|

Payroll - Paid Leave Reports

In AccountMate you can record accrual of employee paid leave time at the

beginning of the year, for each pay period, or for each hour worked, in

accordance with company policy. Employee payroll transactions may include

claimed paid leave time, which will effectively reduce the available balances.

You may also convert unused leave time to cash or adjust any unused balance to

close the accrual for employees who have left the company. The Paid Leave

Reports are available to help you track the paid leave time usage and available

hours without the hassle.

Read the following information to better understand the benefits of the Paid

Leave Reports.

Paid Leave Code Listing

If you need summary information of the paid leave records set up in

AccountMate, generate the Paid Leave Code Listing. Aside from the accrual

method, this report displays the tier, which represents an employee

classification that may be based on seniority, position, or any other basis

that your company has set for granting paid leave benefits. This report also

provides information on the minimum work hours required to qualify for the

accrual; hours accrued per pay period, per hour worked, or per year; maximum

leave hours that may be claimed in a year; maximum leave hours that can be

carried over to the following year; and the GL Account ID to which the system

will record the obligation arising from the paid leave time accrual. This

report is most useful when you need to review the parameters set up for each

paid leave code in order to help ensure accuracy of system-calculated paid

leave time accrual and available balances.

Click image to enlarge view

Click image to enlarge view

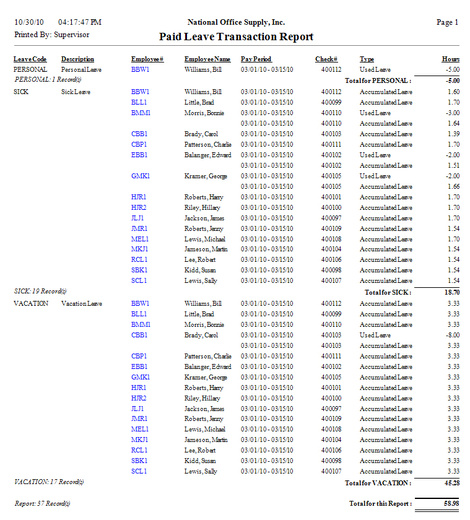

Paid Leave Transaction Report

The Paid Leave Transaction Report shows the payroll transactions that affect

the paid leave time accrual and balance. This report provides information on

the beginning balance, accumulated leave, used leaves, and available balance

for each paid leave code and employee as well as the applicable pay check

number, pay period, and transaction type. You have the option to show the costs

associated with the paid leave hours. This option is intended to minimize

errors that may arise from manually calculating paid leave cost.

This report helps you verify the accuracy of the employees' paid leaves

beginning balances, accrual, usage, adjustments, and available balances as well

as to reconcile the total accrual by paid leave code or by employee. You can

also use this report to determine the accrued paid leaves based on transaction

cost; then, match it with the GL Account ID balance so necessary adjustments

can be posted.

Click image to enlarge view

Click image to enlarge view

|