AM Enterprise 2024 Sample Reports

|

Bank Reconciliation - Bank Transaction Reports

The Bank Transaction Reports provide detailed information on the transactions recorded in the Bank Reconciliation (BR) module only. These reports are useful for reconciling your bank accounts and provide a necessary audit trail. These reports are especially designed to provide filter options so you can generate reports that show the specific information needed. Read the information below to get a closer look at each of the Bank Transaction Reports available in AccountMate Enterprise. BR Transactions Report The BR Transactions Report provides detailed information about transactions recorded in the Bank Reconciliation module only. These transactions include receipts, disbursements, bank transfers, other receipts, and other disbursements which are recorded using the BR module whether they have been marked outstanding, in-transit or reconciled. The report includes information such as the bank code, transaction code, transaction date, reconciled date, transaction #, check number (for checks issues in AP), unreconciled amount and reconciled amount. The report is useful for verifying the accuracy of bank transactions recorded in AccountMate, and serves as reference in reconciling bank accounts. You can generate the report for individual bank accounts or you can opt to generate the report for all or a range

of bank accounts. You can also opt to filter the report for all or a range of transaction codes, specify the

transaction date range or entry date range. You can further filter the report to show fees/disbursement transactions

only, interest/receipt transactions only, transfer transactions only, or all BR transactions. You can also opt to

include voided transactions in the report.

Real-Time Receipts In-Transit Report The Real-Time Receipts In-Transit Report provides detailed information about receipt transactions recorded in the Bank Reconciliation (BR) module that are neither marked as cleared nor received in the bank regardless of the date the report is generated. The report shows BR receipt transactions that are still “in-transit” to the bank. This report includes information such as the transaction code, transaction date, description, transaction #, void date, bank code and receipt amount. You can generate this report to help you in creating a forecast of your cash balance by adding all the total receipts in-transit amounts that will be credited to the bank account in the future; thereby, you can effectively manage your cash transactions. This report also serves as a guide in reconciling receipts. You can generate this report for individual bank accounts or you can generate the report to show all or a range of bank accounts. You can opt to include all or a range of transaction codes, specify a transaction date range or entry date range. You can further filter the report to show only interests earned, other BR receipts only, or all BR receipts. You can also select to show the GL distribution in this report.

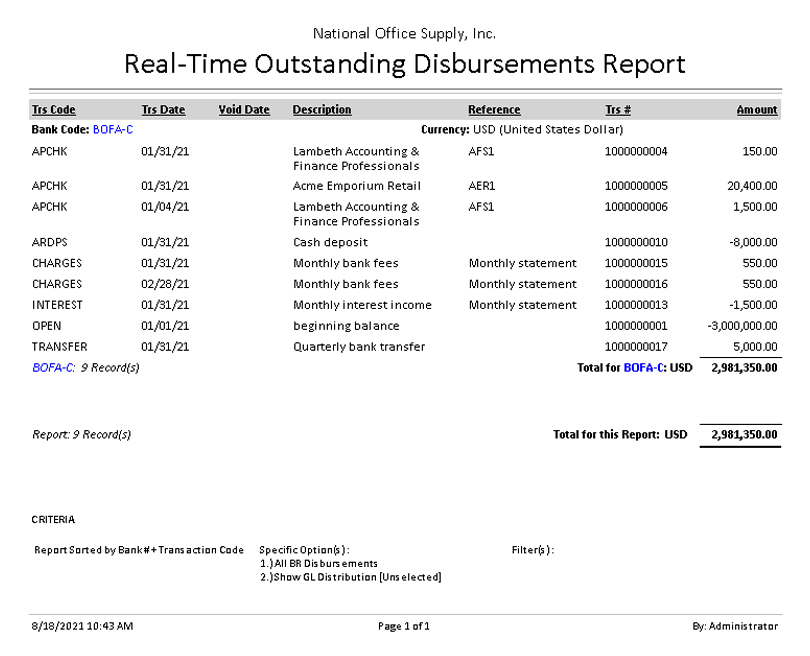

Real-Time Outstanding Disbursements Report The Real-Time Outstanding Disbursements Report provides detailed information about disbursements recorded in the Bank Reconciliation (BR) module that are not yet marked as cleared regardless of the date the report is generated. The report includes BR disbursements that are outstanding based on the actual records entered in the system. The report shows information such as the bank code, transaction code, transaction date, transaction #, void date, description, reference, and disbursement amount. This report is useful for verifying the accuracy of disbursements that are still showing up as outstanding in the system. You can also use the report as reference in reconciling BR disbursements. You can generate this report for an individual bank account or you can filter the report to show all or a range of bank accounts. You can opt to include all or a range of transaction codes, specify a transaction date or entry date ranges. You can further filter the report to show only bank fees, other BR disbursements only, or all BR disbursements. You can also select to include GL distribution in this report.

