|

Accounts Receivable - Bank Reconciliation Reports

The Bank Reconciliation Reports provides various information about bank transactions the Accounts Receivable module. These reports help you focus on a variety of bank data and serves as references for your bank deposit transactions.

Each of the Bank Reconciliation Reports is especially designed with options you can choose that narrows down data to the specific information you need. Read the information below to get a closer look at each of the Receipt Reports available in AccountMate Enterprise.

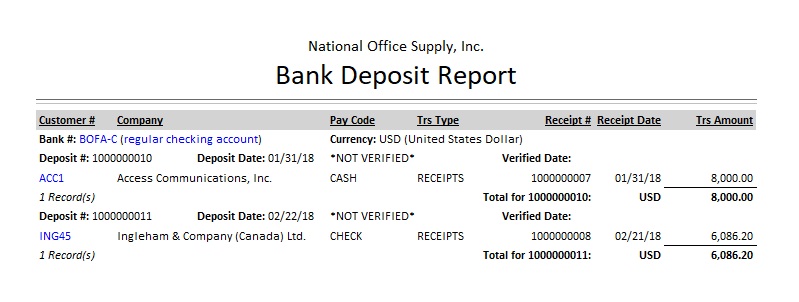

Bank Deposit Report

The Bank Deposit Report provides a summary of all bank deposit transactions in a specific period. This report is useful in determining which bank deposits have been verified. This report is especially helpful in reconciling bank deposits recorded in AccountMate against the bank statements.

You can select to generate this report for verified deposits only, unverified deposits only or all bank deposits. You can filter the report to show only bank fee transactions, only cash receipts transactions, or all deposit transactions.

Click image to enlarge view

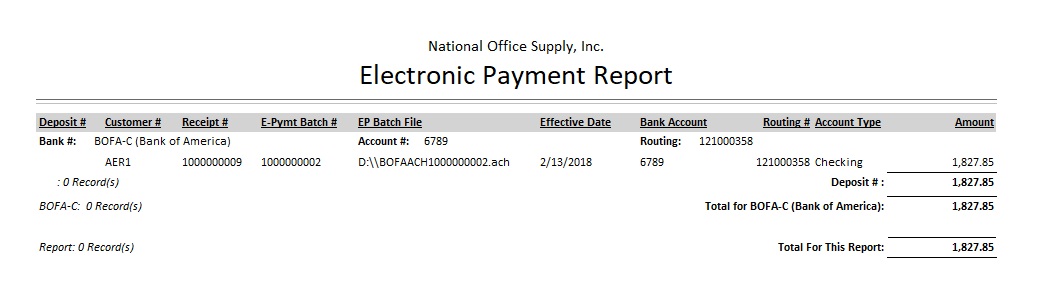

Electronic Payment Report

The Electronic Payment Report provides information on the payment amounts collected from customers paid using direct deposit. The report shows the direct deposit transaction details as well as the deposit # and the AR receipt numbers that were included in each ACH deposit. You can use this report as reference in reconciling your bank account and book balances. This report is also useful for reviewing the direct deposit transactions per bank or per customer.

You can choose to include in the report voided direct deposit transactions, and to show multi-currencies.

Click image to enlarge view

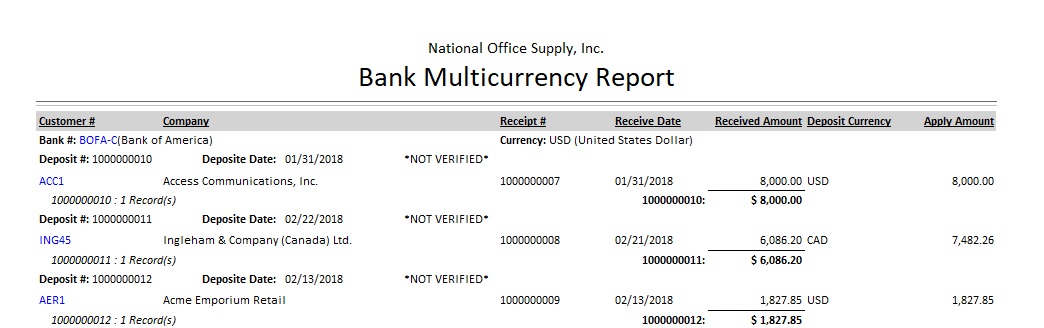

AR Bank Multi-Currency Report

The AR Bank Multi-Currency Report provides information on multi-currency bank deposits made within a specific period. This report helps you assess the status of your multi-currency bank deposits and serves as a useful reference when reconciling multi-currency bank deposits per records against the bank statements.

You can generate this report for verified deposits only, unverified deposits only, or all bank deposits. You can further select to include only the deposits of customer payments made in the same currency as the bank currency, only the deposits of customer payments made in a currency that is different from the bank currency, or all deposits regardless of the currencies used.

Click image to enlarge view

|