|

Payroll - Earning Code Reports

AccountMate uses earning codes to make it possible for you to assign wage

rates, paid leave and wage and tax expense GL Account IDs to payroll

transactions in a more flexible manner to comply with the policies of each

department to which an employee is assigned. An earning code represents

regular, overtime, tip, holiday, paid leave time or other types of payroll

transactions as well as the pay rate, worker's compensation, and GL Account IDs

associated with it; thus, it is important that earning codes be set up

correctly to ensure accuracy of recorded payroll transactions. Equally

important are the Earning Code Reports in helping you review the earning code

parameters and recorded payroll transactions using various earning codes.

Each of the Earning Code Reports is especially designed to provide several

options so you can narrow down data to the specific information needed. Read

the information below to get a closer look at each report.

Earning Code Listing

Do you want to see a list of all the earning codes in AccountMate and how each

one of them is set up? If you do, simply generate the Earning Code Listing.

This report displays the earning code's short description; associated

department; default worker's compensation group and worker's compensation code

when assigning the earning code to employee records. What's more? This report

provides information on whether the payroll transactions assigned the earning

code are subject to payroll taxes; earning type--regular, overtime, tips,

holiday, leave, or others; pay rate type-annual, hourly, fixed, or factor; and

associated leave code for leave earning types. Incorrect set up of earning

codes may result in incorrect payroll computation; thus, using the Earning Code

Listing as reference, it is vital for you to review the completeness and

propriety of the earning codes set up in AccountMate.

You can choose to display the default Wage/Service and Tax Expense GL Account

IDs to which the payroll transactions using the earning code will be posted and

their distribution percentages.

Click image to enlarge view

Click image to enlarge view

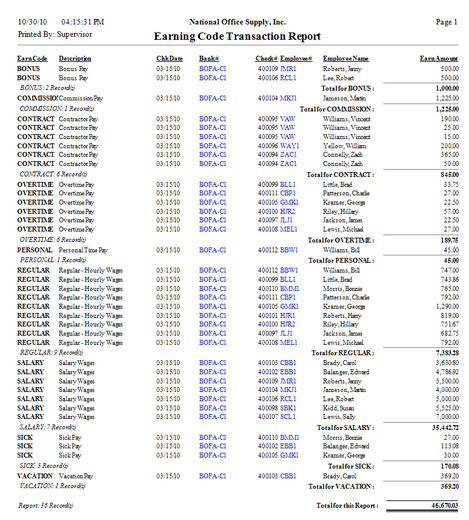

Earning Code Transaction Report

The Earning Code Transaction Report provides information on the various earning

codes used in paid payroll transactions. More specifically, this report shows

the employee earnings for each earning code and the associated check number,

check date, and bank number. This report helps you verify the accuracy of the

system-calculated employee earnings based on the earning code parameters. You

may also use this report as reference when reconciling the total paid earnings

by earning code or by employee.

Click image to enlarge view

Click image to enlarge view

|