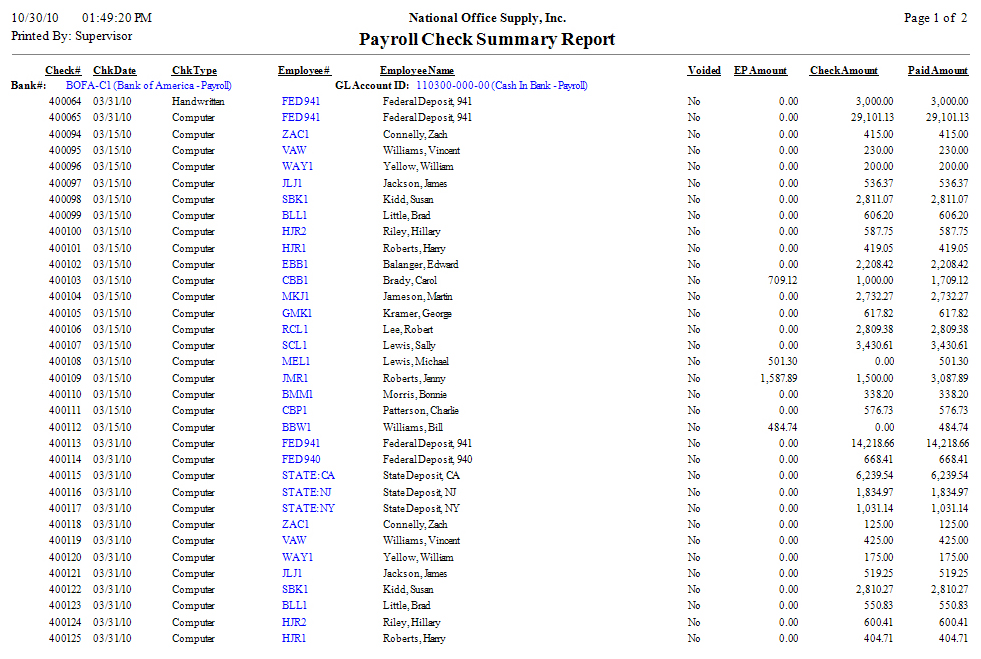

Payroll Check Summary Report

If you need to view summary information on payroll checks, generate the Payroll Check Summary Report. This report serves as a quick reference for all checks issued during a period. You can use this report as basis in verifying the check details in the Check Register Report. You can generate this report for computer-printed checks only, handwritten

checks only, or both. You have an option to include both the electronic

payments and check amounts for each applicable payroll check. You may also opt

to include or exclude voided checks in the report.

