|

Payroll - Payroll Entry Reports

The Payroll Entry Reports provide information about work entered in the Time

Card/Piece Work function and the transactions recorded in the Additional/1099

Payment function. Generate these reports if you want to verify the accuracy of

time card, piece work, 1099 payment, and additional payments records prior to

application of payroll/payment or if you want to determine whether application

of payroll/payment has been done or payroll checks have been issued for these

records. Read the information below to get a closer look at each of the Payroll

Entry Reports available in AccountMate.

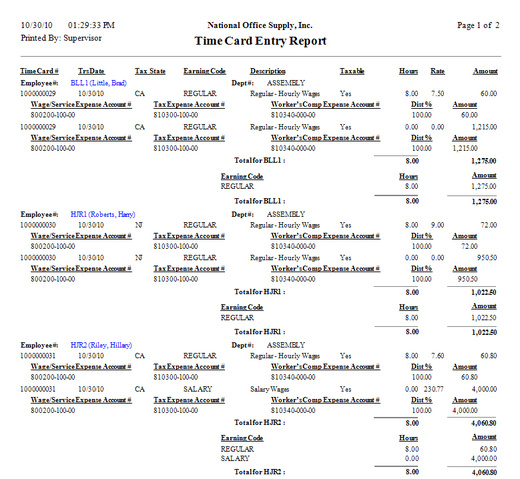

Time Card Entry Report

Information about the employee's regular hours worked as recorded in the Time

Card/Piece Work function or the number of hours an employee has incurred to

complete piece work is available in the Time Card Entry Report. This report

helps you verify the accuracy of time card entries especially prior to

application of payroll.

You can select to generate this report for only the time card records for which

payroll has yet to be applied, only the time card records for which payroll has

been applied but not paid, only the time card records for which payroll checks

have been released, or all time card records. You can opt to include GL Account

IDs assigned to each time card/piece work entry transaction in the report.

Click image to enlarge view

Click image to enlarge view

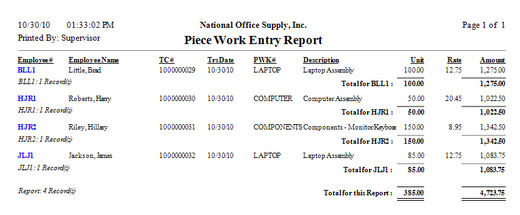

Piece Work Entry Report

The Piece Work Entry Report generates information about completed piece work

units recorded in the Time Card/Piece Work function. Using this report, you can

verify the propriety of piece work entries prior to application of payroll.

You can select to generate the report for only the piece work records for which

payroll has yet to be applied, only the piece work records for which payroll

has been applied but not paid, only the piece work records for which payroll

checks have been released, or all piece work records.

Click image to enlarge view

Click image to enlarge view

Additional/1099 Payment Report

If you need detailed information about additional items for payment to

employees and 1099 services for payment to independent contractors, generate

the Additional/1099 Payment Report. Prior to application of payroll, you can

generate this report to review the accuracy of additional/1099 payments

recorded in the Additional/1099 Payment function.

When generating this report, you can choose to select only the additional/1099

payment records for which payroll has yet to be applied, only the

additional/1099 payment records for which payroll has been applied but not

paid, only the paid additional/1099 payment records, or all additional/1099

payment records.

Click image to enlarge view

Click image to enlarge view

|