AM Enterprise 2021 Sample Reports

|

Bank Reconciliation - Bank Transfer Reports

The Bank Transfer Reports provides detailed information about the status of the bank transfers recorded in the Bank Reconciliation (BR) module. These reports provide a necessary audit trail and are useful for tracking and monitoring bank transfers; thus, facilitates reconciling bank accounts. These reports are especially designed to provide filter options to generate the specific information you require. Read the information below to get a closer look at each of the Bank Transfer Reports available in AccountMate Enterprise. Real-Time Unreconciled Bank Transfers Report The Real-Time Unreconciled Bank Transfers Report provides information on all bank transfer transactions recorded in AccountMate that are not yet marked as having cleared the bank. The report displays all the unreconciled bank transfers in the system regardless of the date the report was generated. The report shows the source bank #, target bank #, transfer date, currency code and the transfer amount. You can use this report as guide to verify all unreconciled bank transfer records are authorized and as reference in reconciling bank transfer transactions. You can generate this report for an individual source bank account or you can opt to filter this report to show transactions from all or a range of source bank accounts and target bank accounts. You can further select to filter this report by specifying all or a range of transaction codes, or by entering the transfer date and entry date.

Real-Time Reconciled Bank Transfers Report The Real-Time Reconciled Bank Transfers Report provides detailed information on all bank transfer transactions marked in AccountMate as having cleared the bank. The report displays all the reconciled bank transfers in the system regardless of the date the report was generated. The report includes information such as source bank #, target bank #, transfer date, currency, transfer amount and the date it was marked as reconciled. The report is useful for verifying that reconciled bank transfers are authorized and can be used as reference in reconciling bank transfer transactions. You can generate this report for an individual source bank account. You can also opt to generate this report either for all or a range of source bank account, all or a range of target bank accounts, and all or a range of transaction codes. You can further filter the report by specifying the transfer date or the reconciled date, and either to show or not to show matching imported bank transfer transactions.

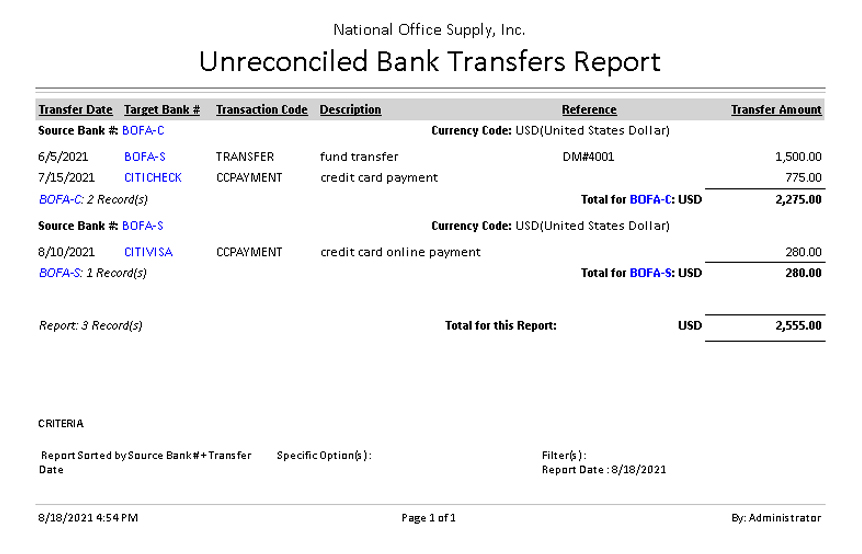

Unreconciled Bank Transfers Report The Unreconciled Bank Transfers Report provides detailed information on bank transfer transactions not yet marked as having cleared the bank as of the specified Report Date. Unreconciled bank transfers include inter-bank transfers and intra-bank transfers. This report shows the transfer date, source bank, target bank, description and transfer amount. Generate this report to help you determine the accuracy of the recorded bank transfers so you can verify that the transaction has been processed as authorized, or use it as a guide in reconciling bank transfers. You must specify a date in the Report Date to successfully generate the report. This report can be generated to show individual, all or a range of source bank accounts and target bank accounts. You can opt to filter the report by transaction code, by bank transfer date and by transaction entry date.

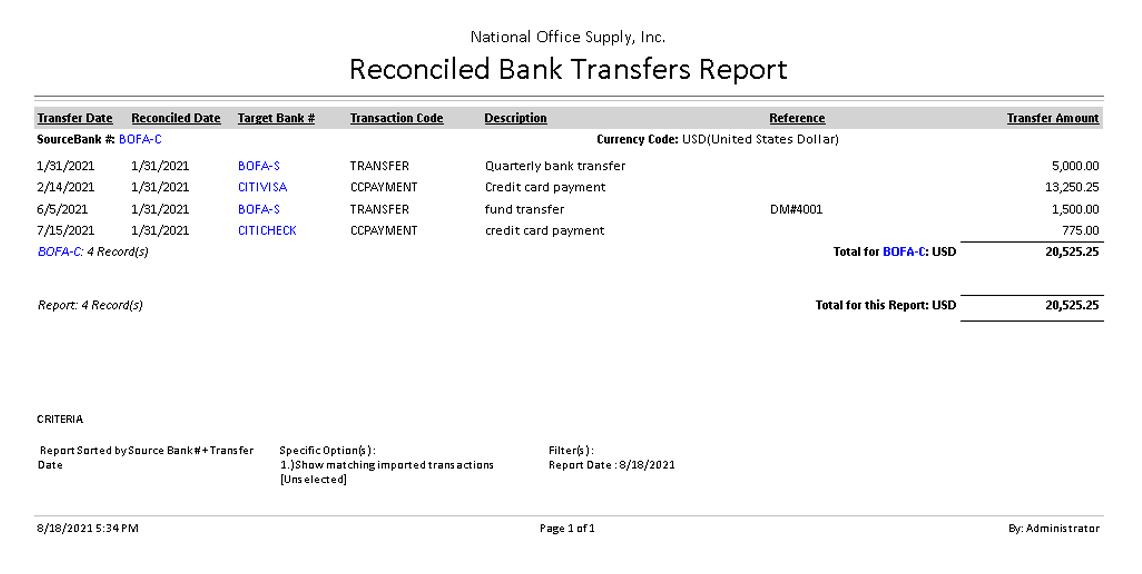

Reconciled Bank Transfers Report The Reconciled Bank Transfers Report provides detailed information on bank transfers marked in AccountMate as having cleared the bank as of the specified Report Date. The report shows the transfer date, source bank, target bank, reconciled date, description, and the transfer amount. The report can be used to determine the accuracy of reconciled bank transfers, to check whether the transaction is authorized, and serves as a reference in reconciling bank transfer transactions. To generate the report, you must specify a Report Date. This report can be generated for an individual, all or a range of source bank accounts and target bank accounts. You can also specify the transaction code and transfer date of the transactions to be displayed in the report. You can further opt to show matching imported bank transfer transactions and specify the date of these imported bank transfer transactions.

|