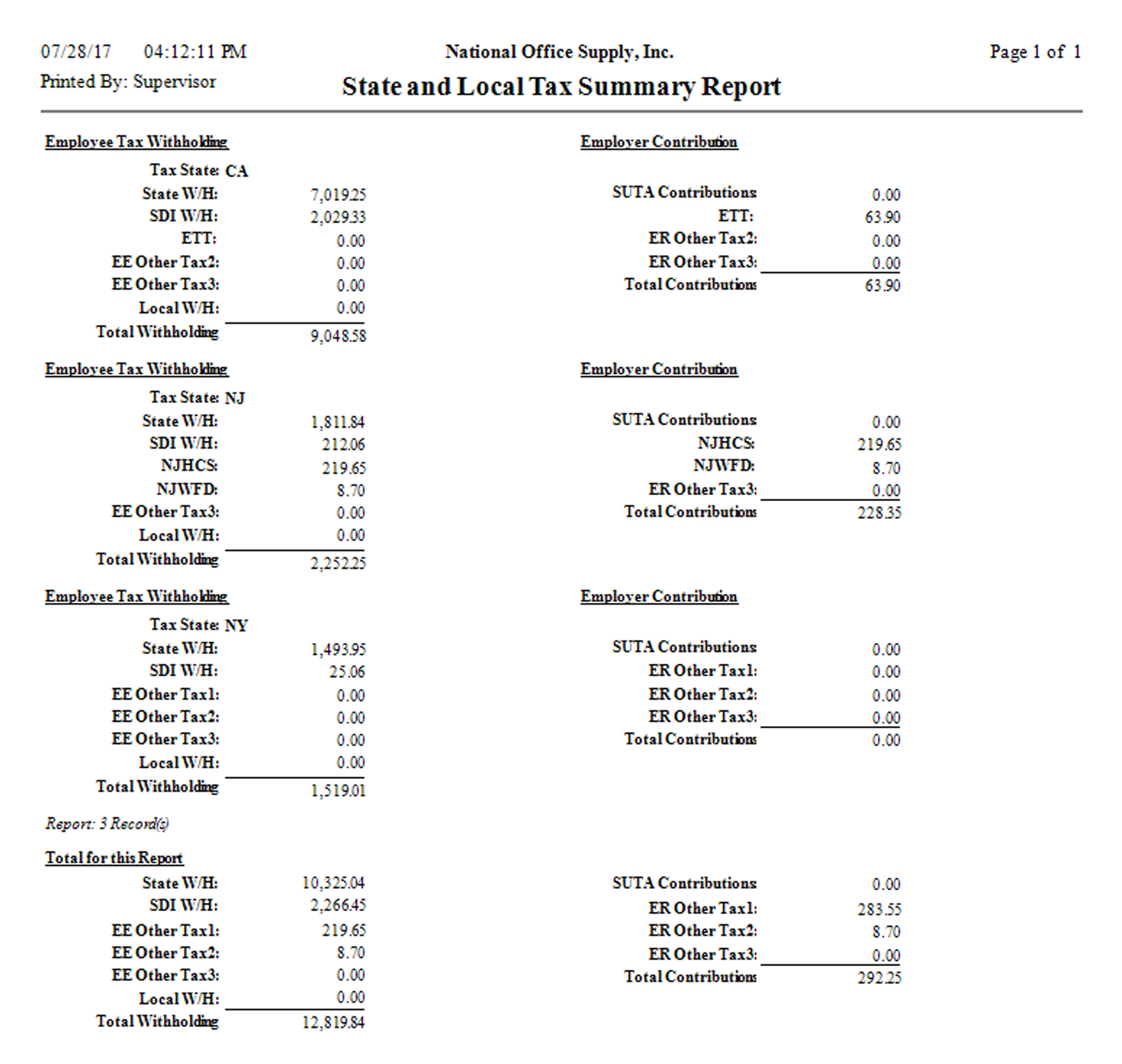

State and Local Tax Summary Report

The State and Local Tax Summary Report provides summary information about the

state and local withholding tax amounts of a particular tax state for a specific

or range of check dates. This report can be used as reference when processing state

and local tax deposits and when generating state tax forms.

