|

Payroll - Annual Reports

The Annual Reports functions allow you to generate a year-to-date tax

withholding report and to print Form 940-EZ annual tax return, W-2 report, and

1099 report, thereby facilitating the filing of your yearly tax requirements.

AccountMate allows you to generate these Annual Reports for either the current

or prior tax year.

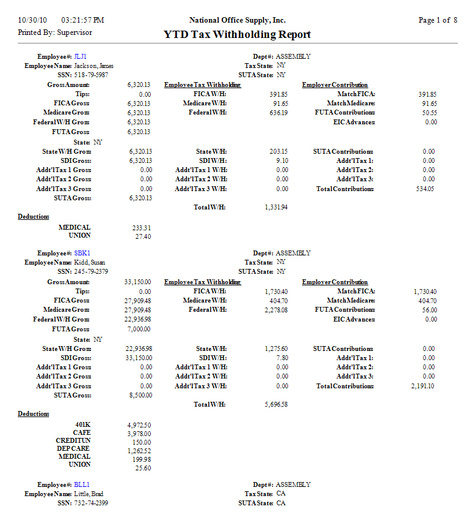

YTD Tax Withholdings Report

The YTD Tax Withholdings Report provides information on the total taxes

withheld from each employee's earnings and the company's total tax contribution

for the current or prior tax year. If an employee has earnings or tax

withholdings in multiple states, the employee's year-to-date earnings and taxes

will be shown separately for each state. This report helps you verify the

accuracy of the annual tax returns. Keep copies of this report for audit trail.

You can select either the current or prior tax year for which you want to print

the report. An option to exclude from the report those employees with zero

year-to-date gross amounts (FICA gross, Medicare gross, Federal Withholding

gross, etc) is also available.

Click image to enlarge view

Click image to enlarge view

Form 940-EZ Annual Tax Return

The Form 940-EZ Annual Tax Return function allows you to generate a report of

the SUTA and FUTA taxes that you submit to the Internal Revenue Service (IRS)

in compliance with the federal tax filing requirements. You need to print this

form if you file on time and/or you are reporting SUTA data for only one state.

If filing is delayed, you still need to print this form and copy the

appropriate data on Form 940; then, submit Form 940 to IRS. If you must report

SUTA data for more than one tax state, print Form 940-EZ separately for each

tax state, summarize the state date, and manually enter data on Form 940; then,

submit Form 940 to IRS.

You have an option to print the form for the current or prior tax year. You can

select to print the form for a particular state or multiple states. If

necessary, you may choose to print your DBA registered company name on the form

and to print the report for alignment test only.

Click image to enlarge view

Click image to enlarge view

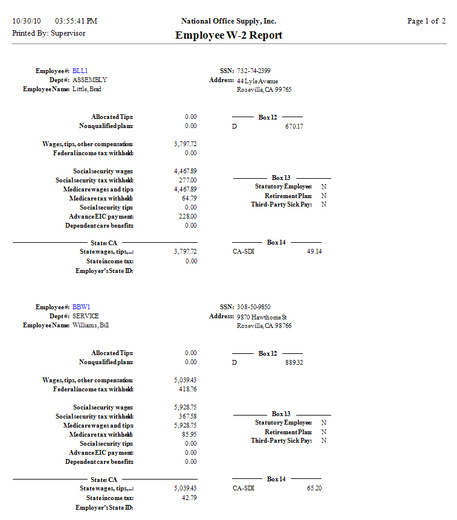

W-2 Report

Prior to printing W-2 forms, you need to review the employees' W-2 information.

You can facilitate the review by generating the W-2 Report. This report

displays the employees' earnings and the federal, state, and/or local tax

withholdings. If the employee has earnings or taxes in multiple states, the

report shows the earnings and taxes separately for each state.

You can choose to print the report for either the current or prior tax year.

Click image to enlarge view

Click image to enlarge view

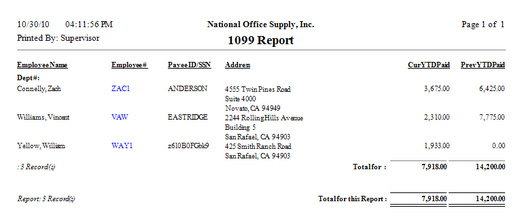

1099 Report

Reviewing 1099 information pertaining to independent contractors is made easy

using the 1099 Report. This report shows the current and previous years'

payments made to independent contractors and the contractors' payee IDs or

social security numbers. This report is most useful in reviewing 1099

information prior to printing 1099 forms.

Click image to enlarge view

Click image to enlarge view

|