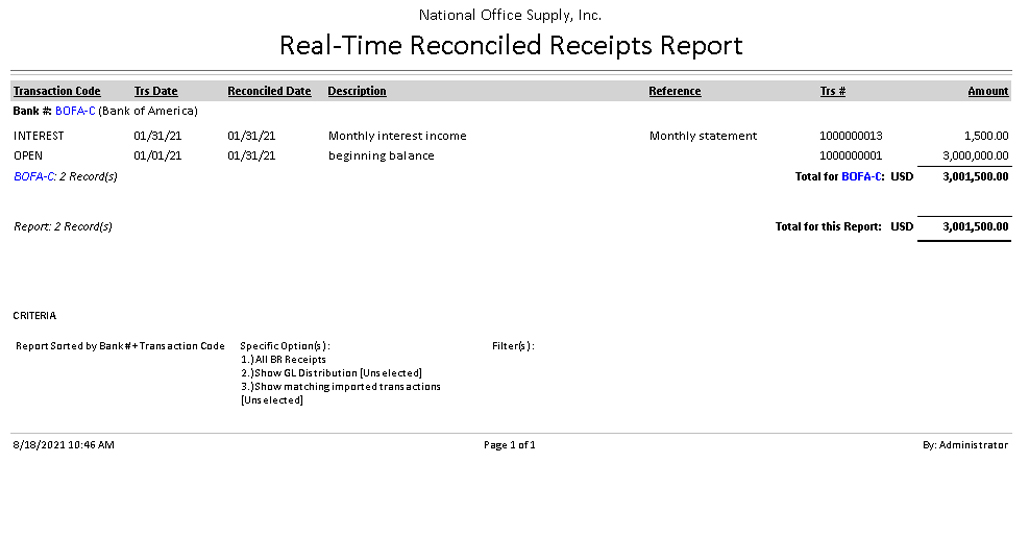

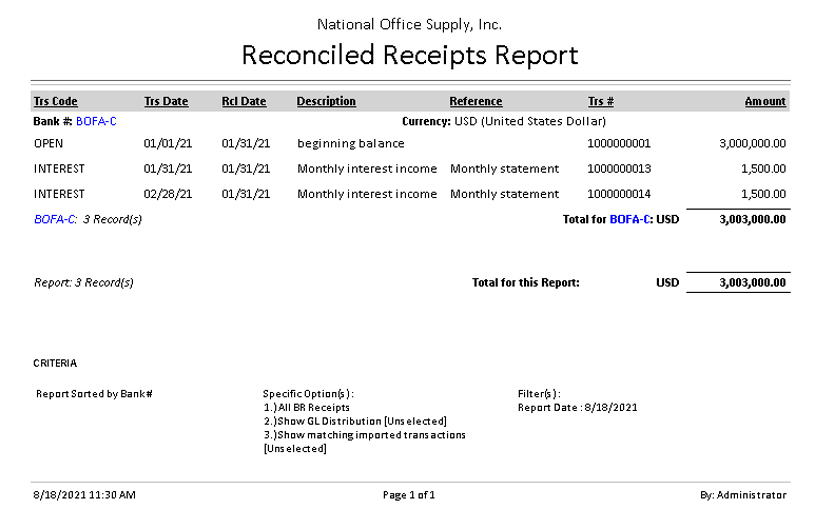

Real-Time Reconciled Receipts Report The Real-Time Reconciled Receipts Report provides information on the details of receipt transactions recorded in the Bank Reconciliation (BR) module that are marked as reconciled regardless of the date the report is generated. The report shows the bank name, transaction code, transaction #, transaction date, reconcile date, description and receipt amount. This report is useful for verifying the accuracy of BR receipts already marked as reconciled in the system. By properly timing the clearing of receipts in your bank accounts, you can better manage your cash disbursements or issuance of checks. The report also serves as a reference in reconciling receipts. You can generate this report for an individual bank account or opt to filter the report to show all or a range of bank accounts. You can also select to include all or a range of transaction codes, specify a transaction date or reconciled date ranges. You can further filter the report to show only interest earned transactions, other BR receipts only, or all BR receipts. You can also select to include GL distribution and show matching imported transactions in this report.