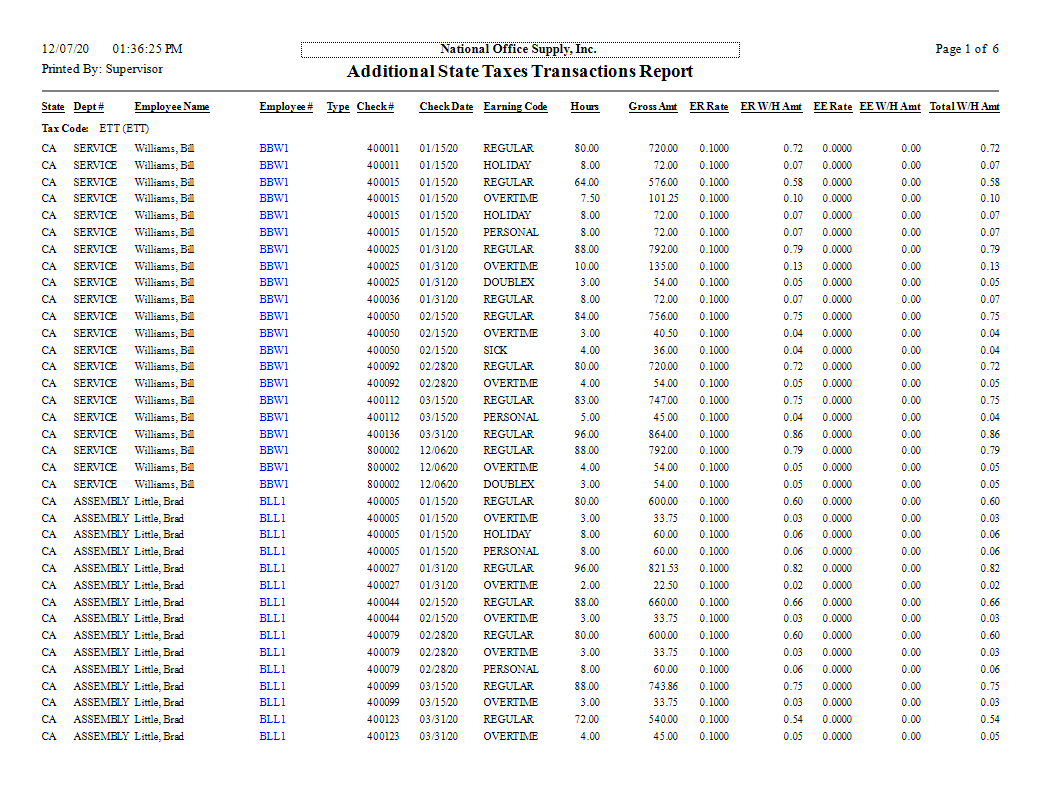

Additional State Taxes Transactions Report

The Additional State Taxes Transactions Report provides information on the

additional state taxes amounts recorded in AccountMate including information about the

particular state, tax codes, employees, and their assigned departments, banks, and check

details. These additional state taxes parameters are set up in PR Module Setup. This report

can be used as reference when reviewing the additional state taxes transactions and when

generating the state tax forms.

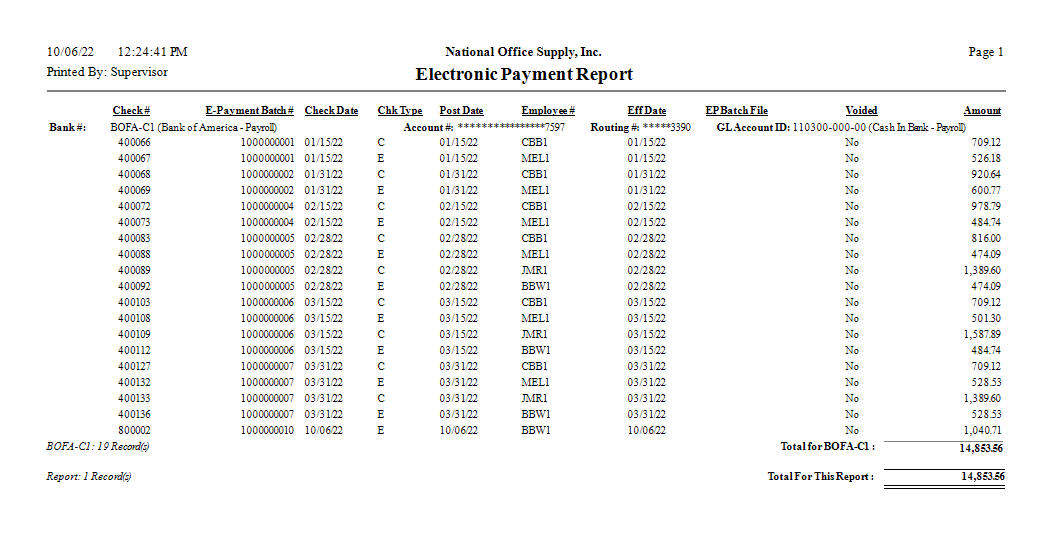

Electronic Payment Report

Electronic funds transfer provides a safer, secure, efficient, and less-expensive-than-paper method of payment to employees and independent contractors. AccountMate supports the processing of payroll electronic payments through an online payment system. To obtain detailed information on the amounts paid by payroll check and paid by direct

deposit through either NPC (National Payment Corporation) or ACH (Automated

Clearing House), generate the Electronic Payment Report. This report is most

useful in tracking the employee deduction amounts and employer contributions as

basis for generating the remittance invoice and check. You can also use this report as

reference for reconciling bank accounts

and book balances. You have an option to include in the report voided

electronic payment transactions and electronic payment distribution details. For data security

and protection purposes this report shows encrypted bank account numbers and bank routing numbers.

