|

|

It is vital for a company to

have full control over its

payroll system to ensure

that it processes employee

compensation accurately and

quickly. With AccountMate’s

Payroll module, you can set

up records for salaried, hourly

and time card/piece work

employees, as well as Software

|

AccountMate 7 for LAN Instant Access to Employee Information

Users can drill down on the Employee number field caption for instant access to an employee

record. They can view or edit salary, W-4, earnings, paid leave benefits, dependents, deduction,

quarterly taxable earnings and payroll tax information. Users can also update the assigned state

and local tax codes, resident status, additional withholding amounts and the setting to override

system-calculated withholding taxes. This flexibility gives users the capacity to review and

update employee data before processing payroll.

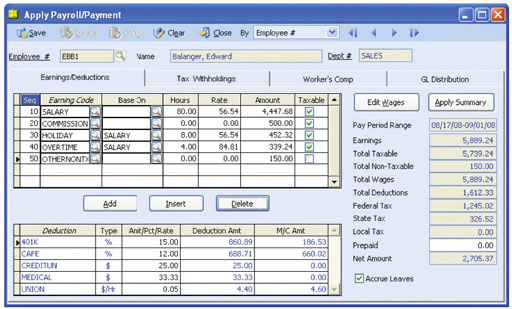

Apply Payroll—Payment

Additional State Tax Codes Can Be Set Up

Users can define up to three additional tax codes for each tax state. For each additional tax,

they can set up employee and employer tax rates and define a maximum wage base. This is

useful for setting up taxes that affect all employees in a state but are not hard-coded into the

system since they may not apply to all companies.

Manage Employee Hours and Pay

The Payroll module allows users to track each employee’s work hours through the use of earning

codes. These may be set up for regular work hours, overtime, holiday or leave time. They can also

represent earnings that are independent of work hours such as tips, commissions, bonuses and

fringe benefits. By assigning a department to each earning code, users can track departmental

accountability for employee work hours. The pay rate defined for an earning code is applied by

default to each employee who is assigned to a particular department allowing the standardization of

pay rates by department and work type. Users can overwrite these pay rates when setting up an

employee record. Finally, they can define whether an earning code is taxable.

Flexible Wage, Tax and Worker’s Compensation Expense Distribution

Users can allocate the expenses for employee wages, employer

payroll taxes and worker’s compensation claims to multiple GL

Account IDs and define a distribution percentage for each. This is

defined on each earning code, thereby offering maximum flexibility

in allocating payroll costs to the appropriate cost centers in the

organization.

Accrue, Track and Adjust Paid Leave

Users can accrue paid leave time for qualified employees.

Unlimited paid leave records can be set up for vacation, sick,

personal or any other paid leave benefits the company offers its

employees. Users can define the accrual hours, minimum hours

required to qualify for accrual, and the maximum leave hours that

can be accrued and carried over into another year. These settings

are applied based on the assigned employee tier. Accrual may be

done at the start of the year or each time payroll is processed.

Users can record the use of an employee’s leave time when

processing payroll. And when the employee leaves the company,

the unused leave time can either be converted to cash or the

remaining balance can be cancelled.

Unlimited Deductions with Option for Employer Matching/Contribution

Users can set up an unlimited number of deductions, and then

apply any number of them to each employee. They can indicate

whether a deduction is to be withheld as a fixed amount per

pay period, a percentage of earnings or a fixed rate per hour

worked. A user can also define whether the deduction will be

based on gross or net pay, set a maximum deduction per payroll

transaction and set an annual deduction limit. Alternatively, users

can apply deduction amounts and annual limits based on the

employee’s age. They can also indicate whether a deduction is

to reduce federal, state or local taxable wages, as in the case

of 401(k) plan contributions. If applicable, users can also set

parameters for calculating employer matching and/or contributions

for these deductions. They can customize each deduction for

each employee and overwrite the deduction rates when

processing payroll.

