|

Accounts Receivable – Bank Reports

The Bank Reports provide information on the bank account records, specifically

a list of the bank accounts and a report on the bank deposits recorded in

AccountMate.

Each of the Bank Reports is especially designed to provide several options so

you can narrow down data to the specific information needed. Read the

information below to get a closer look at each of the Bank Reports available in

AccountMate.

Bank Account Listing

The Bank Account Listing shows detailed information about the bank accounts

including each bank account ID and description, account type, account number,

bank routing number, GL Account IDs assigned to each bank, and currency used

for the transactions using a particular bank account. This report is useful in

reviewing the completeness of the bank account records set up in AccountMate

and in verifying the accuracy of the GL Account IDs assigned to each bank

account. The bank account records are set up using the Bank Account Maintenance

function.

This report can be generated only for checking accounts, only for savings

accounts, or for all account types. You can also choose to generate this report

for bank accounts that are authorized for use only in Accounts Payable, in

Payroll, in Sales Order and Accounts Receivable, or all bank accounts. You can

also opt to show the remarks entered in each bank account record’s notepad.

Click image to enlarge view

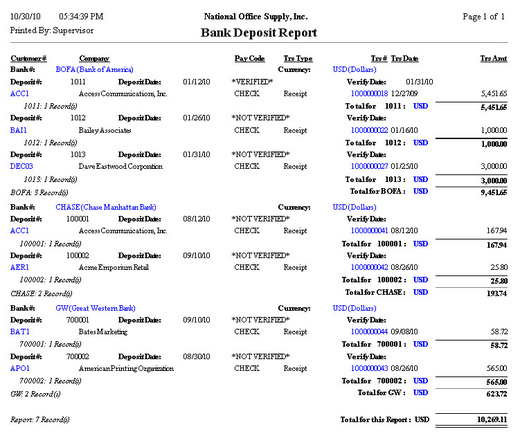

Bank Deposit Report

The Bank Deposit Report provides a summary of all bank deposits in a specific

period. This report is useful in determining which bank deposits have been

verified. This report is especially helpful in reconciling bank deposits

recorded in AccountMate against the bank statements.

You can select to generate this report for verified deposits only, unverified

deposits only or all bank deposits.

Click image to enlarge view

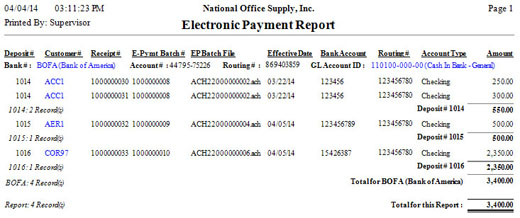

Electronic Payment Report Electronic Payment Report

The Electronic Payment Report provides information on the payment amounts collected from customers paid using direct deposit. The report shows the direct deposit transaction details as well as the deposit # and the AR receipt numbers that were included in each ACH deposit. You can use this report as reference in reconciling your bank account and book balances. This report is also useful for reviewing the direct deposit transactions per bank or per customer.

You can choose to include in the report voided direct deposit transactions and to show multi-currencies.

Click image to enlarge view

|