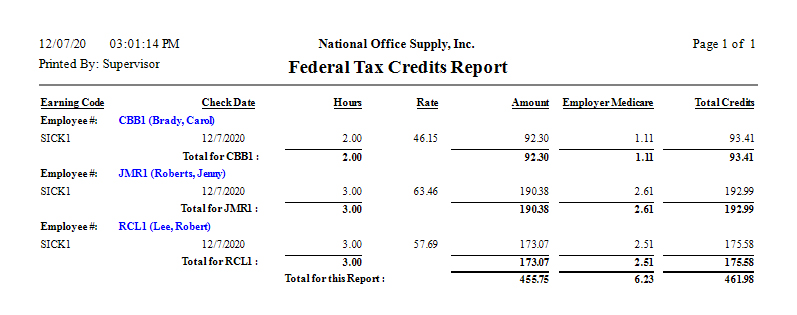

Federal Tax Credits Report

The Federal Tax Credits Report provides information about the tax credits

from the FFCRA, employee retention under the CARES Act, and other tax credits that

employers receive for each quarter. This report is useful in keeping track of these

various tax credits and in preparing the federal tax forms.

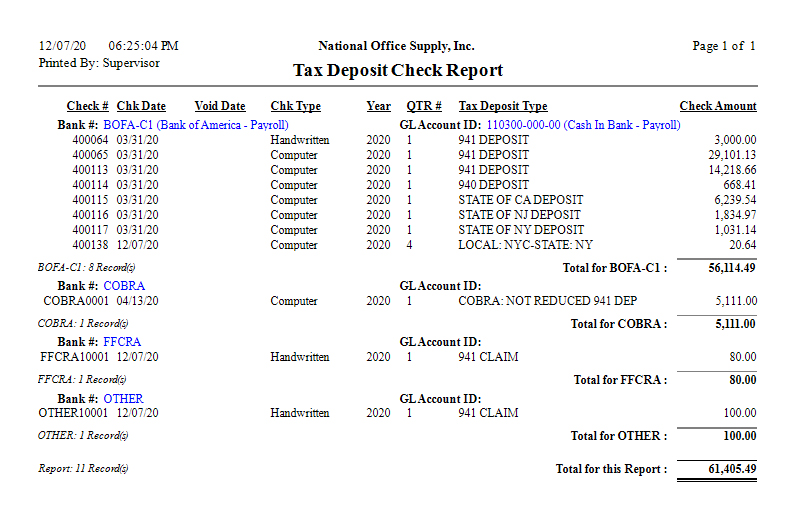

Tax Deposit Check Report

Detailed information about federal 940, federal 941, state, and local tax deposit checks is available in the Tax Deposit Check Report. This report excludes the payroll checks issued to employees and independent contractors. You can use this report as reference during bank account reconciliation. You may also refer to this report to determine which tax deposit checks are voided so you can notify the IRS (Internal Revenue Service) to disregard such checks. You can choose to generate the report for computer-printed tax deposit checks

only, handwritten tax deposit checks only, or both. You can further select to

include information on the 940 federal tax deposit checks only, 941 federal tax

deposit checks only, state tax deposit checks only, local tax deposit checks

only, or all tax deposit checks. The report also provides the flexibility to

include or exclude the voided tax deposit checks.

Voided Check Report

The Voided Check Report provides information on both payroll and tax deposit checks voided using the Void Payroll Check and Void Tax Deposit Check functions. Use this report alongside the Check Register Report to assess the completeness of the checks recorded in AccountMate and to determine which checks are reprinted. You can also verify whether the checks listed in this report match the actual voided checks in your possession. When reconciling bank accounts and book balances, you can use this report as reference. When generating this report, you can select to include the voided

computer-printed checks only, voided handwritten checks only, or both. You can

also opt to include in the report checks that were reissued or replaced using

the Reprint Payroll Check function.

