|

Accounts Payable - Multi Currency Reports

The Multi-Currency Reports provide information on the various currencies used in transactions and the currency gains or losses from multi-currency transactions. Read the information below to get a closer look at each of the Multi-Currency Reports available in AccountMate.

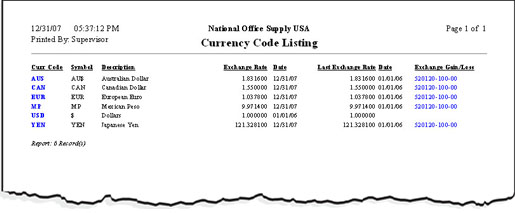

Currency Code Listing

The Currency Code Listing provides information on each currency code including its symbol description, current exchange rate, and the posting GL Account IDs for the foreign exchange gains/losses. The currency codes are set up through the Currency Code Maintenance function. This report can be used to determine the correctness of each currency code's assigned foreign exchange gain/loss GL Account IDs and to ensure that the exchange rates are up to date.

Click on the image to enlarge view.

Click on the image to enlarge view.

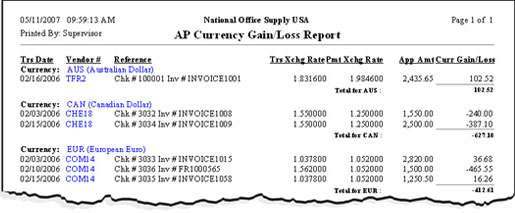

AP Currency Gain/Loss Report

The AP Currency Gain/Loss Report provides information on gains or losses resulting from fluctuations in currency exchange rates used upon posting of the invoice and upon payment. This report is useful for reconciling the AP Currency Gain/Loss GL Account ID balance and serves as a reference when evaluating the effects of exchange rate fluctuations on your business, particularly in paying your company's liabilities.

Click on the image to enlarge view.

Click on the image to enlarge view.

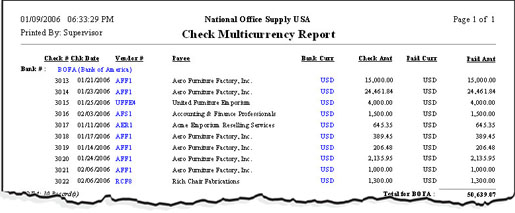

AP Check Multi-Currency Report

The AP Check Multi-Currency Report is a summary on checks issued to vendors using any currency including your company's home currency. You can use this report alongside the AP Currency Gain/Loss Report to determine check transactions that result in a currency gain or loss.

You can generate this report for check transactions only, non-check transactions only, or both. You can select to include voided checks and check details in the report. You can further select to include only the checks with the same currency as the bank currency, only the checks that use foreign currencies, or both.

Click on the image to enlarge view.

Click on the image to enlarge view.

|