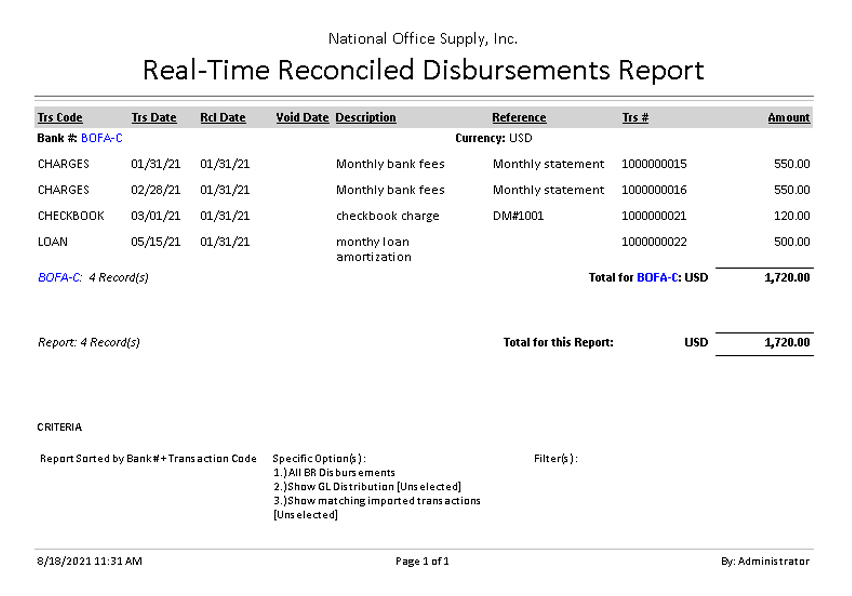

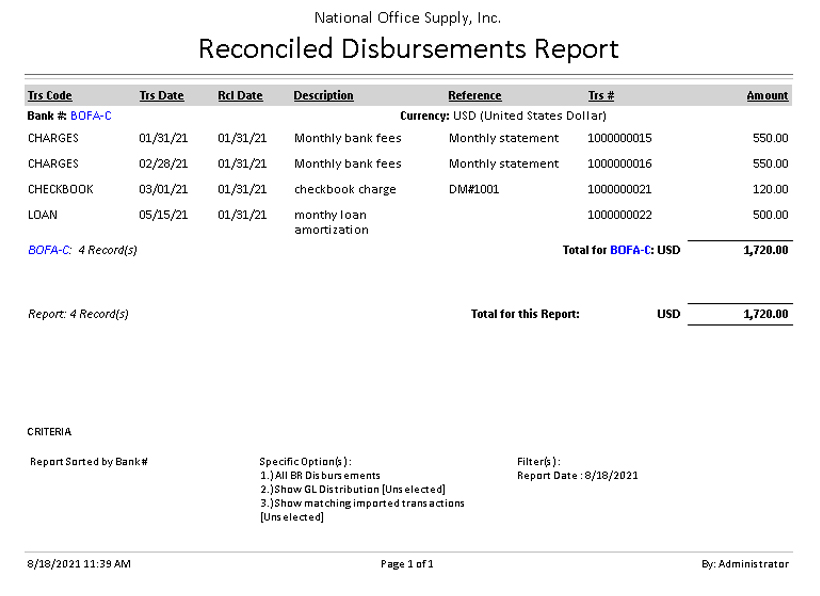

Real-Time Reconciled Disbursements Report The Real-Time Reconciled Disbursements Report provides detailed information about BR disbursements that are marked in AccountMate as reconciled regardless of the date the report is generated. The report shows information such as the bank name, transaction code, transaction date, transaction #, reconciled date, void date, description, reference, and disbursement amount. The report is useful for verifying the accuracy of disbursements in the system that are marked as reconciled. This report also serves as a guide in reconciling BR disbursement transactions. You can generate the report for an individual bank account or you can filter the report to show all or a range of bank accounts. You can select to include all or a range of transaction codes, specify a transaction date, reconciled date, or entry date ranges. You can further select to show only bank fees, other BR disbursements only, or all BR disbursements. You can also select to include GL distribution and show matching imported transactions in this report.