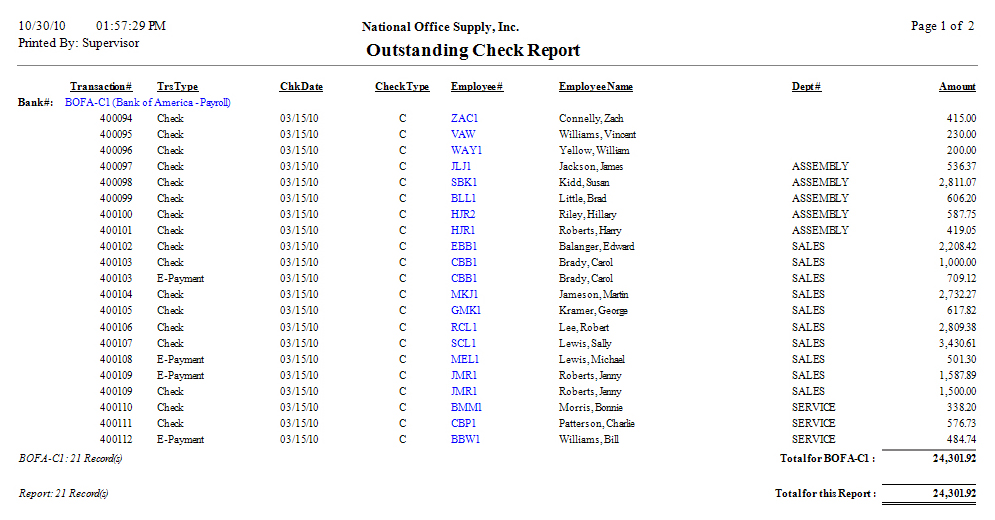

Outstanding Check Report

The Outstanding Check Report provides information on outstanding payroll and tax deposit checks. Outstanding checks are those that have not yet cleared from the bank and are not yet recorded as "cancelled" in AccountMate. The Outstanding Check Report is helpful in reviewing the status of payroll and tax deposit checks. You can also use this report to facilitate bank reconciliation. You can select to include in this report the outstanding, computer-printed

payroll checks only; outstanding, computer-printed tax deposit checks only;

outstanding, handwritten payroll checks only; outstanding, handwritten tax

deposit checks only, or all outstanding payroll and tax deposit checks. This

report also provides flexibility to include electronic payment transactions in

the report.

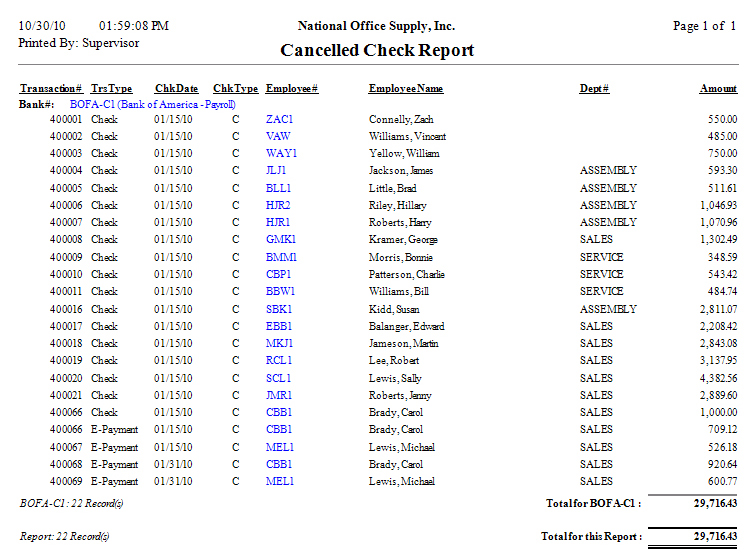

Cancelled Check Report

Generate the Cancelled Check Report if you need information on checks that are cleared by the bank and recorded as "cancelled" in either the Record Cancelled Check function in the Payroll module or the Reconcile Bank Account function in the Bank Reconciliation module. Similar to the Outstanding Check Report and Voided Check Report, this report is especially helpful in reviewing the checks' status and facilitating bank reconciliation. You can select to include in this report the cancelled, computer-printed

payroll checks only; cancelled, computer-printed tax deposit checks only;

cancelled, handwritten payroll checks only; cancelled, handwritten tax deposit

checks only; or all cancelled payroll and tax deposit checks.

|