Calculate Liability for Worker’s Compensation

AccountMate provides users the means to calculate and track

liability for worker’s compensation. They can set up an unlimited

number of worker’s compensation codes and worker’s

compensation groups. For each combination of worker’s

compensation code and group, users can enter the rate and

annual limit set by each state, as well as the experience factor

that applies to the company. They can apply these worker’s

compensation codes and groups to earning codes and employee

records to facilitate calculation of worker’s compensation liability

on qualified employee payroll transactions.

Apply Payroll Automatically or Manually

The automatic application of payroll is a fast and easy way

to accrue payroll for a range of employees or independent

contractors. If users want the flexibility to review, amend,

apply or skip application of payroll for certain employees,

they have the option to apply payroll manually. Regardless

of the method used, the system calculates earnings, deductions,

employer matching/contributions, paid leave accruals, worker’s

compensation and payroll tax amounts based on the data and

settings defined for each employee.

Record Time Card, Piece Work or Additional Payment Transactions

Users can enter time card information using the earning code

records that exist in the system, thereby saving valuable time.

They can also record piece work transactions for employees who

are paid based on their output rather than the amount of time

worked. Finally, users can record bonuses, commissions, fringe

benefits, cash conversion of unused leave time and other similar

employee payments. Time card, piece work and additional

payment records are processed using the Apply Payroll/Payment

function for calculation of the corresponding deductions, employer

matching/contribution, paid leave accrual, worker’s compensation

liability and payroll taxes.

Support 1099 Payments

The Payroll module supports 1099 payments to independent

contractors and tracks these payments for generation of 1099

reports, including printing on 1099-Misc forms. Users can print

1099-Misc forms for the prior or current tax year.

Alerts Help Prevent Duplication of Payment

The system alerts users when a time card has been recorded for

an employee during the day. It also alerts them if there are unpaid

applied payroll records for the employee for whom they are

applying payroll. Users can review the amounts applied for

payment to validate whether the transaction being processed

duplicates an existing applied payroll/payment record.

Record Payroll After-the-Fact

The Post After-the-Fact Payroll function allows users to record

payroll checks generated outside the system and the related

earnings, deductions, and payroll taxes. This is useful for

companies that implement the Payroll system halfway through

the year but need complete payroll data to generate accurate

W-2 and other tax reports by the year’s end.

Support Direct Payroll Deposits and EFTPS Payments

The system supports direct deposit of employee payroll checks

using either the National Payment Corporation or the Automated

Clearing House network. For each employee, users can define

up to three direct deposit bank accounts.

AccountMate also supports the electronic deposit of Form 940 and 941 federal payroll taxes via the Electronic Federal Tax Payment System. This enables users to remit payroll taxes directly to the IRS and avoid having to make trips to the bank. lexible Check Printing and Recording Options

Print checks on either pre-printed or blank check stock. Users

can customize the order in which the bank routing number,

account number and check number are printed using the

Microline font that comes standard with AccountMate. They

can also maintain specimen signatures and a company logo

for automatic printing onto blank check stock. In case users run

into print job problems, they can reprint checks using the same

check numbers without voiding the related check records in the

system. In addition, they can choose to print the employee’s social

security number on check stubs using an encryption format that

has been defined.

The system also supports recording of handwritten checks to pay off existing applied payroll records. This flexibility makes it easy to record the issuance of payroll checks outside the Payroll system. Allow Recalculation of FUTA/SUTA Amounts

Users can recalculate the company’s FUTA and SUTA liabilities.

This feature allows users to quickly adjust to changes in FUTA

and SUTA tax mandates (i.e. rates or maximum wages) that may

occur after paychecks are issued.

Integration with General Ledger, Accounts Payable and Bank Reconciliation Modules

Other Features

AccountMate Software Corporation © AccountMate Software Corporation. All rights reserved. Reproduction in whole or in part without permission is prohibited. The capabilities, Software Requirements and/or compatibility described herein are subject to change without notice. Contact AccountMate or Authorized AccountMate Solution Provider for current information. |

||||||||||||||||||||||||||||||||||||||||||