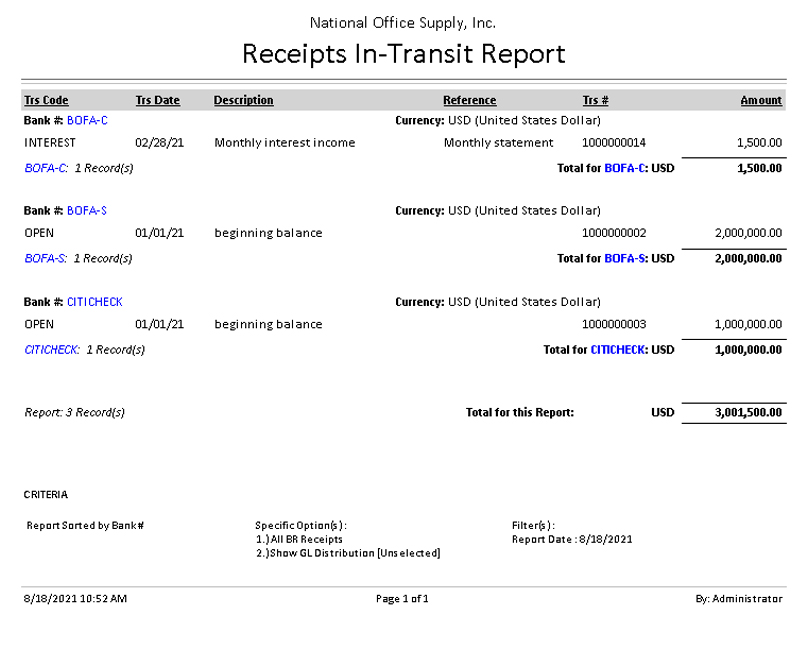

Receipts In-Transit Report The Receipts In-Transit Report provides detailed information about receipt transactions recorded in the Bank Reconciliation (BR) module that are neither marked as cleared nor received in the bank as of a specified Report Date. The report shows BR receipts that are “in-transit” to the bank based on the date specified in the Report Date field of the report criteria. This report includes information such as the transaction code, transaction date, description, transaction #, bank account and receipt amount. You can generate this report to help you verify and monitor your bank’s cash balance as of the specified report date to effectively manage your cash transactions. This report also serves as a guide in reconciling receipts. You can generate this report for individual bank accounts or you can generate the report to show all or a range of bank accounts. You can opt to include all or a range of transaction codes, specify a transaction date range or entry date range. You must specify a Report Date to generate the report successfully. You can further filter the report to show only interests earned, other BR receipts only, or all BR receipts. You can also select to show the GL distribution in this report.

Outstanding Disbursements Report The Outstanding Disbursements Report provides detailed information about disbursements recorded in the Bank Reconciliation (BR) module that are not yet marked as cleared as of a specified Report Date. The report includes BR disbursements that are outstanding based on the date specified in the Report Date field of the report criteria. The report shows the bank account, transaction code, transaction date, transaction #, description, reference, and disbursement amount. This report is useful for verifying the accuracy and monitoring of disbursements in the system. This report also serves as reference in reconciling disbursements. You can generate this report for an individual bank account or you can filter the report to show all or a range of bank accounts. You can opt to include all or a range of transaction codes, specify a transaction date range or entry date range. You must specify a Report Date to generate the report successfully. You can further filter the report to show only bank fees, other BR disbursements, or all BR disbursements. You can also select to include GL distribution in this report.

Reconciled Receipts Report The Reconciled Receipts Report provides information on the details of receipt transactions recorded in the Bank Reconciliation (BR) module that are marked as reconciled as of a specified Report Date. The report includes BR receipts that were marked as reconciled on or before the specified date in the Report Date field of the report criteria. The report shows the bank name, transaction code, transaction #, transaction date, reconcile date, description and receipt amount. This report is useful for verifying the accuracy and monitoring the receipts already marked as reconciled in the system. This report also serves as a reference in reconciling receipts. You can generate this report for an individual bank account or opt to filter the report to show all or a range of bank accounts. You can select to include all or a range of transaction codes, specify a transaction date range or reconciled date range. You must specify a Report Date to generate the report successfully. You can further filter the report to show only interest earned transactions, other BR receipts, or all BR receipts. You can also select to include GL distribution and show matching imported transactions in this report.

Reconciled Disbursements Report The Reconciled Disbursements Report provides detailed information about BR disbursements that are marked as reconciled as of a specified Report Date. The report shows BR disbursements that were marked as reconciled on or before the specified date in the Report Date field of the report criteria. The report includes information such as the bank name, transaction code, transaction date, transaction #, reconciled date, description, reference, and disbursement amount. This report is useful for verifying the accuracy of disbursements in the system that actually cleared the bank as of a certain date. This report also serves as a guide in reconciling disbursement transactions. You can generate the report for an individual bank account or you can filter the report to show all or a range of bank accounts. You can select to include all or a range of transaction code, specify a transaction date, reconciled date, or entry date. You must specify a Report Date to generate the report successfully. You can select to show only bank fees, other BR disbursements only, or all BR disbursements. You can also select to include GL distribution and show matching imported transactions in this report.

|